Last updated: 4/30/2024

Claim To Receive Surplus Of Tax Deed Sale

Start Your Free Trial $ 14.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

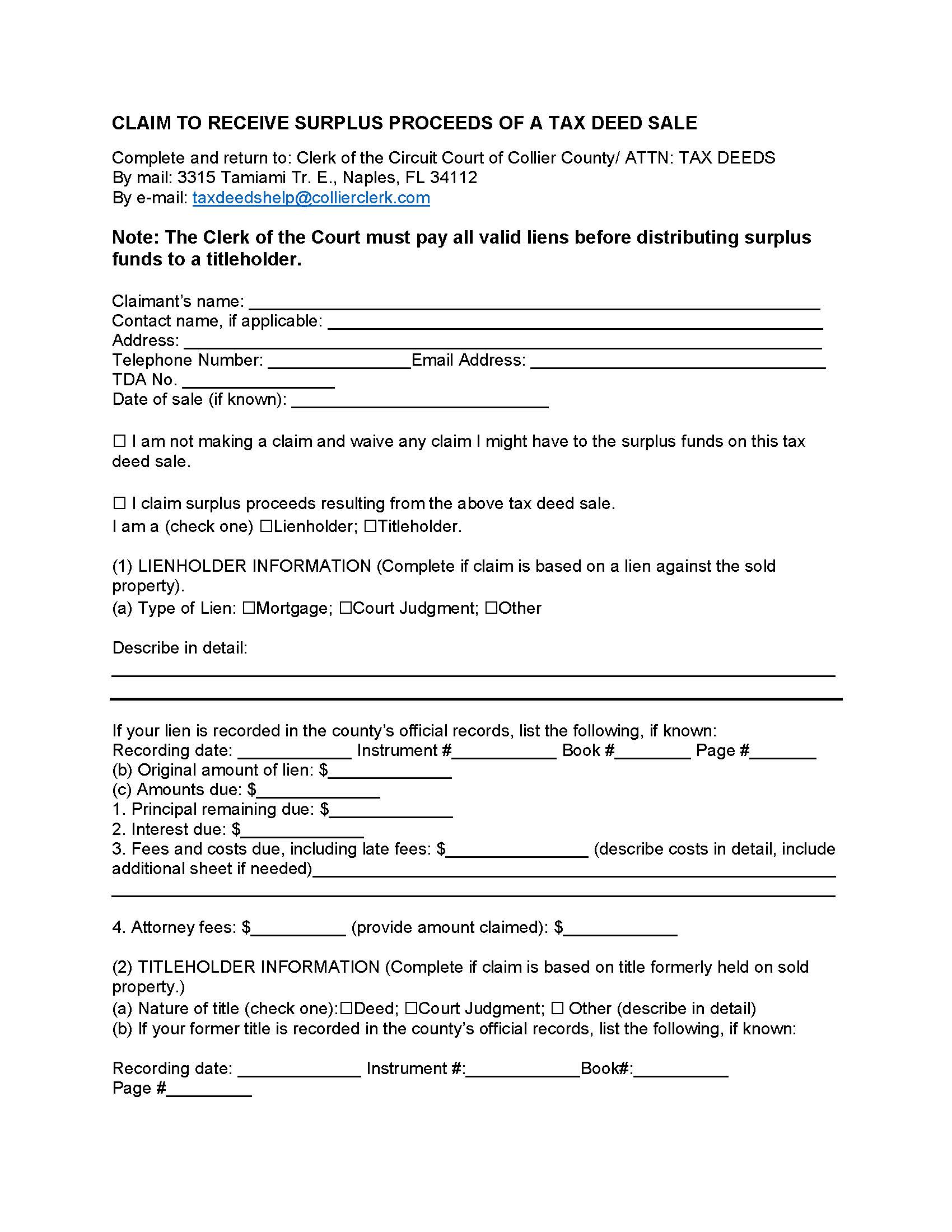

CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED SALE. This form is used for making a claim to receive surplus proceeds from a tax deed sale in Collier County, Florida. It includes sections for claimant information, such as name, contact details, and the Tax Deed Application (TDA) number. The claimant can indicate whether they are a lienholder or titleholder and provide relevant information accordingly. For lienholders, details about the lien, including type, recording information, and amounts due, are required. For titleholders, information about the nature of the title, recording details, and the amount of surplus claimed is necessary. The claimant must swear or affirm the accuracy of the information provided before a notary public or deputy clerk. The form also outlines the procedures for filing the claim, including mailing, delivery, fax, or email, and specifies the deadline for filing. It warns that failure to file a proper and timely claim may result in forfeiture of the right to receive surplus funds. www.FormsWorkflow.com

