Last updated: 1/10/2023

Expense Loss Cost Multiplier Worksheet For Group Sel-Insurance Fund {LIBC-351}

Start Your Free Trial $ 27.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

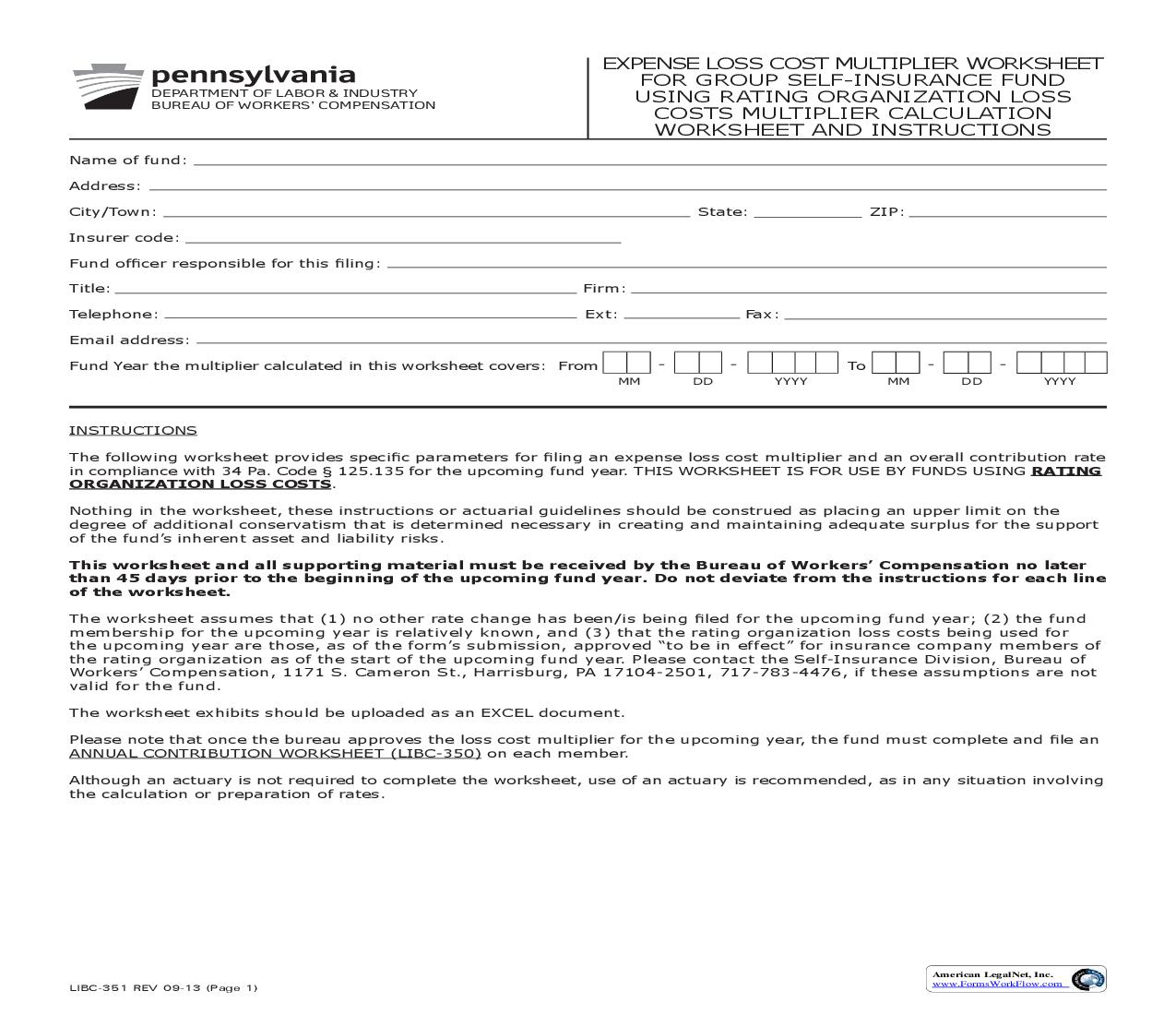

DEPARTMENT OF LABOR & INDUSTRY BUREAU OF WORKERS' COMPENSATION EXPENSE LOSS COST MULTIPLIER WORKSHEET FOR GROUP SELF-INSURANCE FUND USING RATING ORGANIZATION LOSS COSTS MULTIPLIER CALCULATION WORKSHEET AND INSTRUCTIONS Name of fund: Address: City/Town: Insurer code: Fund officer responsible for this filing: Title: Telephone: Email address: Fund Year the multiplier calculated in this worksheet covers: From MM State: ZIP: Firm: Ext: Fax: DD YYYY To MM DD YYYY INSTRUCTIONS The following worksheet provides specific parameters for filing an expense loss cost multiplier and an overall contribution rate in compliance with 34 Pa. Code § 125.135 for the upcoming fund year. THIS WORKSHEET IS FOR USE BY FUNDS USING RATING ORGANIZATION LOSS COSTS. Nothing in the worksheet, these instructions or actuarial guidelines should be construed as placing an upper limit on the degree of additional conservatism that is determined necessary in creating and maintaining adequate surplus for the support of the fund's inherent asset and liability risks. This worksheet and all supporting material must be received by the Bureau of Workers' Compensation no later than 45 days prior to the beginning of the upcoming fund year. Do not deviate from the instructions for each line of the worksheet. The worksheet assumes that (1) no other rate change has been/is being filed for the upcoming fund year; (2) the fund membership for the upcoming year is relatively known, and (3) that the rating organization loss costs being used for the upcoming year are those, as of the form's submission, approved "to be in effect" for insurance company members of the rating organization as of the start of the upcoming fund year. Please contact the Self-Insurance Division, Bureau of Workers' Compensation, 1171 S. Cameron St., Harrisburg, PA 17104-2501, 717-783-4476, if these assumptions are not valid for the fund. The worksheet exhibits should be uploaded as an EXCEL document. Please note that once the bureau approves the loss cost multiplier for the upcoming year, the fund must complete and file an ANNUAL CONTRIBUTION WORKSHEET (LIBC-350) on each member. Although an actuary is not required to complete the worksheet, use of an actuary is recommended, as in any situation involving the calculation or preparation of rates. LIBC-351 REV 09-13 (Page 1) American LegalNet, Inc. www.FormsWorkFlow.com LOSS COST MULTIPLIER CALCULATION WORKSHEET FOR GROUP USING RATING ORGANIZATION LOSS COSTS A. LOSS COST CONTRIBUTION (in dollars) A. · Create an exhibit which includes the following fields for each expected member during the upcoming fund year: · · · Rating Organization Classification The exposure of the member (e.g., $100 of payroll) The loss costs for the classification · Multiple rows of such fields must be included for members with exposure in more than one classification. (The ANNUAL CONTRIBUTION WORKSHEET, LIBC-350, provides guidance for this exhibit.) Multiply exposure by loss costs and enter into this box the sum of all the products for all members. · Based on its experience, the fund should consider loss costs at a greater level than the