Last updated: 10/13/2023

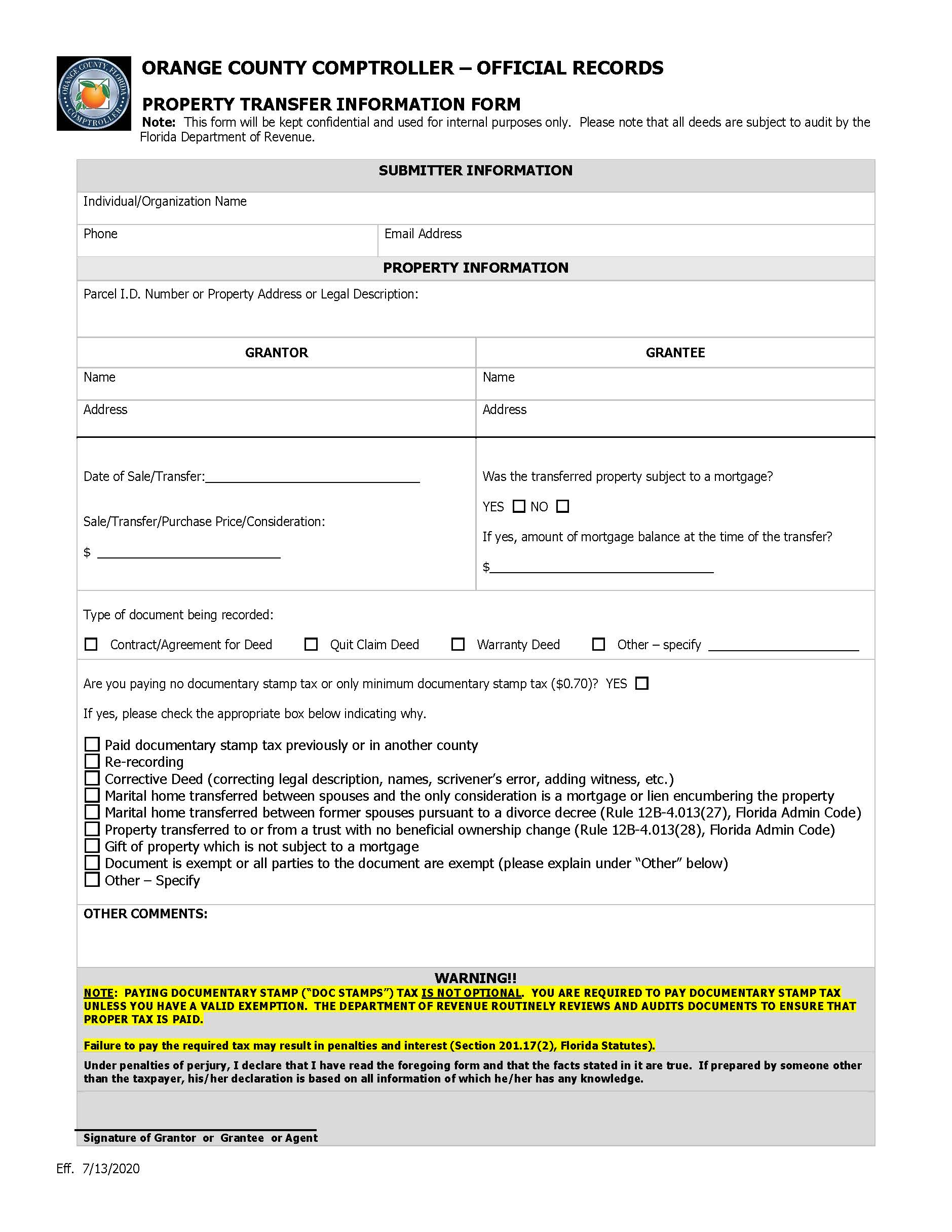

Property Transfer Information Form

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

PROPERTY TRANSFER INFORMATION FORM. Section 201.02(1)(a), Florida Statutes, imposes a tax (commonly referred to as documentary stamp tax) on documents, such as deeds, that transfer, assign, or otherwise convey an interest in Florida real property. The tax is to be paid at the rate of $0.70 per $100 or fraction thereof on the total consideration. Consideration includes, but is not limited to, the money paid or agreed to be paid; the discharge of an obligation; and the amount of any mortgage, purchase money mortgage lien, or other encumbrance, whether or not the underlying indebtedness is assumed. If the consideration paid or given in exchange for real property or any interest therein includes property other than money, it is presumed that the consideration is equal to the fair market value of the real property that is transferred or interest therein. The attached form is to be completed and submitted with the conveyance document, but will not be recorded with the document. It is for purposes of helping to determine the correct tax amount due at the time of recording. PENALTY FOR FAILING TO PAY THE REQUIRED TAX: A penalty is imposed (§ 201.17(2)(b), Florida Statutes), equal to 10% of any unpaid tax if the failure is for not more than 30 days, with an additional amount of 10% for each additional 30 days or fraction thereof, up to 50% of the unpaid tax. Additionally, interest shall be charged based upon the amount of tax due from the date of recording until the tax is paid (§ 201.17(2)(c ), Florida Statutes). www.FormsWorkflow.com

Related forms

-

Statement Of Claim

Statement Of Claim

Florida/Local County/Orange/General/ -

Affidavit As To Military Service Proper Venue And Indebtedness

Affidavit As To Military Service Proper Venue And Indebtedness

Florida/Local County/Orange/General/ -

Claim Of Exemption And Request For Hearing

Claim Of Exemption And Request For Hearing

Florida/Local County/Orange/General/ -

Continuing Writ Of Garnishment Against Salary Or Wages

