Connecticut

Statewide

Department Of Revenue Services

Estate Tax Section

Last updated: 10/1/2025

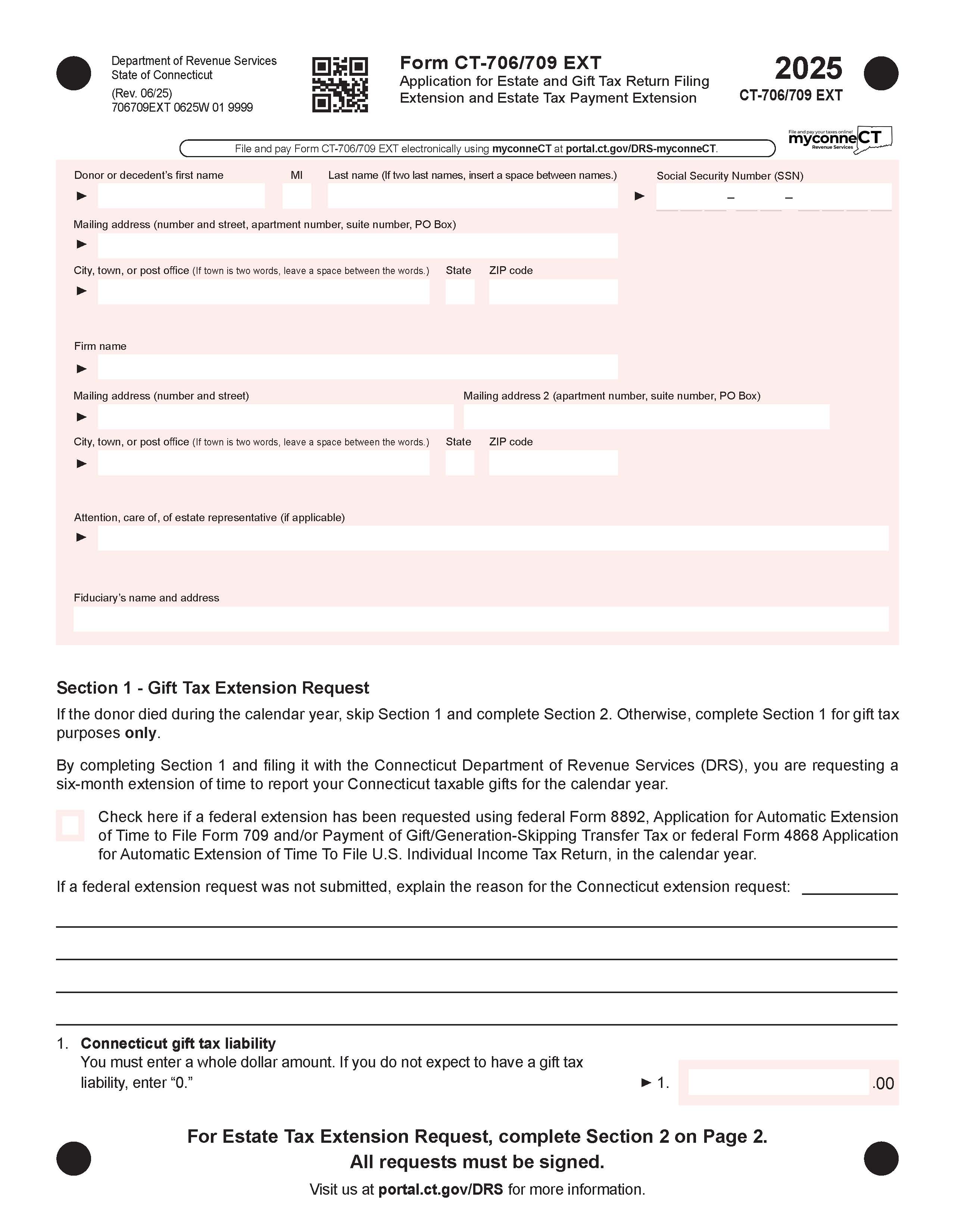

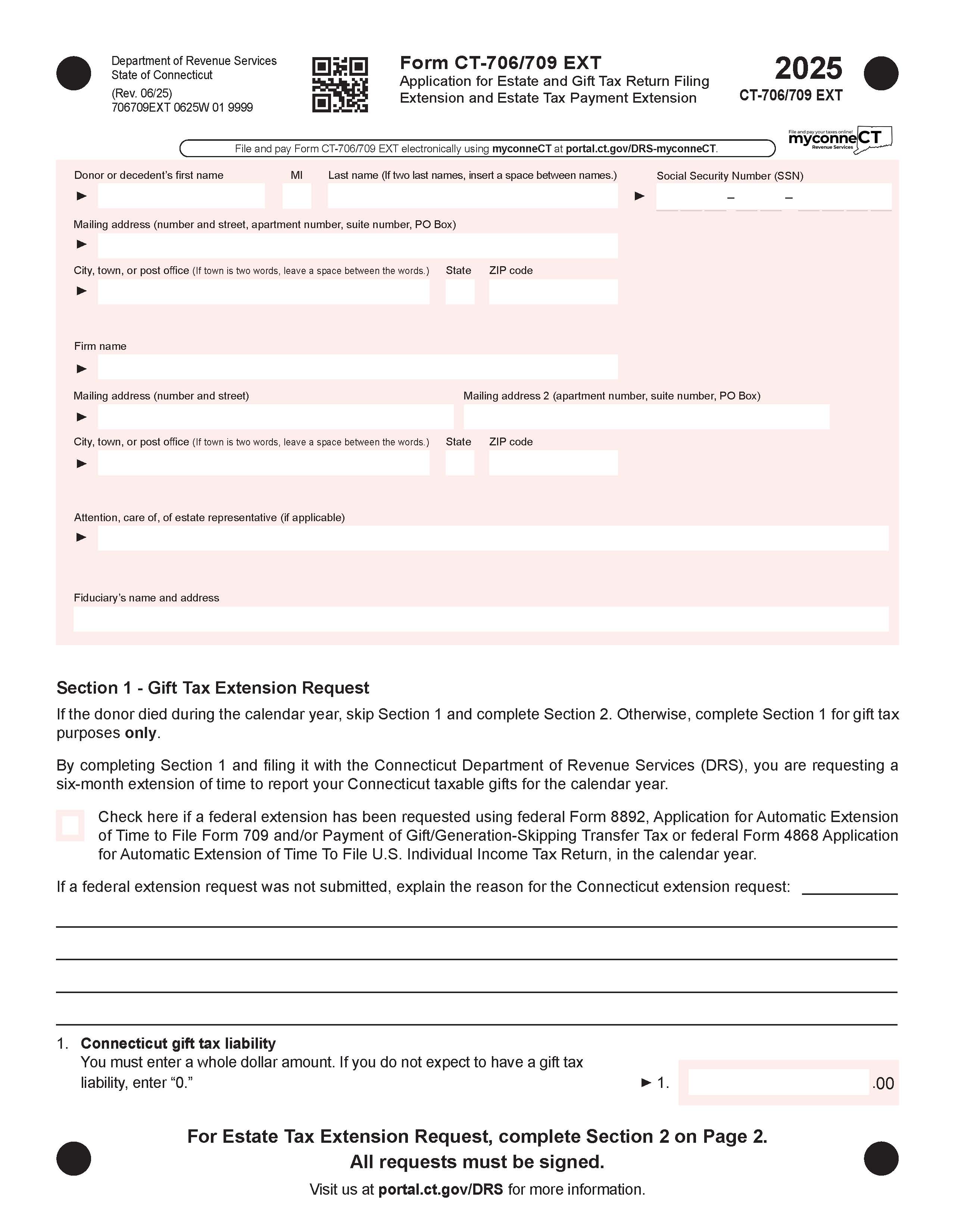

Application For Estate and Gift Tax Return Filing Extension And For Estate Tax {CT-706 709 EXT}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Form CT-706/709 EXT - APPLICATION FOR EXTENSION OF TIME TO FILE A RETURN AND/OR PAY U.S. ESTATE (AND GENERATION-SKIPPING TRANSFER) TAXES. Use this form to request a nine-month extension of time to file Form CT-706/709, Connecticut Estate and Gift Tax Return, or to request a six-month extension of time to pay the Connecticut estate tax, or both. File Form CT-706/709 EXT to request a six-month extension to file the gift tax return. www.FormsWorkflow.com

Related forms

Our Products