approved rating organization loss costs to avoid deficit funding. B. STANDARD CONTRIBUTION (in dollars) · Additional Columns should be added to BOX A's exhibit which show: · · The member's experience modification, according to rating organization formula and manual calculated based upon that member. The member's "Standard Contribution" (in dollars) which is the loss cost contribution multiplied by its experience modification. B. · The sum of each member's standard contribution gives the Fund's total Standard Contribution. · The sum does NOT include any discounting for time value of money, allowances for income from (nor any transfer of) earlier fund years' surplus, credits, expenses, or expense constant. C. ADJUSTED PROJECTED EXCESS INSURANCE PREMIUM GROSS OF EXCESS LOSSES (in dollars) C. · The premium may not be reduced by the losses expected to be covered by the excess insurance. · Attach an exhibit or other information explaining the amount of estimated gross excess insurance premium, e.g., a written premium quote. · D. The premium must also be entered in Part 1, Line A of the attached EXPENSE EXHIBIT form. D. ADJUSTED PROJECTED VARIABLE EXPENSE (in dollars) · Complete the attached EXPENSE EXHIBIT form. The adjusted projected variable expense is taken from Part 1, Line E of that form. E. ADJUSTED PROJECTED FIXED EXPENSE (in dollars) E. · The adjusted projected fixed expenses are taken from Part 2, Line D of the EXPENSE EXHIBIT form. NOTE: This is net of expense constant. F. EXPENSE CONSTANT COMPONENT OF CONTRIBUTION · This is taken from Part 2, Line C of the EXPENSE EXHIBIT form. G. CONSERVATIVE ESTIMATE OF DEFICITS (as negative amount) FROM THE CURRENT AND PREVIOUS LOSS YEARS. G. F. · Create an exhibit showing the amount of any known surplus for each loss year the fund has existed. "Surplus" refers to a loss year's collected premium (and accrued investment income) after subtracting of ultimate losses and expenses (including the dividends already approved for that loss year). · Estimates produced (within the last 12 months) by an actuarial report is preferable, especially if a discounted estimate at 75 percent or higher confidence level was used. Estimates of the surpluses for each of the prior loss years should have been produced at least as recently as the latest fiscal year report. If no such analysis has been created for the current loss year the exhibit will be limited to only prior years. · If the sum of the exhibit's surpluses is negative, then enter that negative sum into BOX G and submit the exhibit with this form. · If the sum of such surpluses is positive or zero, then enter 0 into BOX G and submit the exhibit with this form. LIBC-351 REV 09-13 (Page 2) American LegalNet, Inc. www.FormsWorkFlow.com BOX G NOTE: Box H BOX I NOTE: BOX J NOTE: BOX K BOX O BOX B Box O BOX O - - BOX O BOX O LIBC-351 REV 09-13 (Page 3) American LegalNet, Inc. www.FormsWorkFlow.com EXPENSE LOSS COSTS MULTIPLIER WORKSHEET FOR GROUP SELF-INSURANCE FUND USING RATING ORGANIZATION LOSS COSTS EXPENSE EXHIBITS AND INSTRUCTIONS FOR COMPLETING BOXES D AND E OF THE WORKSHEET INSTRUCTIONS The following exhibits are used to calculate a group self-insurance fund's projected annual adjusted variable expenses and adjusted fixed expenses for inclusion in the submission of its LOSS COST MULTIPLIER WORKSHEET (LIBC-351). THESE EXHIB