Continuing Writ Of Garnishment Against Salary Or Wages

Florida/Local County/Orange/General/ -

Motion

Motion

Florida/Local County/Orange/General/ -

Writ Of Garnishment

Writ Of Garnishment

Florida/Local County/Orange/General/ -

Order Of Referral To General Magistrate - Civil

Order Of Referral To General Magistrate - Civil

Florida/Local County/Orange/General/ -

Stipulation And Consent To Referral And Regarding Transcript

Stipulation And Consent To Referral And Regarding Transcript

Florida/Local County/Orange/General/ -

Final Judgment Against

Final Judgment Against

Florida/Local County/Orange/General/ -

Subpoena Duces Tecum For Deposition (County Court)

Subpoena Duces Tecum For Deposition (County Court)

Florida/Local County/Orange/General/ -

Subpoena Duces Tecum For Deposition (Circuit Court)

Subpoena Duces Tecum For Deposition (Circuit Court)

Florida/Local County/Orange/General/ -

Subpoena (Trial - Circuit Court)

Subpoena (Trial - Circuit Court)

Florida/Local County/Orange/General/ -

Subpoena Duces Tecum (Trial - Circuit Court)

Subpoena Duces Tecum (Trial - Circuit Court)

Florida/Local County/Orange/General/ -

Certificate of Mailing (Summons And Complaint)

Certificate of Mailing (Summons And Complaint)

Florida/Local County/Orange/General/ -

Voluntary Dismissal

Voluntary Dismissal

Florida/Local County/Orange/General/ -

Motion For Ex-Parte Hearing In Aid Of Execution

Motion For Ex-Parte Hearing In Aid Of Execution

Florida/Local County/Orange/General/ -

Notice Of Contest Of Lien

Notice Of Contest Of Lien

Florida/Local County/Orange/General/ -

Notice Of Termination Of Notice of Commencement

Notice Of Termination Of Notice of Commencement

Florida/Local County/Orange/General/ -

Declaration Of Domicile (English-Spanish)

Declaration Of Domicile (English-Spanish)

Florida/Local County/Orange/General/ -

Summons

Summons

Florida/Local County/Orange/General/ -

Affidavit Of Non-Compliance

Affidavit Of Non-Compliance

Florida/2 Local County/Orange/General/ -

Transfer Of Lien To Security Request Form

Transfer Of Lien To Security Request Form

Florida/2 Local County/Orange/General/ -

Release Of Transfer (Of Lien)

