Last updated: 2/12/2025

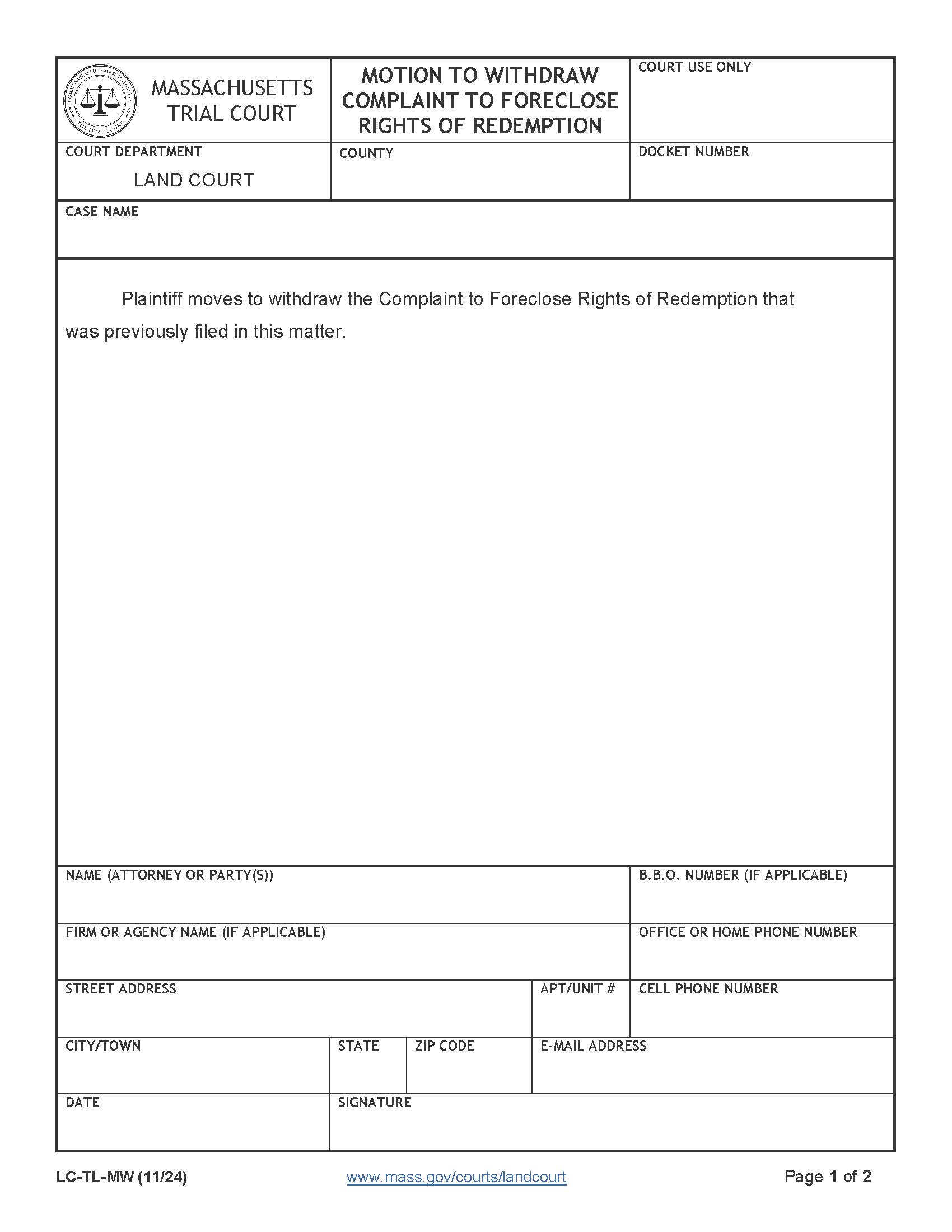

Motion To Withdraw Complaint To Foreclose Rights Of Redemption

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

MOTION TO WITHDRAW COMPLAINT TO FORECLOSE RIGHTS OF REDEMPTION. This form is used in the Massachusetts Land Court when a plaintiff seeks to withdraw a previously filed complaint that aimed to foreclose a property owner’s right to redeem a tax lien. In tax foreclosure cases, municipalities or third-party lienholders file a Complaint to Foreclose Rights of Redemption to obtain full ownership of a property when a taxpayer has not paid outstanding property taxes. If circumstances change—such as the taxpayer paying off the debt, a settlement agreement, or the plaintiff deciding not to proceed—the plaintiff can file this motion to formally request the court’s approval to withdraw the complaint. The form includes the case details, the plaintiff’s attorney or representative’s information, and a certification of service to confirm that all relevant parties have been notified. If granted by the court, the withdrawal halts the foreclosure process, allowing the property owner to retain their right to redeem the property. www.FormsWorkflow.com