Related forms

-

Defendants Answer To Claim Petition Under Pennsylvania Occupational Disease Act

Defendants Answer To Claim Petition Under Pennsylvania Occupational Disease Act

Pennsylvania/Workers Comp/ -

Informal Conference Agreement Form

Informal Conference Agreement Form

Pennsylvania/Workers Comp/ -

Notice Of Request For An Informal Conference

Notice Of Request For An Informal Conference

Pennsylvania/Workers Comp/ -

Petition For Joinder Of Additional Defendant

Petition For Joinder Of Additional Defendant

Pennsylvania/Workers Comp/ -

Petition For Physical Examination Or Expert Interview Of Employee (Section 314)

Petition For Physical Examination Or Expert Interview Of Employee (Section 314)

Pennsylvania/Workers Comp/ -

Notice Medical Treatment For Work Injury Or Occupational Illness

Notice Medical Treatment For Work Injury Or Occupational Illness

Pennsylvania/Workers Comp/ -

Notice To Claimant

Notice To Claimant

Pennsylvania/Workers Comp/ -

Answer To Petition To

Answer To Petition To

Pennsylvania/Workers Comp/ -

Defendants Answer To Claim Petition Under Pennsylvania Workers Compensation Act

Defendants Answer To Claim Petition Under Pennsylvania Workers Compensation Act

Pennsylvania/Workers Comp/ -

Fatal Claim Petition For Compensation By Dependents Of Deceased Employees

Fatal Claim Petition For Compensation By Dependents Of Deceased Employees

Pennsylvania/Workers Comp/ -

Notice Of AbilityTo Return To Work

Notice Of AbilityTo Return To Work

Pennsylvania/Workers Comp/ -

Petition For Review Of Utilization Review Determination

Petition For Review Of Utilization Review Determination

Pennsylvania/Workers Comp/ -

Physicians Affidavit Of Recovery

Physicians Affidavit Of Recovery

Pennsylvania/Workers Comp/ -

Claim Petition For Benefits From Uninsured Employer Guaranty Fund And Uninsured Employer

