Last updated: 9/8/2025

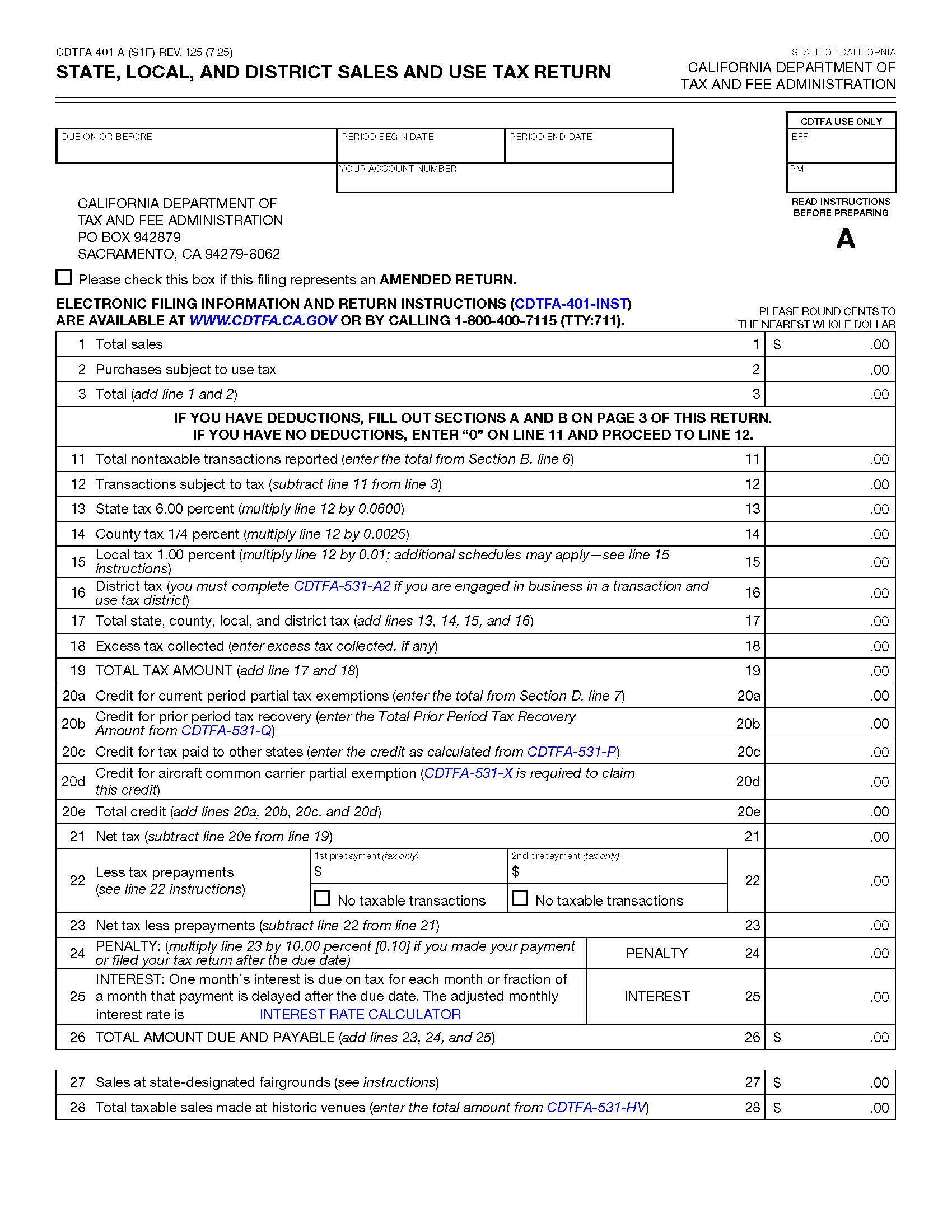

State Local And District Sales And Use Tax Return {CDTFA-401-A}

Start Your Free Trial $ 0.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

CDTFA-401-A - STATE, LOCAL, AND DISTRICT SALES AND USE TAX RETURN. This form is used in California by businesses to report and remit sales and use taxes. It serves as a comprehensive tool for accurately capturing sales data, tax liabilities, and applicable deductions, ensuring compliance with state tax regulations. Filing this form on time is essential to avoid penalties and maintain proper tax standing. The form includes fields that record total sales, purchases subject to use tax, deductions, applicable state and local tax rates, and the total tax amount owed. By completing these sections, businesses can ensure accurate tax reporting and timely payments. Failing to submit the CDTFA-401-A form by the due date can lead to penalties and interest charges on unpaid taxes. Late fees may be assessed for missing the filing deadline, and any unpaid taxes will accrue interest over time. Repeated failure to file on time may result in increased scrutiny from tax authorities, potentially leading to audits. To stay compliant, businesses operating in California must submit this form quarterly, based on their accrued sales and purchases within that period. The form also allows businesses to claim applicable tax exemptions and ensures adherence to California tax laws through timely and accurate reporting. www.FormsWorkflow.com