Last updated: 12/19/2022

Affidavit Of Exemption From Documentary Transfer Tax

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

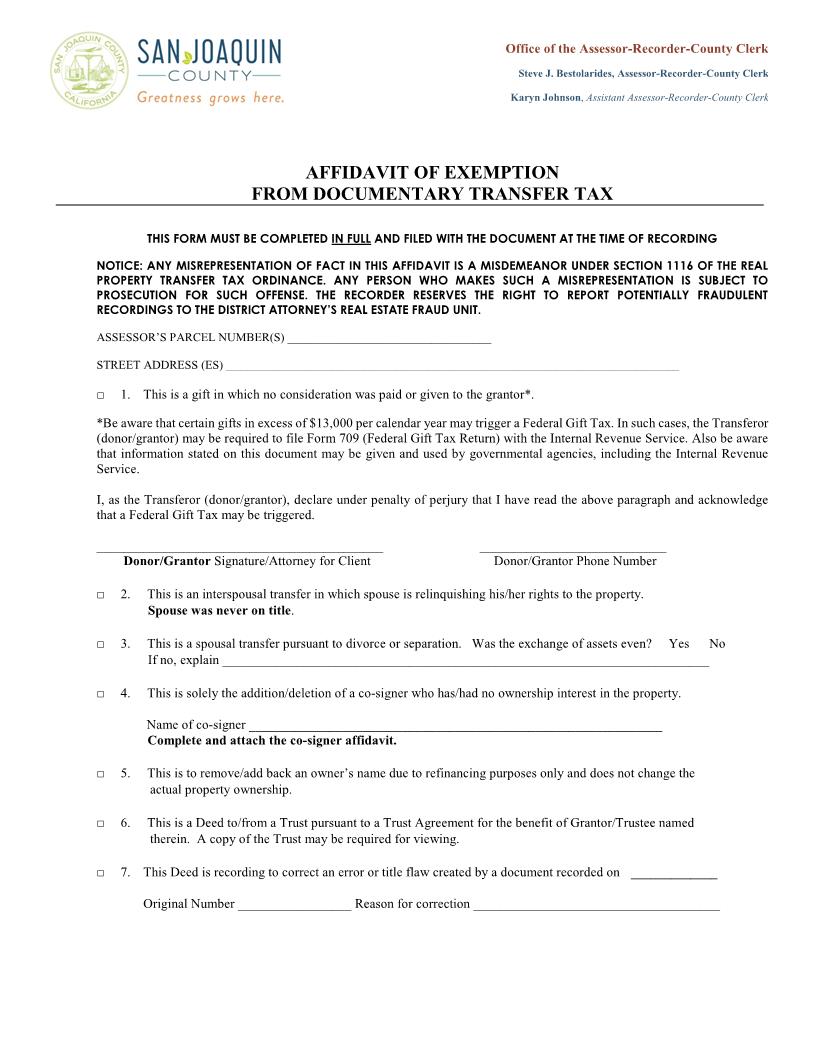

Steve J. Bestolarides San Joaquin County Assessor - Recorder County Clerk 44 N. San Joaquin Street, Suite 260, Stockton CA 95202-3274 PO Box 1968 Stockton Ca 95201-1968 (209) 468-3939 FAX (209) 468-8040 Karyn Johnson Assistant Assessor-Recorder-County Clerk Teresa Williamson Operations Manager AFFIDAVIT OF EXEMPTION FROM DOCUMENTARY TRANSFER TAX THIS FORM MUST BE COMPLETED IN FULL AND FILED WITH THE DOCUMENT AT THE TIME OF RECORDING NOTICE: ANY MISREPRESENTATION OF FACT IN THIS AFFIDAVIT IS A MISDEMEANOR UNDER SECTION 1116 OF THE REAL PROPERTY TRANSFER TAX ORDINANCE. ANY PERSON WHO MAKES SUCH A MISREPRESENTATION IS SUBJECT TO PROSECUTION FOR SUCH OFFENSE. THE RECORDER RESERVES THE RIGHT TO REPORT POTENTIALLY FRAUDULENT RECORDINGS TO THE DISTRICT ATTORNEY'S REAL ESTATE FRAUD UNIT. ASSESSOR'S PARCEL NUMBER(S) __________________________________ STREET ADDRESS(ES) _____________________________________________________________________________________ 1. This is a gift in which no consideration was paid or given to the grantor*. *Be aware that certain gifts in excess of $13,000 per calendar year may trigger a Federal Gift Tax. In such cases, the Transferor (donor/grantor) may be required to file Form 709 (Federal Gift Tax Return) with the Internal Revenue Service. Also be aware that information stated on this document may be given and used by governmental agencies, including the Internal Revenue Service. I, as the Transferor (donor/grantor), declare under penalty of perjury that I have read the above paragraph and acknowledge that a Federal Gift Tax may be triggered. ___________________________________________ Donor/Grantor Signature/Attorney for Client 2. ____________________________ Donor/Grantor Phone Number This is an interspousal transfer in which spouse is relinquishing his/her rights to the property. Spouse was never on title. This is a spousal transfer pursuant to divorce or separation. Was the exchange of assets even? Yes No If no, explain _________________________________________________________________________ This is solely the addition/deletion of a co-signer who has/had no ownership interest in the property. Name of co-signer ______________________________________________________________ Complete and attach the co-signer affidavit. 3. 4. 