Last updated: 12/9/2022

Trustee Deed

Start Your Free Trial $ 0.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

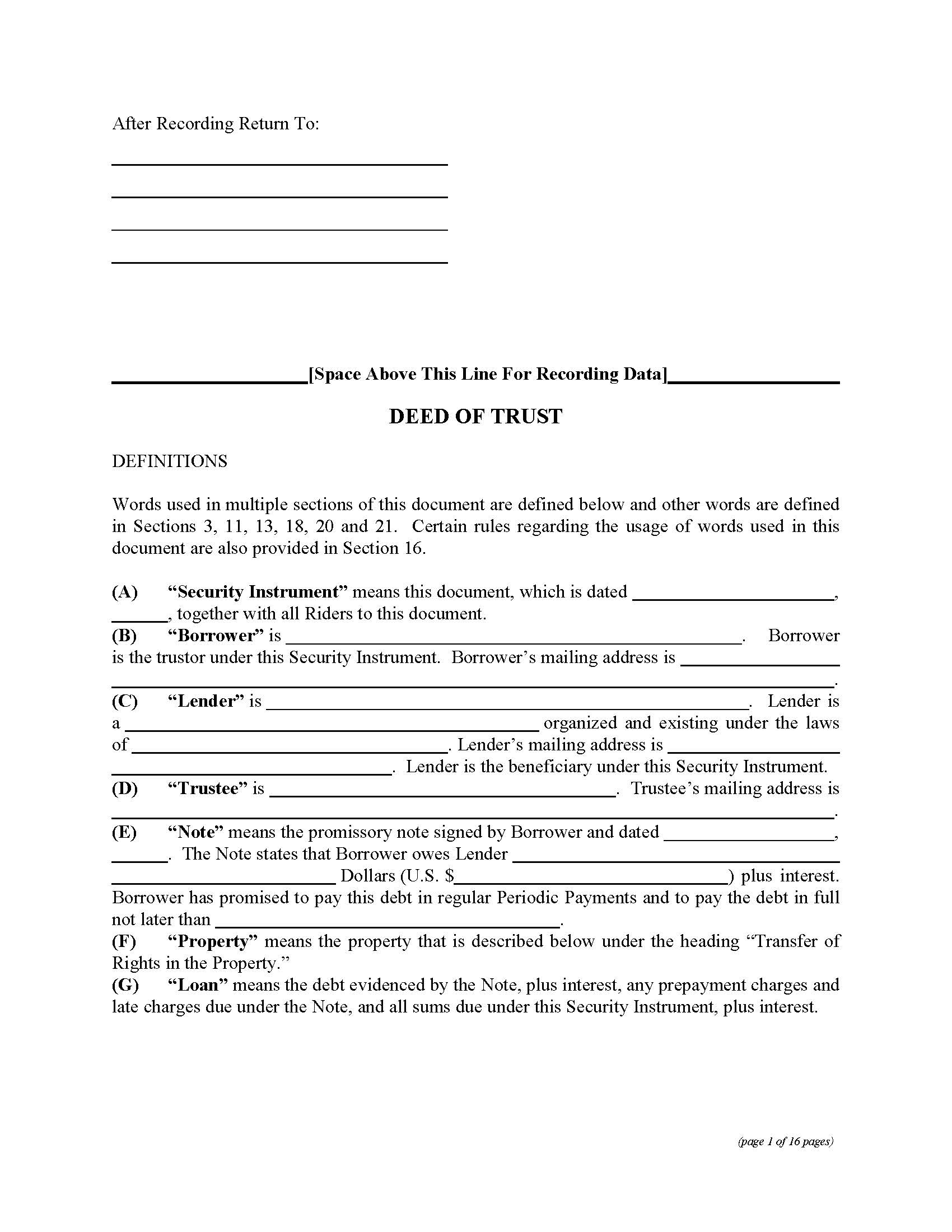

DEED OF TRUST. This form is a legal document used as security for a real estate loan. It is recorded with the county recorder or registrar of titles in the county where the real estate is located. Here are some key points about deeds of trust: A deed of trust serves as security for a real estate loan. When someone borrows money to buy real estate, the lender requires a deed of trust to protect their interests. In some states, a deed of trust is used instead of a traditional mortgage. While both create a lien against the property, a mortgage agreement is directly between the borrower and the lender. In contrast, a deed of trust involves three parties: the borrower (trustor), the lender (beneficiary), and a neutral third party known as the trustee. The trustee holds legal title to the property on behalf of the lender until the loan is paid off. If the borrower defaults on the loan, the trustee can initiate foreclosure proceedings and sell the property to satisfy the debt. The deed of trust provides a streamlined process for handling foreclosures and allows lenders to recover their investment more efficiently. It’s important for borrowers to understand the terms of the deed of trust and their obligations to avoid defaulting on the loan. www.FormsWorkflow.com