Last updated: 4/9/2025

Certificate Of Conversion For Entities Converting Within Or Off The Records {700}

Start Your Free Trial $ 25.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

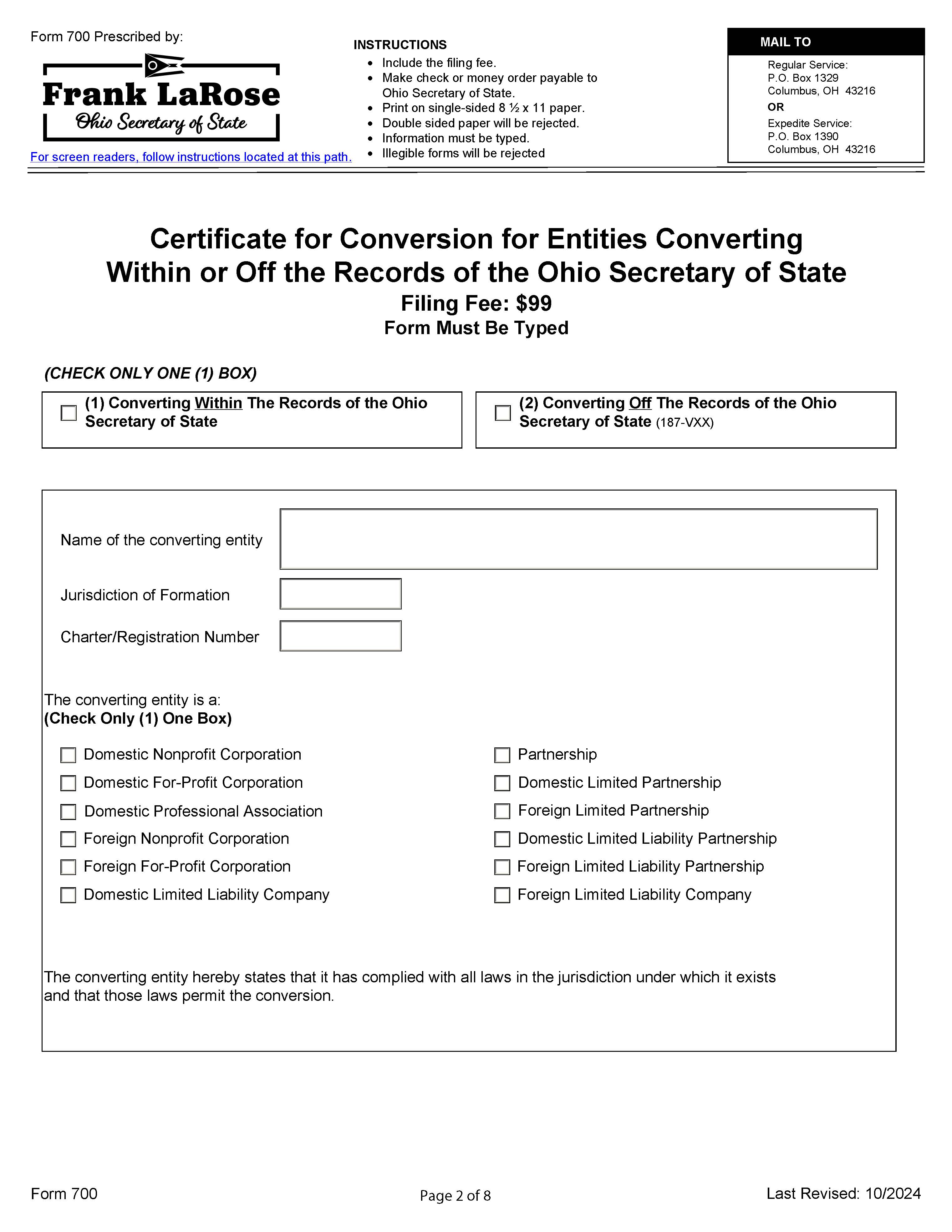

Form 700 - CERTIFICATE FOR CONVERSION FOR ENTITIES CONVERTING WITHIN OR OFF THE RECORDS OF THE OHIO SECRETARY OF STATE. This form should be used to file a certificate of conversion to document that an entity converted "within (entities already on record with our office and remaining on record following the conversion filing)" or "off (entities already on record with our office who will no longer be on record following the conversion filing)" the records of the Ohio Secretary of State. Pursuant to Ohio Revised Code §§1701.811, 1706.722, 1776.72 and 1782.4310, the certificate of conversion must set forth the name of the converting entity, the jurisdiction of formation of the converting entity and the form of the converting entity. The authorized representative signing the certificate on behalf of the converting entity agrees that the converting entity has complied with all of the laws under which it exists and that the laws permit the conversion. If a foreign or domestic corporation licensed in Ohio is a converting entity and the converted entity is not a foreign or domestic corporation to be licensed in Ohio, Ohio Revised Code §1701.811 (with respect to for-profit domestic constituent corporations) and §1702.462 (with respect to nonprofit domestic constituent corporations) require that additional information be submitted with the certificate. A domestic corporation must provide the affidavits, receipts, certificates or other evidence required by Ohio Revised Code §1701.86(H) or §1701.86 (I) (with respect to for-profit domestic constituent corporations) or §1702.47(G) (with respect to nonprofit domestic constituent corporations). A foreign corporation must submit the affidavits, receipts, certificates or other evidence required by Ohio Revised Code §1703.17 (C) or (D) if it is the converting entity. The required affidavits are attached to this form for your convenience. www.FormsWorkflow.com