Claim Petition For Benefits From Uninsured Employer Guaranty Fund And Uninsured Employer

Pennsylvania/Workers Comp/ -

Charge Of Unfair Labor Practices

Charge Of Unfair Labor Practices

Pennsylvania/Workers Comp/ -

Charge of Unfair Practices

Charge of Unfair Practices

Pennsylvania/Workers Comp/ -

Joint Election Request

Joint Election Request

Pennsylvania/Workers Comp/ -

Joint Request For Certification

Joint Request For Certification

Pennsylvania/Workers Comp/ -

Request For Appointment Of Fact-Finding Panel

Request For Appointment Of Fact-Finding Panel

Pennsylvania/Workers Comp/ -

Claimants Statement

Claimants Statement

Pennsylvania/Workers Comp/ -

Death Claim Supplement To Compromise And Release Agreement

Death Claim Supplement To Compromise And Release Agreement

Pennsylvania/Workers Comp/ -

Electronic Data Interchange First Report Of Injury

Electronic Data Interchange First Report Of Injury

Pennsylvania/Workers Comp/ -

Defendants Answer To Occupational Disease Claim Petition Section 301(i) Only

Defendants Answer To Occupational Disease Claim Petition Section 301(i) Only

Pennsylvania/Workers Comp/ -

Electronic Data Interchange Subsequent Report Of Injury

Electronic Data Interchange Subsequent Report Of Injury

Pennsylvania/Workers Comp/ -

Group Self-Insurance Fund Member Annual Contribution Worksheet Form

Group Self-Insurance Fund Member Annual Contribution Worksheet Form

Pennsylvania/Workers Comp/ -

Supplemental Information Addendum To Annual Report Of Runoff Group Self-Insurance Fund

Supplemental Information Addendum To Annual Report Of Runoff Group Self-Insurance Fund

Pennsylvania/Workers Comp/ -

Supplemental Information Addendum To Application As A Group Workers Compensation Fund

Supplemental Information Addendum To Application As A Group Workers Compensation Fund

Pennsylvania/Workers Comp/ -

Answer To Petition For Commutation

Answer To Petition For Commutation

Pennsylvania/Workers Comp/ -

Petition For Commutation

Petition For Commutation

Pennsylvania/Workers Comp/ -

Child Support Lien Affidavit

Child Support Lien Affidavit

Pennsylvania/Workers Comp/ -

Conciliation Invoice

Conciliation Invoice

Pennsylvania/Workers Comp/ -

Fact Finding Invoice

Fact Finding Invoice

Pennsylvania/Workers Comp/ -

Act 88 Arbitration Invoice

Act 88 Arbitration Invoice

Pennsylvania/Workers Comp/ -

Act 195 Interest Arbitration Invoice

Act 195 Interest Arbitration Invoice

Pennsylvania/Workers Comp/ -

Authorization To Release Information-Verification Or Information

Authorization To Release Information-Verification Or Information

Pennsylvania/Workers Comp/ -

Impairment Rating Determination Sheet

Impairment Rating Determination Sheet

Pennsylvania/Workers Comp/ -

Petition To

Petition To

Pennsylvania/Workers Comp/ -

Request For Panel Of Neutral Interest Arbitrators

Request For Panel Of Neutral Interest Arbitrators

Pennsylvania/Workers Comp/ -

Claim Petition For Workers Compensation

Claim Petition For Workers Compensation

Pennsylvania/Workers Comp/ -

Notice Of Claim Against Uninsured Employer

Notice Of Claim Against Uninsured Employer

Pennsylvania/Workers Comp/ -

Request For Hearing To Contest Fee Review Determination

Request For Hearing To Contest Fee Review Determination

Pennsylvania/Workers Comp/ -

Compromise And Release Agreement

Compromise And Release Agreement

Pennsylvania/Workers Comp/ -

Statement Of Wages (For Injuries Occurring On Or Before June 23 1996)

