Last updated: 2/15/2023

Employers Wage Statement For School Districts {DWC-3SD}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

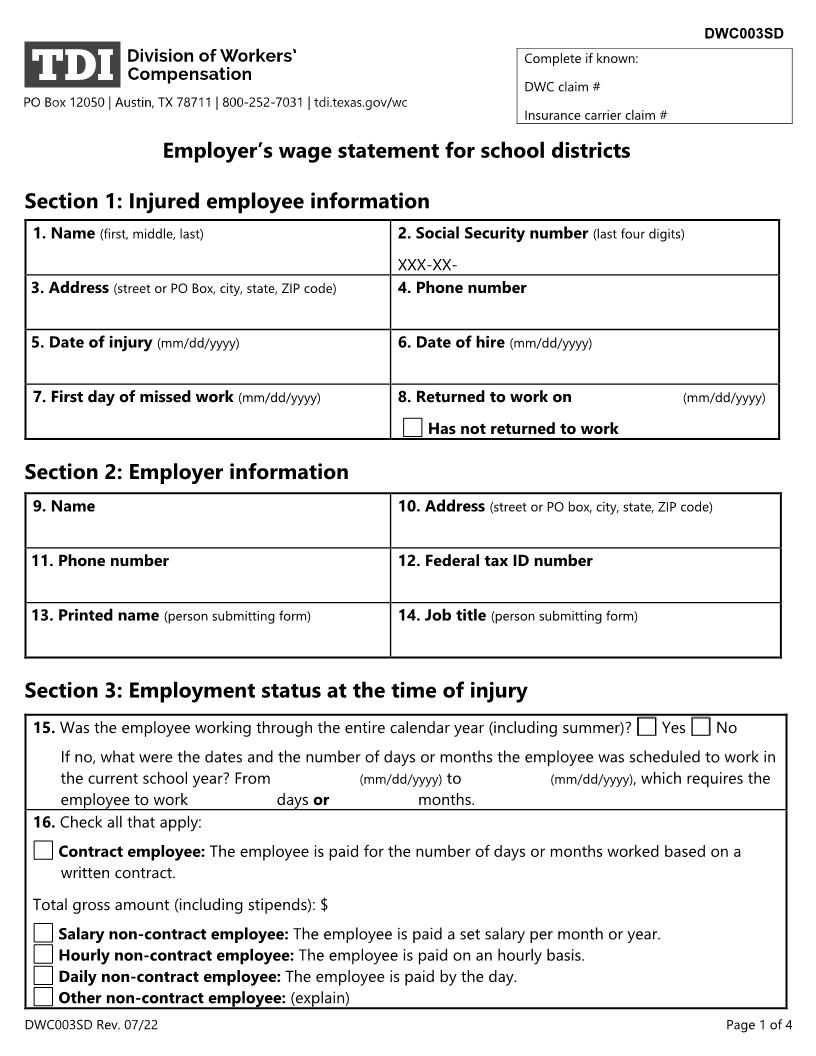

Send to workers' compensation carrier: _______________ _______ (name and fax number of carrier) ___ CLAIM # CARRIER'S CLAIM # Initial Amended EMPLOYER'S WAGE STATEMENT FOR SCHOOL DISTRICTS The employer shall timely file a complete wage statement in the form and manner prescribed by the Division. (1) The wage statement shall be filed ("filed" means received) with the carrier, the claimant, and the claimant's representative (if any) within 30 days of the earliest of: (A) the employee's eighth day of disability; (B) the date the employer is notified that the employee is entitled to income benefits; (C) the date of the employee's death as a result of a compensable injury. (2) The wage statement shall also be filed with the Division within seven days of receiving a request from the Division (Only When Requested). (3) A subsequent wage statement shall be filed with the carrier, employee, and the employee's representative (if any) within seven days if any information contained on the previous wage statement changes. All applicable DWC rules can be found at www.tdi.state.tx.us The Texas Workers' Compensation Act and Workers' Compensation rules require an employer to provide an Employer's Wage Statement to its workers' compensation insurance carrier (carrier) and the claimant or the claimant's representative, if any. The purpose of the form is to provide the employee's wage information to the carrier for calculating the employee's Average Weekly Wage (AWW) to establish benefits due to the employee or a beneficiary. The AWW for a school district employee is computed based upon the wages earned in a week. "Wages earned in a week" are equal to the amount that would be deducted from an employee's salary if the employee were absent from work for one week and the employee did not have personal leave to compensate the employee for the lost wages from that week. NOTE - An employer who fails without good cause to timely file a complete wage statement as required by the Texas Workers' Compensation Act, Texas Labor Code, Section 408.063(c) and Workers' Compensation Rule 120.4 may be assessed an administrative penalty not to exceed $500.00 for an initial offense and not to exceed $10,000.00 for a repeated administrative violation. EMPLOYEE AND EMPLOYER INFORMATION Employee's Name (Last, First, M.I.): Employee's Mailing Address (Street or P.O. Box): City: Social Security Number: Date of Hire: Date of Injury: State: ZIP Code: Employer's Business Name: Employer's Mailing Address (Street or P.O. Box): City: Federal Tax I.D. Number: Name and Phone # of Person Providing Wage Information: I HEREBY CERTIFY THAT THIS WAGE STATEMENT is complete, accurate, and complies with the Texas Workers' Compensation Act and applicable rules; and the listed wages include all pecuniary wages and stipends as required by statute and rule and I understand that making a misrepresentation about a workers' compensation claim is a crime that can result in fines and/or imprisonment. Signature: __________________________________ Date: ____________ State: ZIP Code: The employee has not returned to work. OR The employee returned to work on __________ without