Last updated: 7/16/2025

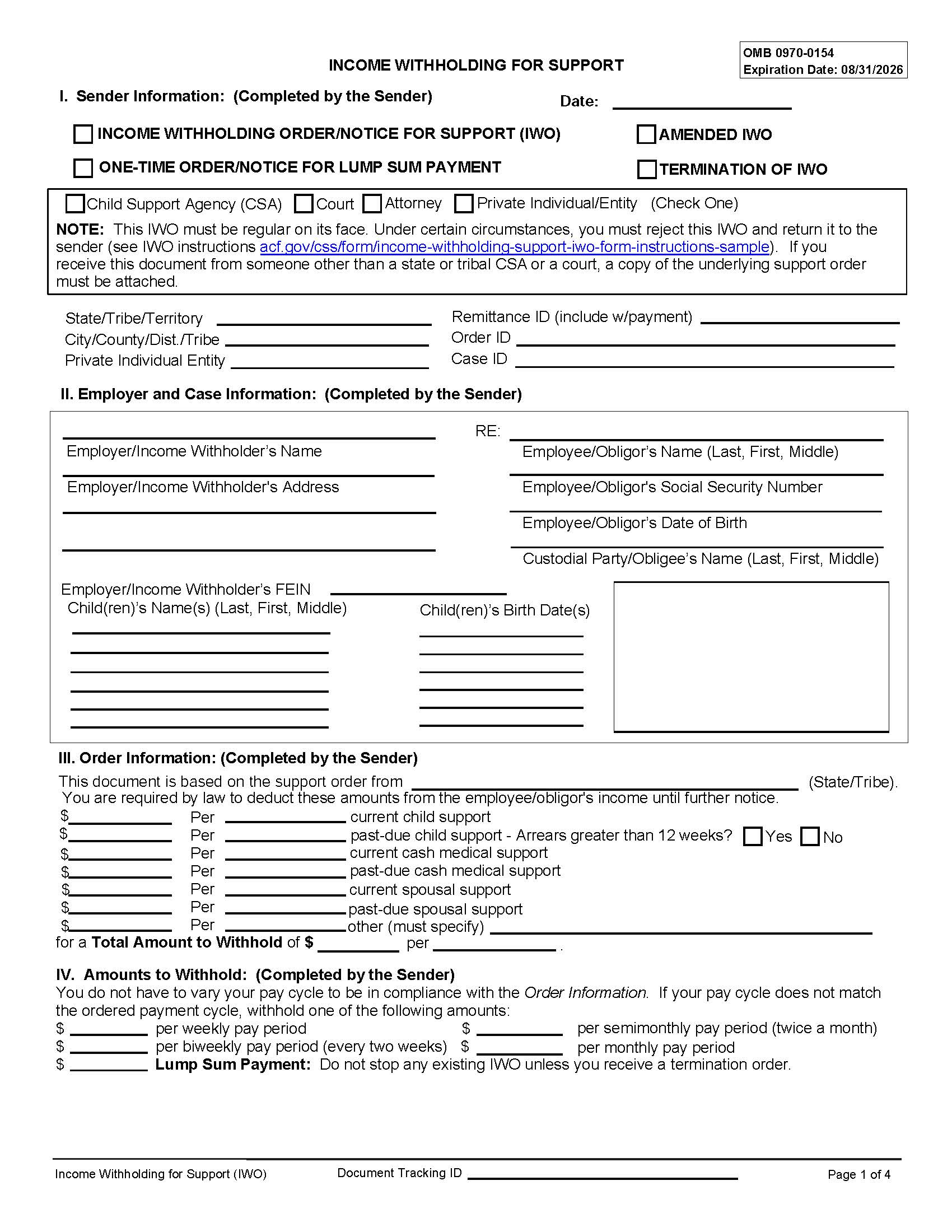

Income Withholding For Support

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

INCOME WITHHOLDING FOR SUPPORT. This form is used by child support agencies, courts, attorneys, or private individuals to legally mandate the withholding of a portion of an employee or obligor’s income to satisfy current and past-due child support, spousal support, or other related obligations. This federally standardized form allows authorized entities to notify employers or income withholders to begin automatic deductions from an individual's wages, bonuses, or other income sources to fulfill a court-ordered or agency-determined support obligation. The form outlines the sender’s and obligor’s identifying information, the amounts to be withheld, the remittance schedule, and instructions for payment submission to the appropriate State Disbursement Unit (SDU) or tribal payee. It also provides information about legal compliance, employer liability for noncompliance, protections against discrimination of the obligor, and directions on handling lump sum payments or employment termination. Employers must act within specified timeframes and withholding limits and are required to forward payments promptly. www.FormsWorkflow.com