Last updated: 1/23/2025

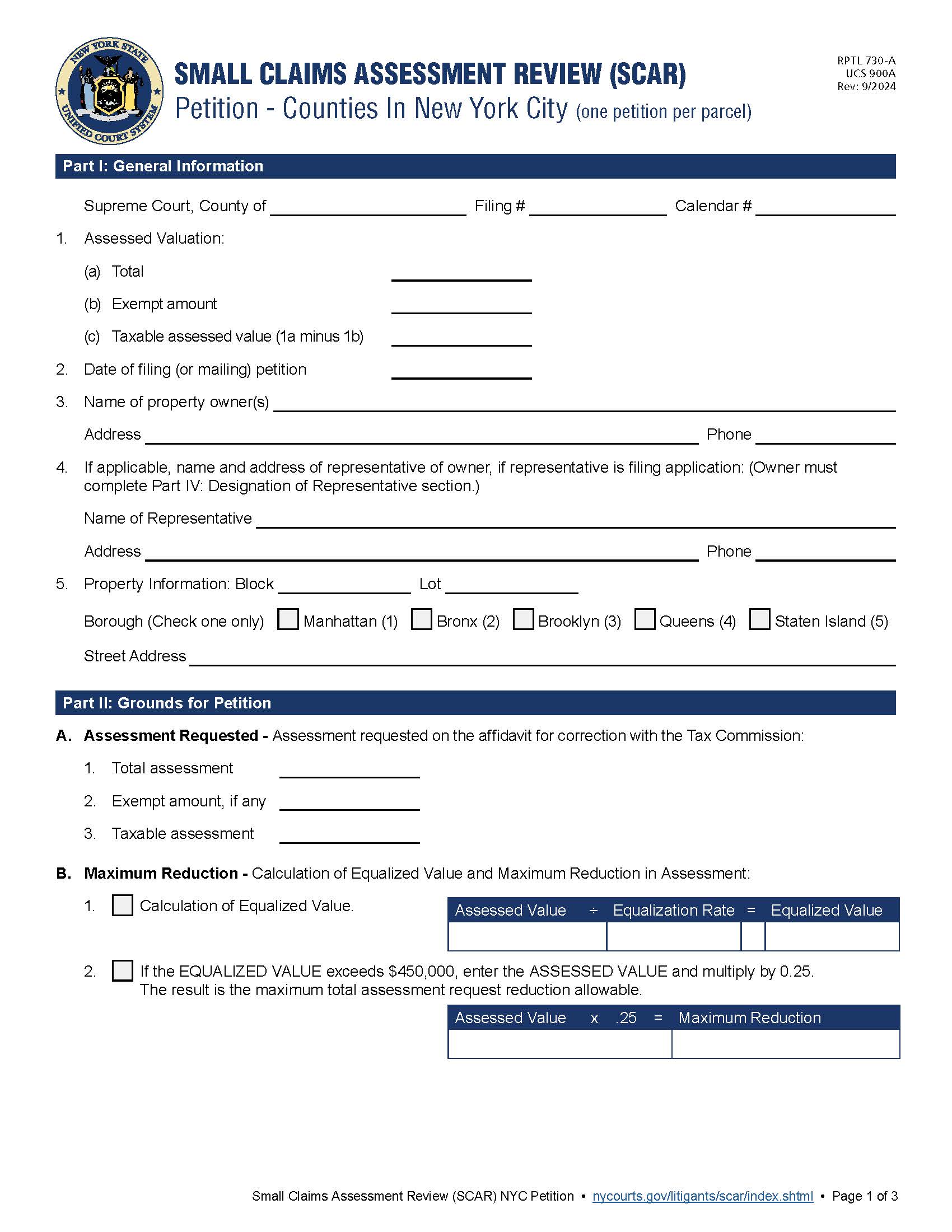

Petition Small Claims Assessment Review In Counties In New York City {UCS 900A}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

UCS 900A - PETITION - COUNTIES IN NEW YORK CITY. This form is used by Class 1 property owners to challenge their property tax assessments. It allows owners to dispute the assessed value of their property if it is unequal compared to similar properties or excessive in relation to its market value. The petition seeks to reduce the assessed value to a fair amount. Eligible properties must be owner-occupied, used exclusively for residential purposes, and have already filed an application for correction with the NYC Tax Commission. If the property’s equalized value exceeds $450,000, any requested reduction cannot exceed 25% of the assessed value. The form must be filed with the Supreme Court in the relevant county, and a copy must be sent to the Tax Commission within ten days of filing. www.FormsWorkflow.com