Last updated: 8/26/2015

Mortgage Recording Tax Claim For Refund {MT-15.1}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

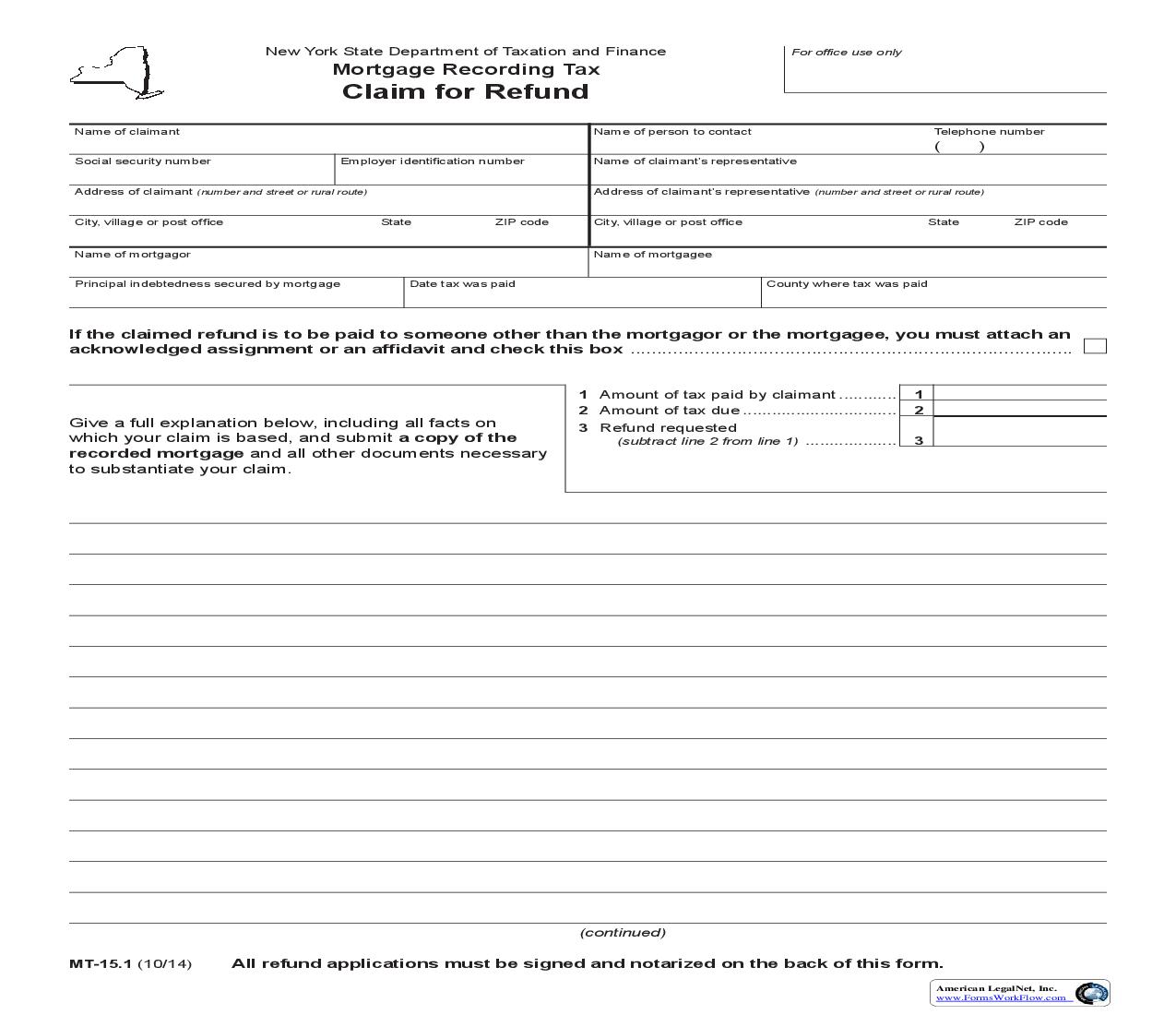

New York State Department of Taxation and Finance For office use only Mortgage Recording Tax Claim for Refund Name of claimant Socialsecuritynumber Employeridentificationnumber Name of person to contact Nameofclaimant'srepresentative ( Telephone number ) Address of claimant (number and street or rural route) City,villageorpostoffice Nameofmortgagor Principalindebtednesssecuredbymortgage Datetaxwaspaid State ZIPcode Addressofclaimant'srepresentative(number and street or rural route) City,villageorpostoffice Nameofmortgagee Countywheretaxwaspaid State ZIPcode If the claimed refund is to be paid to someone other than the mortgagor or the mortgagee, you must attach an acknowledged assignment or an affidavit and check this box ................................................................................... 1 Amount of tax paid by claimant ............ 1 2 Amount of tax due ................................ 2 3 Refund requested (subtract line 2 from line 1) ................... Giveafullexplanationbelow,includingallfactson which your claim is based, and submit a copy of the recorded mortgage and all other documents necessary to substantiate your claim. 3 (continued) MT-15.1 (10/14) All refund applications must be signed and notarized on the back of this form. American LegalNet, Inc. www.FormsWorkFlow.com MT-15.1 (10/14) (back) (continued) State of New York County of .................................................................... ...................................................... , beingdulysworn deposes and says: Iamtheclaimantidentifiedaboveinthismortgage recordingtaxclaimforrefund,andIhavereadthe foregoingclaimandallaccompanyingstatements and documents, and know their contents. To my own knowledge,thisclaimistrueinallrespects. Signature (print name below signature) Sworn to before me this ........... day of .......................................................... , 20 ..... NotaryPublic State of New York County of .................................................................... ......................................................., beingdulysworn deposes and says: Iresideat .................................................... ,andIam a/the.................. of ..............................................., the partnershiporcorporationdescribedintheforegoing mortgagerecordingtaxclaimforrefund,andIhave readtheforegoingclaimandallaccompanying statements and documents, and know their contents. Tomyownknowledge,thisclaimistrueinallrespects. Signature (print name below signature) Sworn to before me this ..............day of .......................................................... , 20 ... NotaryPublic When to file Anapplicationforrefundofthemortgagerecordingtax paidpursuanttoArticle11oftheTaxLawmustbefiled on Form MT15.1 within two years of the date that the erroneouspaymentoftaxwasreceivedbytherecording officer. Instructions Privacy notification --TherightoftheCommissioner of Taxation and Finance and the Department of Taxation and Finance to collect and maintain personal information, includingmandatorydisclosureofsocialsecuritynumbers inthemannerrequiredbytaxregulations,instructions,and forms, is found in Articles 8, 11, and 31 of the Tax Law; and 42USC405(c)(2)(C)(i). The Tax Department uses this information primarily to determine andadministerthemortgagerecordingandrealestatetransfer taxes, and for any other purpose authorized by law. Failuretoprovidetherequiredinformationmaysubjectyouto civilorcriminalpenalties,orboth,undertheTaxLaw,andmay also result in your failure to secure a refund of all or a portion of therealestatetransfertaxorthemortgagerecordingtax. SeePublication54,Privacy Notification, for more information. If,however,arefundisclaimedbecauseofthe mortgagor'sexerciseofthestatutoryrightofrescission, FormMT15.1mustbefiledwithinthelaterofthe following:twoyearsfromthetimeofpaymentofthetaxor oneyearfromthedatethemortgagewasdischarged. Where to file Send your application to: NYSTAXDEPARTMENT TDABMORTGAGE TAX WAHARRIMANCAMPUS ALBANY NY 122279299 American LegalNet, Inc. www.FormsWorkFlow.com