Related forms

-

Standing Order In Civil Cases In The Twentieth Judicial Circuit

Standing Order In Civil Cases In The Twentieth Judicial Circuit

Florida/Local County/Collier/Civil/ -

Answer (General Form)

Answer (General Form)

Florida/Local County/Collier/Civil/ -

Motion (General Form)

Motion (General Form)

Florida/Local County/Collier/Civil/ -

Foreclosure Mediation Form A (Certifications)

Foreclosure Mediation Form A (Certifications)

Florida/2 Local County/Collier/Civil/ -

Owners Claim For Mortgage Foreclosure Surplus

Owners Claim For Mortgage Foreclosure Surplus

Florida/2 Local County/Collier/Civil/ -

Summons Notice To Appear For Pretrial Conference

Summons Notice To Appear For Pretrial Conference

Florida/2 Local County/Collier/Civil/ -

Notice Of Confidential Information Within Court FIling

Notice Of Confidential Information Within Court FIling

Florida/2 Local County/Collier/Civil/ -

Lobbyist Withdrawal Form

Lobbyist Withdrawal Form

Florida/2 Local County/Collier/Civil/ -

(Writ Of) Execution

(Writ Of) Execution

Florida/2 Local County/Collier/Civil/ -

Lobbyist Registration Form

Lobbyist Registration Form

Florida/2 Local County/Collier/Civil/ -

Affidavit And Notice Of Non-Compliance Of Mediation Agreement

Affidavit And Notice Of Non-Compliance Of Mediation Agreement

Florida/2 Local County/Collier/Civil/ -

Order Of Referral To The Magistrate (Pamela Barger Civil)

Order Of Referral To The Magistrate (Pamela Barger Civil)

Florida/2 Local County/Collier/Civil/ -

Uniform Pretrial Conference Trial Order Setting Trial (Judge Brodie)

Uniform Pretrial Conference Trial Order Setting Trial (Judge Brodie)

Florida/2 Local County/Collier/Civil/ -

Agreed Case Management Plan And Order (Judge Brodie)

Agreed Case Management Plan And Order (Judge Brodie)

Florida/2 Local County/Collier/Civil/ -

Uniform Order Setting Jury Trial-Non-Jury Trial Pretrial Conference

Uniform Order Setting Jury Trial-Non-Jury Trial Pretrial Conference

Florida/2 Local County/Collier/Civil/ -

Final Discharge Checklist (Judge Brodie)

Final Discharge Checklist (Judge Brodie)

Florida/2 Local County/Collier/Civil/ -

Checklist And Certification - Petition For Formal Administration (Judge Brodie)

Checklist And Certification - Petition For Formal Administration (Judge Brodie)

Florida/2 Local County/Collier/Civil/ -

Checklist And Certification - Petition For Summary Administration (Judge Brodie)

Checklist And Certification - Petition For Summary Administration (Judge Brodie)

Florida/2 Local County/Collier/Civil/ -

Agreed Case Management Plan And Order (Judge Hayes)

Agreed Case Management Plan And Order (Judge Hayes)

Florida/2 Local County/Collier/Civil/ -

Uniform Trial Order (Judge Hayes)

Uniform Trial Order (Judge Hayes)

Florida/2 Local County/Collier/Civil/ -

Uniform Order Setting Jury Non-Jury Trial Pretrial Conference (Judge Hayes)

Uniform Order Setting Jury Non-Jury Trial Pretrial Conference (Judge Hayes)

Florida/2 Local County/Collier/Civil/ -

Order Permitting Withdrawal Of Attorney (Judge Hayes)

Order Permitting Withdrawal Of Attorney (Judge Hayes)

Florida/2 Local County/Collier/Civil/ -

Order-Referral To Non-Binding Arbitration (Judge Hayes)

Order-Referral To Non-Binding Arbitration (Judge Hayes)

Florida/2 Local County/Collier/Civil/ -

Order Granting Petition Appointment Of Guardian (Adopting Guardianship Dente) (Judge Krier)