Statement Of Wages (For Injuries Occurring On Or Before June 23 1996)

Pennsylvania/Workers Comp/ -

Statement Of Wages (For Injuries Occurring On And After June 24 1996)

Statement Of Wages (For Injuries Occurring On And After June 24 1996)

Pennsylvania/Workers Comp/ -

Final Statement Of Account Of Compensation Paid

Final Statement Of Account Of Compensation Paid

Pennsylvania/Workers Comp/ -

Employees Report Of Benefits For Offsets

Employees Report Of Benefits For Offsets

Pennsylvania/Workers Comp/ -

Commutation Of Compensation

Commutation Of Compensation

Pennsylvania/Workers Comp/ -

Employee Verification Of Employment Self-Employment Or Change In Physical Condition

Employee Verification Of Employment Self-Employment Or Change In Physical Condition

Pennsylvania/Workers Comp/ -

Notice Of Suspension For Failure To Return Form LIBC-760

Notice Of Suspension For Failure To Return Form LIBC-760

Pennsylvania/Workers Comp/ -

Notice Of Reinstatement Of Workers Compensation Benefits

Notice Of Reinstatement Of Workers Compensation Benefits

Pennsylvania/Workers Comp/ -

Notice Of Workers Compensation Benefit Offset

Notice Of Workers Compensation Benefit Offset

Pennsylvania/Workers Comp/ -

Interested Party Update Request

Interested Party Update Request

Pennsylvania/Workers Comp/ -

Employers Insurance Information Sheet

Employers Insurance Information Sheet

Pennsylvania/Workers Comp/ -

Employee Report Of Wages And Physical Condition

Employee Report Of Wages And Physical Condition

Pennsylvania/Workers Comp/ -

Dismemberment Chart (Foot)

Dismemberment Chart (Foot)

Pennsylvania/Workers Comp/ -

Workers Compensation Medical Report Form

Workers Compensation Medical Report Form

Pennsylvania/Workers Comp/ -

Authorization For Alternative Delivery Of Compensation Payments

Authorization For Alternative Delivery Of Compensation Payments

Pennsylvania/Workers Comp/ -

Dismemberment Chart (Hand)

Dismemberment Chart (Hand)

Pennsylvania/Workers Comp/ -

Qualifications Of Reviewer

Qualifications Of Reviewer

Pennsylvania/5 Workers Comp/ -

Electronic Data Interchange First Report Of Injury

Electronic Data Interchange First Report Of Injury

Pennsylvania/5 Workers Comp/ -

Utilization Review Request

Utilization Review Request

Pennsylvania/Workers Comp/ -

Annual Report Of Accident And Illness Prevention Program Status

Annual Report Of Accident And Illness Prevention Program Status

Pennsylvania/Workers Comp/ -

Initial Report Of Accident And Illness Prevention Program Status

Initial Report Of Accident And Illness Prevention Program Status

Pennsylvania/Workers Comp/ -

Insurers Annual Report Of Accident And Illness Prevention Services

Insurers Annual Report Of Accident And Illness Prevention Services

Pennsylvania/Workers Comp/ -

Insurers Initial Report Of Accident And Illness Prevention Services

Insurers Initial Report Of Accident And Illness Prevention Services

Pennsylvania/Workers Comp/ -

Self-Insured Employers Initial Report Of Accident Prevention Program

Self-Insured Employers Initial Report Of Accident Prevention Program

Pennsylvania/Workers Comp/ -

Utilization Review Determination Face Sheet

Utilization Review Determination Face Sheet

Pennsylvania/Workers Comp/ -

Annual Report Of Accident And Illness Prevention Program Status Self Insured

Annual Report Of Accident And Illness Prevention Program Status Self Insured

Pennsylvania/Workers Comp/ -

Expense Loss Cost Multiplier Worksheet For Group Sel-Insurance Fund

Expense Loss Cost Multiplier Worksheet For Group Sel-Insurance Fund

Pennsylvania/Workers Comp/ -

Expense Loss Cost Multiplier Worksheet For Group Sel-Insurance Fund

Expense Loss Cost Multiplier Worksheet For Group Sel-Insurance Fund

Pennsylvania/Workers Comp/ -

Application For Fee Review Pursuant To Section 306 (F.1)