5. This is to remove/add back an owner's name due to refinancing purposes only and does not change the actual property ownership. This is a Deed to/from a Trust pursuant to a Trust Agreement for the benefit of Grantor/Trustee named therein. A copy of the Trust may be required for viewing. 6. 7. This Deed is recording to correct an error or title flaw created by a document recorded on _____________ Original Number _________________ Reason for correction _____________________________________ American LegalNet, Inc. www.FormsWorkFlow.com COUNTY OF SAN JOAQUIN ASSESSOR - RECORDER - COUNTY CLERK 8. This transfer is between an individual or individuals and a legal entity or between legal entities, and the proportional ownership interest in the realty remains exactly the same. This means that the underlying ownership after the transfer is exactly the same as before the transfer. Provide the owners and percentages both before and after this transfer including each owner as an individual and each owner of the entity. Owners include shareholders, members, and partners. Attach a separate sheet if needed. Example: Before: John Doe Inc John Doe 50% Jane Doe 50% After: John Doe LLC John Doe 50% Jane Doe 50% Before: ______________________________ ______________________________ ______________________________ After:_______________________________ _______________________________ _______________________________ 9. 10. This is a Foreclosure or Trustee sale. Is the Transferee the Beneficiary or Mortgagee? YES OR NO This is a lease with a term, including options, of less than 35 years. What is the term including all options? _________________ The property is being conveyed by an Executor/Administrator/Trustee in accordance with an estate. 11. I DECLARE OR AFIRM UNDER PENALTY OF PERJURY THAT THE FOREGOING IS TRUE AND CORRECT. _______________________________________ ____________________________________________ Grantor/Grantee Signature/Attorney for Client Print Name ____________________________________________________________________________________ Address _______________________________________________ Phone Number TRANSFEREE TRANSFEROR _______________________________________________ _____________________________________ Place of Execution (City, County, State) Date of Execution SAN JOAQUIN COUNTY RECORDER 44 N. SAN JOAQUIN STREET SUITE 260 STOCKTON CA 95202 PHONE: (209) 468-3939 FAX (209) 468-8040 EMAIL: recorder@sjgov.org www.sjgov.org/recorder MAILING ADDRESS: SAN JOAQUIN COUNTY RECORDER P.O. BOX 1968 STOCKTON CA 95201 American LegalNet, Inc. www.FormsWorkFlow.com Updated 8-25-15