Last updated: 9/8/2006

Impound Of Funds Agreement

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

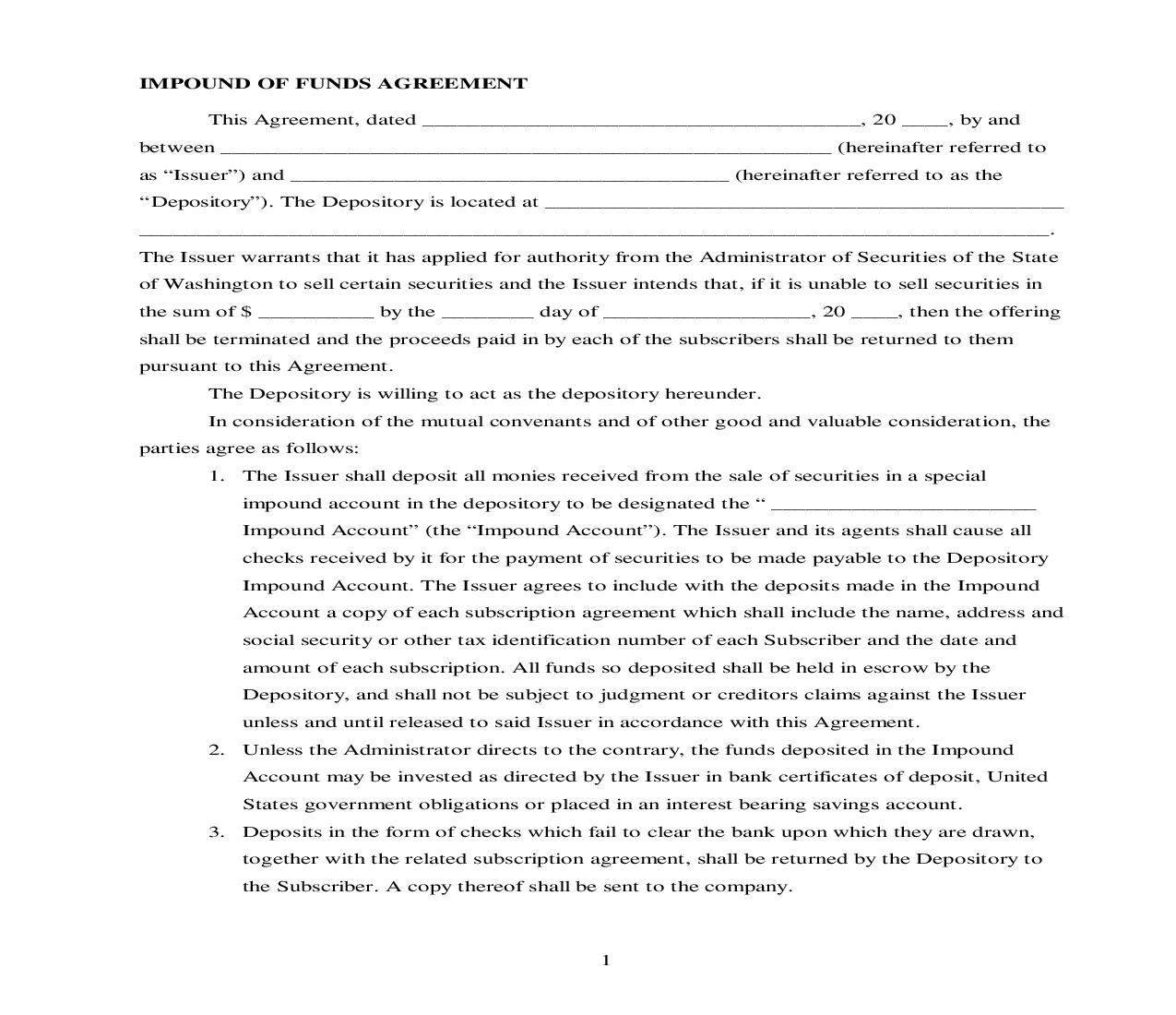

IMPOUND OF FUNDS AGREEMENT This Agreement, dated ______________________________________, 20 ____, b y andbetween _____________________________________________________ (hereinaf ter referred toas Issuer) and ______________________________________ (hereinafter referred to as theDepository). The Depository is located at _______________________________________ ______________________________________________________________________________ _______.The Issuer warrants that it has applied for authority from the Administr ator of Securities of the Stateof Washington to sell certain securities and the Issuer intends that, if it is unable to sell securities inthe sum of $ __________ by the ________ day of __________________, 20 __ __, then the offeringshall be terminated and the proceeds paid in by each of the subscribers shall be returned to thempursuant to this Agreement. The Depository is willing to act as the depository hereunder. In consideration of the mutual convenants and of other good and valuable consideration, theparties agree as follows: 1. The Issuer shall deposit all monies received from the sale of securities in a special impound account in the depository to be designated the _______________________ Impound Account (the Impound Account). The Issuer and its agents shall cause all checks received by it for the payment of securities to be made payable t o the Depository Impound Account. The Issuer agrees to include with the deposits made in the Impound Account a copy of each subscription agreement which shall include the na me, address and social security or other tax identification number of each Subscriber an d the date and amount of each subscription. All funds so deposited shall be held in esc row by the Depository, and shall not be subject to judgment or creditors claims aga inst the Issuer unless and until released to said Issuer in accordance with this Agreeme nt. 2. Unless the Administrator directs to the contrary, the funds deposited in the Impound Account may be invested as directed by the Issuer in bank certificates o f deposit, United States government obligations or placed in an interest bearing savings a ccount. 3. Deposits in the form of checks which fail to clear the bank upon which t hey are drawn, together with the related subscription agreement, shall be returned by t he Depository to the Subscriber. A copy thereof shall be sent to the company. 1<<<<<<<<<********>>>>>>>>>>>>> 24. If the funds deposited in the Impound Account amount to or exceed $ _______________ (The Minimum Subscription), the Issuer shall request the Depository to confirm the aggregate amount of deposit, the names of all subscribers and the amount deposited by each. The Issuer shall forward the Depository confirmation to the Securities Administrator. The Depository shall continue to hold such funds and all other funds thereafter deposited with it hereunder until it has received a direction in writing from the Administrator instructing the Depository as to the disposition of the funds.5. Upon receipt by the Depository of written notification signed by the Issuer advising that it was unable to sell the minimum subscription within the specific offering period, the funds deposited in the Impound Account shall be returned by the Depository to the Subscribers according to the amount each contributed. Total interest, less interest used to satisfy Depository costs and fees, will be divided and returned to subscribers based upon the investment. 