Last updated: 7/26/2022

Schedule C-1 Property Claimed As Exempt After Jan. 1 2006

Start Your Free Trial $ 21.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

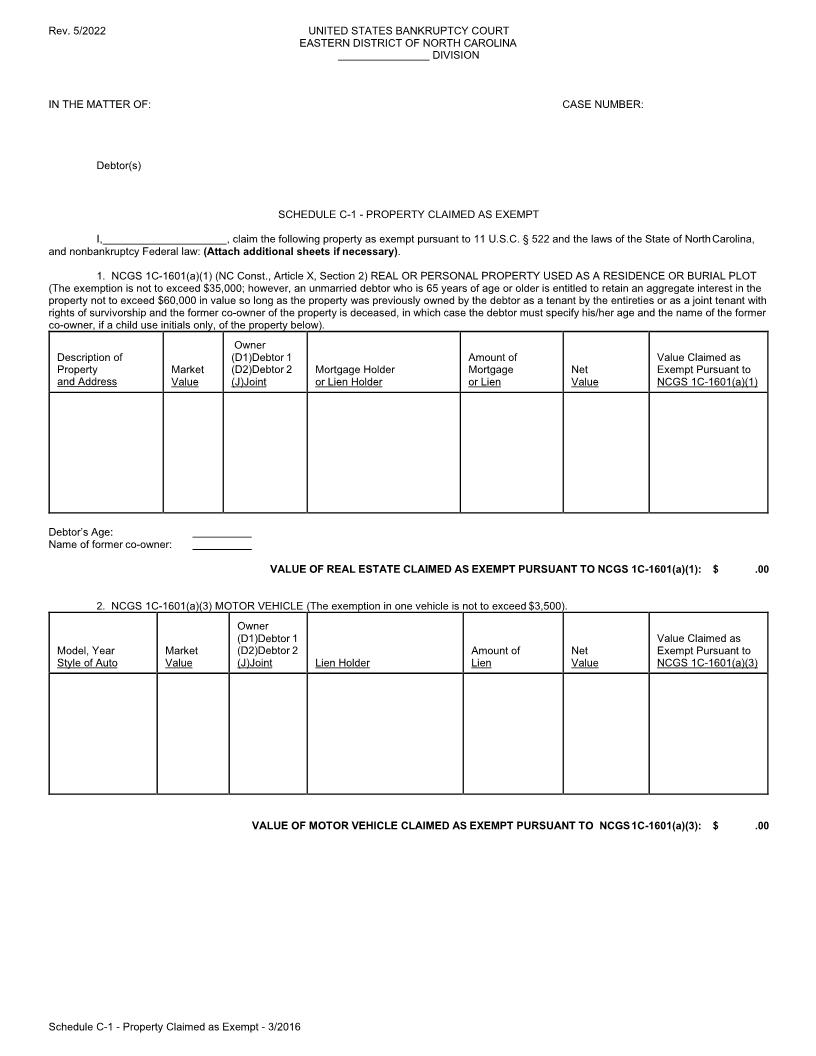

Rev. 4/2006 UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF NORTH CAROLINA DIVISION IN THE MATTER OF: CASE NUMBER: Debtor(s) SCHEDULE C-1 - PROPERTY CLAIMED AS EXEMPT I, , claim the following property as exempt pursuant to 11 U.S.C. § 522 and the laws of the State of North Carolina, and nonbankruptcy Federal law: (Attach additional sheets if necessary). 1. NCGS 1C-1601(a)(1) (NC Const., Article X, Section 2) REAL OR PERSONAL PROPERTY USED AS A RESIDENCE OR BURIAL PLOT (The exemption is not to exceed $18,500; however, an unmarried debtor who is 65 years of age or older is entitled to retain an aggregate interest in the property not to exceed $37,000 in value so long as the property was previously owned by the debtor as a tenant by the entireties or as a joint tenant with rights of survivorship and the former co-owner of the property is deceased, in which case the debtor must specify his/her age and the name of the former co-owner, if a child use initials only, of the property below). Owner (H)Husband (W)Wife (J)Joint Description of Property and Address Market Value Mortgage Holder or Lien Holder Amount of Mortgage or Lien Net Value Value Claimed as Exempt Pursuant to NCGS 1C-1601(a)(1) Debtor's Age: Name of former co-owner: VALUE OF REAL ESTATE CLAIMED AS EXEMPT PURSUANT TO NCGS 1C-1601(a)(1): $ .00 2. NCGS 1C-1601(a)(3) MOTOR VEHICLE (The exemption in one vehicle is not to exceed $3,500). Owner (H)Husband (W)Wife (J)Joint Model, Year Style of Auto Market Value Lien Holder Amount of Lien Net Value Value Claimed as Exempt Pursuant to NCGS 1C-1601(a)(3) VALUE OF MOTOR VEHICLE CLAIMED AS EXEMPT PURSUANT TO NCGS 1C-1601(a)(3): $ .00 Schedule C-1 - Property Claimed as Exempt - 4/2006 American LegalNet, Inc. www.USCourtForms.com 3. NCGS 1C-1601(a)(4) (NC Const., Article X, Section 1) PERSONAL OR HOUSEHOLD GOODS (The debtor's aggregate interest is not to exceed $5,000 plus $1,000 for each dependent of the debtor, not to exceed $4,000 total for dependents). The number of dependents for exemption purposes is . Owner (H)Husband (W)Wife (J)Joint Description of Property Clothing & personal Kitchen appliances Stove Refrigerator Freezer Washing machine Dryer China Silver Jewelry Living room furniture Den furniture Bedroom furniture Dining room furniture Television ()Stereo ()VCR/DVD ()Radio ()Video Camera Musical Instruments ()Piano ()Organ Air conditioner Paintings/Art Lawn mower Yard tools Crops Recreational Equipment ()Computer Market Value Lien Holder Amount of Lien Net Value Claimed as Exempt Pursuant to NCGS 1C-1601(a)(4) VALUE CLAIMED AS EXEMPT PURSUANT TO NCGS 1C-1601(a)(4) : $ .00 Schedule C-1 - Property Claimed as Exempt - 4/2006 Page 2 American LegalNet, Inc. www.USCourtForms.com 4. NCGS 1C-1601(a)(5) TOOLS OF TRADE (The debtor's aggregate interest is not to exceed $2,000 in value). Owner (H)Husband (W)Wife (J)Joint Description Market Value Lien Holder Amount of Lien Net Value Value Claimed as Exempt Pursuant to NCGS 1C-1601(a)(5) VALUE CLAIMED AS EXEMPT PURSUANT TO NCGS-1C-1601(a)(5): 5. NCGS 1C-1601(a)(6) LIFE INSURANCE (NC Const., Article X, Section 5) Last Four Digits of Policy Number