Last updated: 6/1/2025

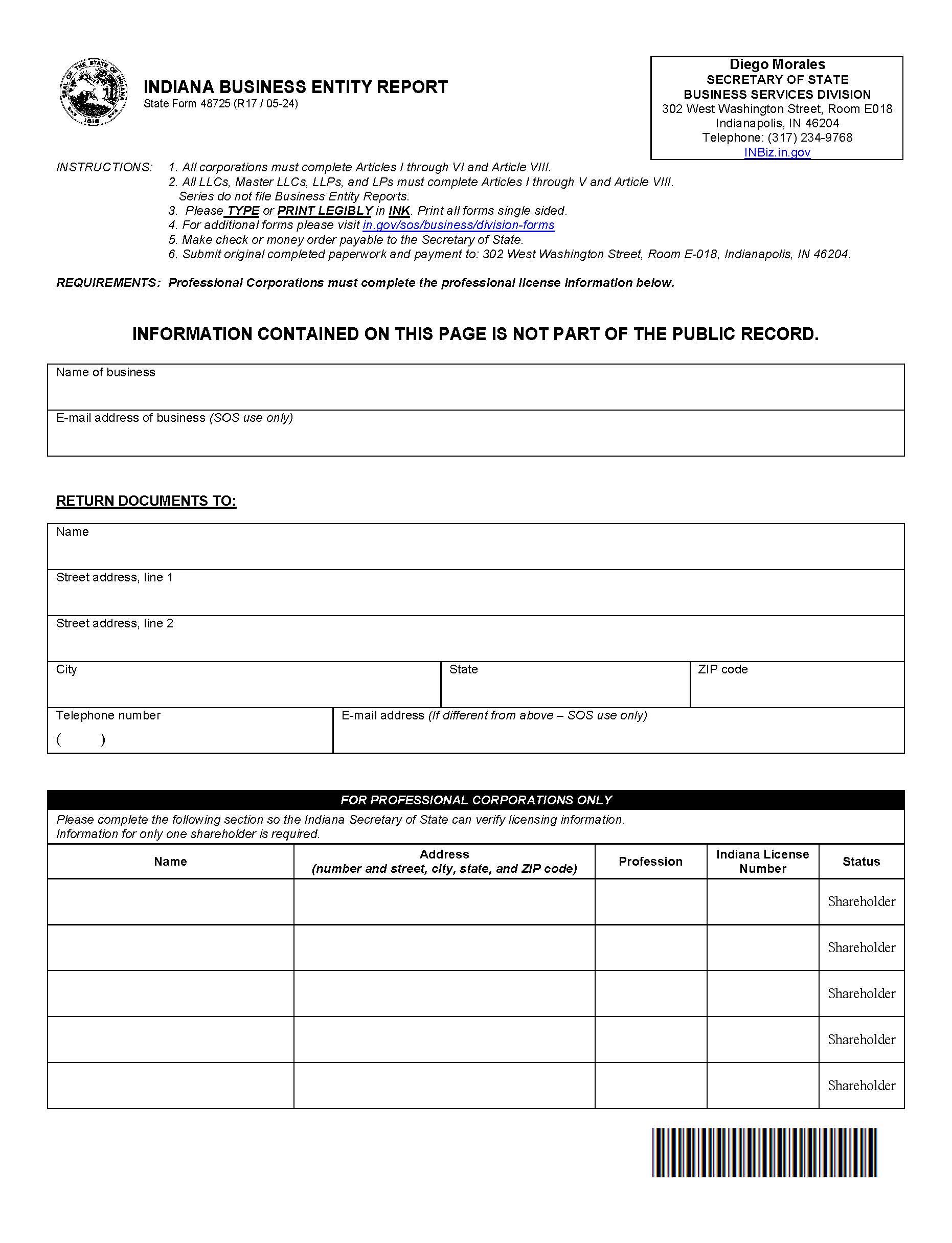

Indiana Business Entity Report {48725}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

State Form 48725 - INDIANA BUSINESS ENTITY REPORT. This form is used by registered business entities in Indiana to comply with the state's biennial reporting requirements. This form must be filed every other year by domestic and foreign corporations, limited liability companies (LLCs), limited liability partnerships (LLPs), and limited partnerships (LPs), while nonprofit corporations file a similar report at a reduced fee. The purpose of this report is to ensure that the Secretary of State has accurate and up-to-date information regarding a business’s legal status, structure, and key details. The form requires information such as the entity's name, principal office address, jurisdiction and date of formation, entity type, and registered agent details. Corporations must also include or confirm their governing officers or directors, and professional corporations must verify licensing credentials of at least one shareholder. Filing this report maintains a business's good standing with the state and allows for continued legal operation in Indiana. Failure to file can lead to administrative dissolution or revocation of the entity's authority to conduct business. www.FormsWorkflow.com