6. If, at any time prior to the disbursement of funds by the Depository as provided in Paragraph 4 or 5 of this Agreement, the Depository is advised by the Administrator that the registration to sell securities of the Issuer has been suspended or revoked, that any condition of its registration permit has not been met or that any provision of the Washington securities laws have not be complied with, then the Administrator may direct the Depository not to disburse the proceeds until further notice by the Administrator.7. This Impound Agreement shall terminate upon the disbursement of funds pursuant to Paragraphs 4 or 5; provided, however, the Issuer may abandon the public offering. Upon the receipt of a letter from the Issuer stating that the offering has been abandoned, copy to the Administrator, the Depository is authorized to return the monies received hereunder to the subscribers according to the amount each subscriber contributed with interest, less interest used to satisfy Depository costs and fees, and this Agreement shall terminate upon said distribution. 8. The sole duty of the Depository other than as herein specified, shall be to establish and maintain the Impound Account and receive and hold the funds deposited by the company pursuant to all applicable banking laws and regulations of the State of Washington.9. The Issuer acknowledges that the Depository is performing the limited function of Depository and that this fact in no way means the Depository has passed in any way upon 2<<<<<<<<<********>>>>>>>>>>>>> 3 the merits or qualifications of, or has recommended, or given approval t o, any person, security or transaction. A statement to this effect shall be included in the offering circular. 10. The Administrator may, at any time, inspect the records of the Depositor y, insofar as they relate to this Agreement, for the purpose of making any determination he reunder or effecting compliance with and conformance to the provisions of this Agre ement. 11. The terms and conditions of this Agreement shall be binding on the heirs , executors and assigns, creditors or transferees, or successors in interest, whether by operation of law or otherwise, of the parties hereto. If, for any reason, the Depository nam ed herein should be unable or unwilling to continue as such depository, then the Company may substitute, with the consent of the Administrator, another person to serve as Deposi tory. IN WITNESS WHEREOF, the parties have executed this Agreement the _________ day of___________________, 20 _____. ISSUER:____________________________________ By _________________________________________ President DEPOSITORY:_______________________________ By _________________________________________ Its _________________________________________ACKNOWLEDGED: __________________________________________ Securities Division State of Washington 3