Last updated: 4/13/2015

Non-Wage Garnishment Notice {P1-MISC-46}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

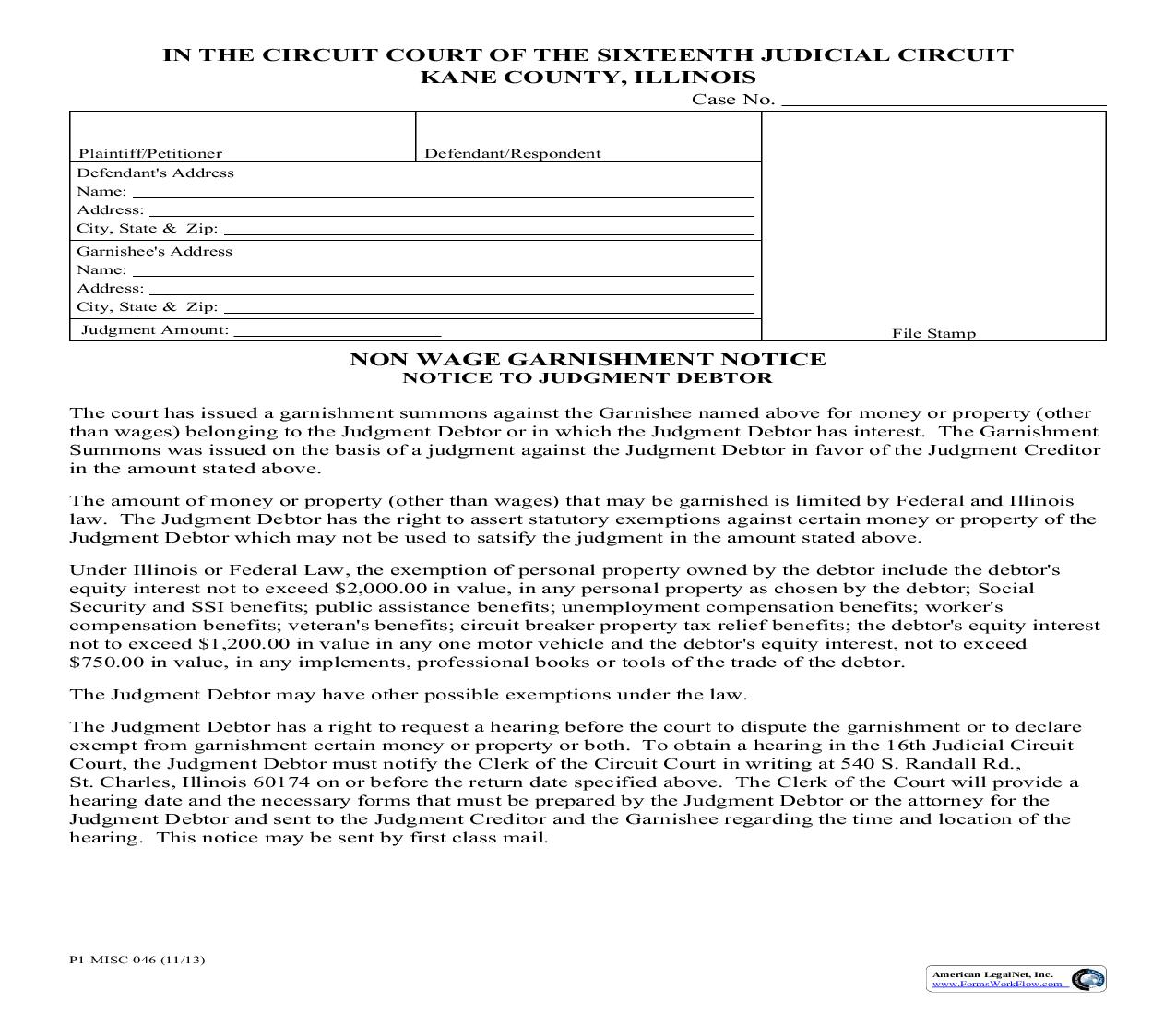

IN THE CIRCUIT COURT OF THE SIXTEENTH JUDICIAL CIRCUIT KANE COUNTY, ILLINOIS Case No. Plaintiff/Petitioner Defendant's Address Name: Address: City, State & Zip: Garnishee's Address Name: Address: City, State & Zip: Judgment Amount: Defendant/Respondent File Stamp NON WAGE GARNISHMENT NOTICE NOTICE TO JUDGMENT DEBTOR The court has issued a garnishment summons against the Garnishee named above for money or property (other than wages) belonging to the Judgment Debtor or in which the Judgment Debtor has interest. The Garnishment Summons was issued on the basis of a judgment against the Judgment Debtor in favor of the Judgment Creditor in the amount stated above. The amount of money or property (other than wages) that may be garnished is limited by Federal and Illinois law. The Judgment Debtor has the right to assert statutory exemptions against certain money or property of the Judgment Debtor which may not be used to satsify the judgment in the amount stated above. Under Illinois or Federal Law, the exemption of personal property owned by the debtor include the debtor's equity interest not to exceed $2,000.00 in value, in any personal property as chosen by the debtor; Social Security and SSI benefits; public assistance benefits; unemployment compensation benefits; worker's compensation benefits; veteran's benefits; circuit breaker property tax relief benefits; the debtor's equity interest not to exceed $1,200.00 in value in any one motor vehicle and the debtor's equity interest, not to exceed $750.00 in value, in any implements, professional books or tools of the trade of the debtor. The Judgment Debtor may have other possible exemptions under the law. The Judgment Debtor has a right to request a hearing before the court to dispute the garnishment or to declare exempt from garnishment certain money or property or both. To obtain a hearing in the 16th Judicial Circuit Court, the Judgment Debtor must notify the Clerk of the Circuit Court in writing at 540 S. Randall Rd., St. Charles, Illinois 60174 on or before the return date specified above. The Clerk of the Court will provide a hearing date and the necessary forms that must be prepared by the Judgment Debtor or the attorney for the Judgment Debtor and sent to the Judgment Creditor and the Garnishee regarding the time and location of the hearing. This notice may be sent by first class mail. P1-MISC-046 (11/13) American LegalNet, Inc. www.FormsWorkFlow.com