Application For Fee Review Pursuant To Section 306 (F.1)

Pennsylvania/Workers Comp/ -

Claim Petition For Additional Compensation From Subsecquent Injury Fund

Claim Petition For Additional Compensation From Subsecquent Injury Fund

Pennsylvania/Workers Comp/ -

Notification Of Suspension Or Modification Pursuant To Section 413 (C) And (D)

Notification Of Suspension Or Modification Pursuant To Section 413 (C) And (D)

Pennsylvania/Workers Comp/ -

Application For Benefits Under Section 909

Application For Benefits Under Section 909

Pennsylvania/Workers Comp/ -

Occupational Disease Claim Petition

Occupational Disease Claim Petition

Pennsylvania/Workers Comp/ -

Notice Of Change Of Workers Compensation Disability Status

Notice Of Change Of Workers Compensation Disability Status

Pennsylvania/5 Workers Comp/ -

Appeal From Judges Finding Of Fact

Appeal From Judges Finding Of Fact

Pennsylvania/Workers Comp/ -

Agreement For Compensation For Disability Or Permanent Injury

Agreement For Compensation For Disability Or Permanent Injury

Pennsylvania/Workers Comp/ -

Supplemental Agreement For Compensation For Disability Or Permanent Injury

Supplemental Agreement For Compensation For Disability Or Permanent Injury

Pennsylvania/Workers Comp/ -

Agreement For Compensation For Death

Agreement For Compensation For Death

Pennsylvania/Workers Comp/ -

Supplemental Agreement Form Compensation For Death

Supplemental Agreement Form Compensation For Death

Pennsylvania/Workers Comp/ -

Supplemental Information Addendum To Group Workers Compensation Fund

Supplemental Information Addendum To Group Workers Compensation Fund

Pennsylvania/Workers Comp/ -

Third Party Settlement Agreement

Third Party Settlement Agreement

Pennsylvania/Workers Comp/ -

Agreement To Stop Weekly Workers Compensation Payments (Final Receipt)

Agreement To Stop Weekly Workers Compensation Payments (Final Receipt)

Pennsylvania/Workers Comp/ -

Supplemental Information Addendum To Group Self-Insurance Fund Annual Report

Supplemental Information Addendum To Group Self-Insurance Fund Annual Report

Pennsylvania/Workers Comp/ -

Payment Authorization

Payment Authorization

Pennsylvania/Workers Comp/ -

Health And Safety Self Insured Group Funds Audit Worksheet

Health And Safety Self Insured Group Funds Audit Worksheet

Pennsylvania/Workers Comp/ -

Health And Safety Insurance Carriers Audit Worksheet

Health And Safety Insurance Carriers Audit Worksheet

Pennsylvania/Workers Comp/ -

Section 304.2 Application For Religious Exception Of Specified Employes

Section 304.2 Application For Religious Exception Of Specified Employes

Pennsylvania/Workers Comp/ -

Employees Affidavit And Waiver Of Workers Compensation Benefits And Statement Of Religious Sect

Employees Affidavit And Waiver Of Workers Compensation Benefits And Statement Of Religious Sect

Pennsylvania/Workers Comp/ -

Application For Executive Officer Exception

Application For Executive Officer Exception

Pennsylvania/Workers Comp/ -

Executive Officers Declaration

Executive Officers Declaration

Pennsylvania/Workers Comp/ -

Employers Certificate Of Insurance

Employers Certificate Of Insurance

Pennsylvania/Workers Comp/ -

Subpoena

Subpoena

Pennsylvania/Workers Comp/ -

Petition Under The Public Employe Relations Act

Petition Under The Public Employe Relations Act

Pennsylvania/Workers Comp/ -

Petition (Police, Fire And Private Sector)

Petition (Police, Fire And Private Sector)

Pennsylvania/Workers Comp/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!