Beneficiary (if child, initials only) $ .00 Description Insured Cash Value 6. NCGS 1C-1601(a)(7) PROFESSIONALLY PRESCRIBED HEALTH AIDS (For Debtor or Debtor's Dependents, no limit on value). Description 7. NCGS 1C-1601(a)(8) COMPENSATION FOR PERSONAL INJURY, INCLUDING COMPENSATION FROM PRIVATE DISABILITY POLICIES OR ANNUITIES, OR COMPENSATION FOR DEATH OF A PERSON UPON WHOM THE DEBTOR WAS DEPENDENT FOR SUPPORT. COMPENSATION NOT EXEMPT FROM RELATED LEGAL, HEALTH OR FUNERAL EXPENSE. Source of Compensation, Including Name (If child, initials only) & Last Four Digits of Account Number of any Disability Policy/Annuity Description 8. NCGS 1C-1601(a)(2) ANY PROPERTY [Debtor's aggregate interest in any property is not to exceed $5,000 in value of any unused exemption amount to which the debtor is entitled under NCGS 1C-1601(a)(1)]. Owner (H)Husband (W)Wife (J)Joint Description of Property and Address Market Value Lien Holder Amount of Lien Net Value Value Claimed as Exempt Pursuant to NCGS 1C-1601(a)(2) VALUE CLAIMED AS EXEMPT PURSUANT TO NCGS 1C-1601(a)(2) : $ .00 9. NCGS 1C-1601(a)(9) and 11 U.S.C. § 522 INDIVIDUAL RETIREMENT PLANS & RETIREMENT FUNDS, as defined in the Internal Revenue Code, and any plan treated in the same manner as an individual retirement plan, including individual retirement accounts and Roth retirement accounts as described in §§ 408(a) and 408A of the Internal Revenue Code, individual retirement annuities as described in § 408(b) of the Internal Revenue Code, accounts established as part of a trust described in § 408(c) of the Internal Revenue Code, and funds in an account exempt from taxation under § 401, 403, 408, 408A, 414, 457, or 510(a) of the Internal Revenue Code. For purposes of this subdivision, "Internal Revenue Code" means Code as defined in G.S. 105-228.90. Type of Account Location of Account Last Four Digits of Account Number Schedule C-1 - Property Claimed as Exempt - 4/2006 Page 3 American LegalNet, Inc. www.USCourtForms.com 10. NCGS 1C-1601(a)(10) FUNDS IN A COLLEGE SAVINGS PLAN, as qualified under § 529 of the Internal Revenue Code, and that are not otherwise excluded from the estate pursuant to 11 U.S.C. §§ 541(b)(5)-(6), (e), not to exceed a cumulative limit of $25,000. If funds were placed in a college savings plan within the 12 months prior to filing, the contributions must have been made in the ordinary course of the debtor's financial affairs and must have been consistent with the debtor's past pattern of contributions. The exemption applies to funds for a child of the debtor that will actually be used for the child's college or university expenses. College Savings Plan Last Four Digits of Account Number Value Initials of Child Beneficiary 11. NCGS 1C-1601(a)(11) RETIREMENT BENEFITS UNDER THE RETIREMENT PLANS OF OTHER STATES AND GOVERNMENTAL UNITS OF OTHER STATES (The debtor's interest is exempt only to the extent that these benefits are exempt under the laws of the state or governmental unit under which the benefit plan is established). Name of Retirement Plan State Governmental Unit Last Four Digits of Identifying Number 12. NCGS 1C-1601(a)(12) ALIMONY, SUPPORT, SEPARATE MAINTENANCE, AND CHILD SUPPORT PAYMENTS OR FUNDS THAT HAVE BEEN RECEIVED OR TO WHICH THE DEBTOR IS ENTITLED (The debtor's interest is exempt to the extent the payments or funds are r