Order Granting Petition Appointment Of Guardian (Adopting Guardianship Dente) (Judge Krier)

Florida/2 Local County/Collier/Civil/ -

Order Granting Leave To Withdraw As Attorney Of Record (Judge Krier)

Order Granting Leave To Withdraw As Attorney Of Record (Judge Krier)

Florida/2 Local County/Collier/Civil/ -

Order Granting Petition To Determine Incapacity (Adopting Incapacity Dente) (Judge Krier)

Order Granting Petition To Determine Incapacity (Adopting Incapacity Dente) (Judge Krier)

Florida/2 Local County/Collier/Civil/ -

Order Scheduling Case Management Conference

Order Scheduling Case Management Conference

Florida/2 Local County/Collier/Civil/ -

Declaration Of Domicile

Declaration Of Domicile

Florida/Local County/Collier/Civil/ -

Agreed Case Management Plan And Order

Agreed Case Management Plan And Order

Florida/2 Local County/Collier/Civil/ -

Order Determining Incapacity

Order Determining Incapacity

Florida/2 Local County/Collier/Civil/ -

Checklist And Certification - Petition For Summary Administration (Judge Krier)

Checklist And Certification - Petition For Summary Administration (Judge Krier)

Florida/2 Local County/Collier/Civil/ -

Final Discharge Checklist (Judge Krier)

Final Discharge Checklist (Judge Krier)

Florida/2 Local County/Collier/Civil/ -

Attorney Checklist For Uuncontested Dissolutions

Attorney Checklist For Uuncontested Dissolutions

Florida/2 Local County/Collier/Civil/ -

Checklist And Certification - Petition For Formal Administration (Judge Krier)

Checklist And Certification - Petition For Formal Administration (Judge Krier)

Florida/2 Local County/Collier/Civil/ -

Order Of Referral To Magistrate Judge Barger (Judge Brodie)

Order Of Referral To Magistrate Judge Barger (Judge Brodie)

Florida/2 Local County/Collier/Civil/ -

Order Of Referral To Magistrate Judge Ellis (Judge Brodie)

Order Of Referral To Magistrate Judge Ellis (Judge Brodie)

Florida/2 Local County/Collier/Civil/ -

Notice Of Commencement

Notice Of Commencement

Florida/2 Local County/Collier/Civil/ -

Uniform Order Setting Trial Pretrial Conference (Notice For Trial)

Uniform Order Setting Trial Pretrial Conference (Notice For Trial)

Florida/2 Local County/Collier/Civil/ -

Uniform Pretrial Conference Trial Order Setting Trial

Uniform Pretrial Conference Trial Order Setting Trial

Florida/2 Local County/Collier/Civil/ -

Order Of Referral To The Magistrate (Mag. Ellis - Probate)

Order Of Referral To The Magistrate (Mag. Ellis - Probate)

Florida/2 Local County/Collier/Civil/ -

Information Sheet Deeds Other Documents Transferring Interest In Real Property

Information Sheet Deeds Other Documents Transferring Interest In Real Property

Florida/2 Local County/Collier/Civil/ -

Statement Of Claim (Small Claims)

Statement Of Claim (Small Claims)

Florida/2 Local County/Collier/Civil/ -

Order Of Referral To Magistrate Judge Barger (Probate)

Order Of Referral To Magistrate Judge Barger (Probate)

Florida/2 Local County/Collier/Civil/ -

Claim To Receive Surplus Of Tax Deed Sale

Claim To Receive Surplus Of Tax Deed Sale

Florida/2 Local County/Collier/Civil/ -

Family Order Of Referral To General Magistrate Dente

Family Order Of Referral To General Magistrate Dente

Florida/2 Local County/Collier/Civil/ -

Automated Clearing House (ACH) - Electronic Funds Transfer (EFT) Authorization

Automated Clearing House (ACH) - Electronic Funds Transfer (EFT) Authorization

Florida/2 Local County/Collier/Civil/ -

Request For Redaction Exempt Personal Info Non-Judicial Public Records

Request For Redaction Exempt Personal Info Non-Judicial Public Records

Florida/2 Local County/Collier/Civil/ -

Order Granting Leave To Withdraw As Attorney Of Record (Judge Brodie)

Order Granting Leave To Withdraw As Attorney Of Record (Judge Brodie)

Florida/2 Local County/Collier/Civil/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!