restriction. OR with restrictions and is earning wages of $_____________ per week/month (circle one). NOTE Rule 120.3 requires the employer file the Supplemental Report of Injury (DWC FORM-6) to report changes in Work Status and Post-Injury Earnings. EMPLOYMENT STATUS Does the employee work continuously through the calendar year for the school district (i.e. does the employee work in the summer?) The answer to this question is not affected by whether the employee is paid over a 12 month period or over a shorter period. YES NO. If no, what were the dates and the number of days or months the employee was scheduled to work in the current school year? From _____/______/______ to _____/______/______ which requires the employee to work ________ days OR _____ months. WRITTEN CONTRACT EMPLOYEE: an employee who has a written contract of employment with the school district that specifies amount that will be paid for completion of the contract and either the number of days the employee is required to work or the period of the contract. EMPLOYEE WITHOUT A WRITTEN CONTRACT: Salaried: an "at-will", "exempt" employee paid a set salary per month/year (generally personnel staff). Hourly: an "at-will", "non-exempt" employee paid on an hourly basis (generally staff such as cafeteria workers, bus drivers, janitorial workers). Daily: an "at will" employee employed and paid on a daily basis (generally substitute teachers). Other: (specify) If the employee is employed through a written contract, complete the "Written Contract Wage Information" and the "Annual Wage Information" sections on page 2. If the employee is NOT employed through a written contract, complete the "Wage Information for Salaried, Hourly, Daily, And Other Non-Contract Employment" and the "Annual Wage Information" sections on page 2. NOTE TO INJURED EMPLOYEE If you were injured on or after 7/1/02, and had employment with more than one employer on the date of injury, you can provide your insurance carrier with wage information from your other employment for the carrier to include in your AWW and this may affect your benefits. Contact your carrier for additional information or call the Division at (800) 252-7031. You can also read rule 122.5 at www.tdi.state.tx.us DWC FORM-3SD (Rev. 10/05) Page 1 DIVISION OF WORKERS' COMPENSATION American LegalNet, Inc. www.USCourtForms.com PAGE 2 WAGE INFORMATION WRITTEN CONTRACT WAGE INFORMATION Total Gross Value of Written Contract (including stipends): Employee Name: Social Security #: Date of Injury: Number of Work Days in Written Contract: OR Number of Months in Written Contract: WAGE INFORMATION FOR SALARIED, HOURLY, DAILY, & OTHER NON-CONTRACT EMPLOYMENT - Report the Gross Pecuniary Wages earned in the 13 weeks immediately prior to the date of injury. Consider as earnings amounts from paid holidays and any vacation, personal or sick leave an employee used but not the market value of leave time earned but not used. - Pecuniary Wages include all wages that are paid to the employee in the form of money. These include, but are not limited to: hourly, weekly, biweekly, monthly, etc. wages; salary; tips/gratuities; piecework compensation; monetary allowances; bonuses; and commissions. Earnings are reported in the periods they are earned, NOT when they are paid and some (such as bonuses and commi