Release Of Transfer (Of Lien)

Florida/2 Local County/Orange/General/ -

Notice Of Change Of Address

Notice Of Change Of Address

Florida/2 Local County/Orange/General/ -

Notice Of Hearing And Order Case Management Conference (Business Court)

Notice Of Hearing And Order Case Management Conference (Business Court)

Florida/2 Local County/Orange/General/ -

Final Judgment Of Replevin

Final Judgment Of Replevin

Florida/2 Local County/Orange/General/ -

Request Copies Of Court Records By Mail

Request Copies Of Court Records By Mail

Florida/2 Local County/Orange/General/ -

Additional Plaintiffs Statement Page

Additional Plaintiffs Statement Page

Florida/2 Local County/Orange/General/ -

Law Enforcement-Public Safety Request Remove Information From Public Inspection

Law Enforcement-Public Safety Request Remove Information From Public Inspection

Florida/2 Local County/Orange/General/ -

Request To Release Exempt Status Of Home Address

Request To Release Exempt Status Of Home Address

Florida/2 Local County/Orange/General/ -

Fully Briefed Motion Checklist

Fully Briefed Motion Checklist

Florida/2 Local County/Orange/General/ -

Complex Construction Case Management Order

Complex Construction Case Management Order

Florida/2 Local County/Orange/General/ -

Civil Cover Sheet With Business Court Addendum

Civil Cover Sheet With Business Court Addendum

Florida/2 Local County/Orange/General/ -

Order For Monitored Visitation Exchange (Overnight Unsupervised Visitation)

Order For Monitored Visitation Exchange (Overnight Unsupervised Visitation)

Florida/2 Local County/Orange/General/ -

Order For Supervised Visitation

Order For Supervised Visitation

Florida/2 Local County/Orange/General/ -

Request (By Protected Party) To OC Comptroller To Release Redacted Information

Request (By Protected Party) To OC Comptroller To Release Redacted Information

Florida/2 Local County/Orange/General/ -

Request To Release Redacted Information On Recorded Documents For Title Search

Request To Release Redacted Information On Recorded Documents For Title Search

Florida/2 Local County/Orange/General/ -

Notice To Appear For Pretrial Conference-Mediation

Notice To Appear For Pretrial Conference-Mediation

Florida/Local County/Orange/General/ -

Landlord-Tenant Stipulation

Landlord-Tenant Stipulation

Florida/Local County/Orange/General/ -

Notice Of Exemption From Public Records

Notice Of Exemption From Public Records

Florida/Local County/Orange/General/ -

Exhibit List

Exhibit List

Florida/Local County/Orange/General/ -

Notice Of Fully Briefed Motion (Business Court)

Notice Of Fully Briefed Motion (Business Court)

Florida/Local County/Orange/General/ -

Request For Name-Address Change And Email Designation Form

Request For Name-Address Change And Email Designation Form

Florida/2 Local County/Orange/General/ -

Pre-Trial Conference Checklist And Order Controlling Trial (Business Court)

Pre-Trial Conference Checklist And Order Controlling Trial (Business Court)

Florida/Local County/Orange/General/ -

Property Transfer Information Form

Property Transfer Information Form

Florida/Local County/Orange/General/ -

Notice Of Commencement

Notice Of Commencement

Florida/Local County/Orange/General/ -

Case Management Order (Business Court - Judge Jordan)

Case Management Order (Business Court - Judge Jordan)

Florida/Local County/Orange/General/ -

Request For Redaction Of Personal Information (Non-Judicial Public Records)

Request For Redaction Of Personal Information (Non-Judicial Public Records)

Florida/2 Local County/Orange/General/ -

Refund Request Of The Orange County Comptrollers Official Records Department

Refund Request Of The Orange County Comptrollers Official Records Department

Florida/2 Local County/Orange/General/ -

Request To Release Protected Decedents Removed Information

Request To Release Protected Decedents Removed Information

Florida/2 Local County/Orange/General/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!