Last updated: 6/27/2022

Chapter 13 Plan

Start Your Free Trial $ 19.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

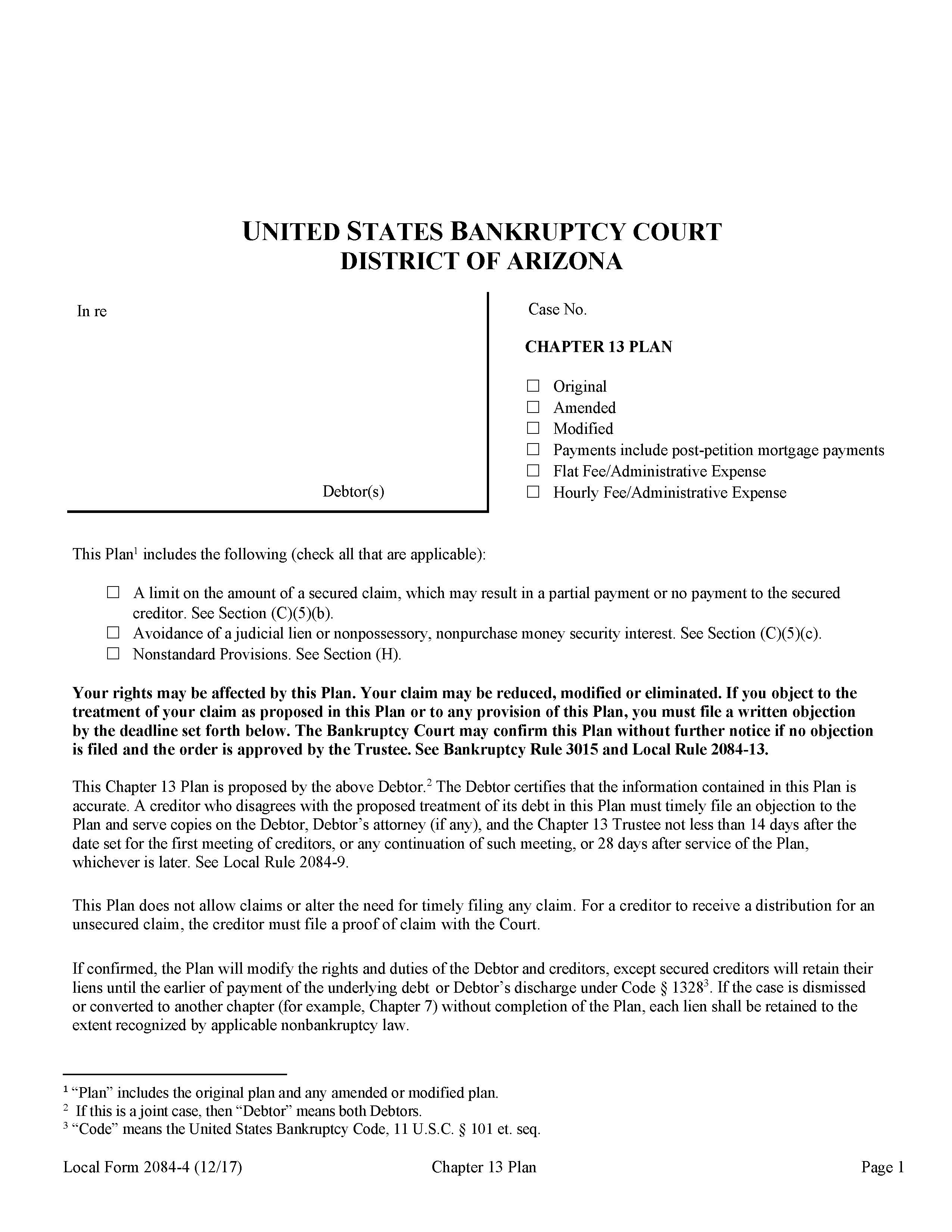

Local Form 2084-4 - CHAPTER 13 PLAN. This Chapter 13 Plan is a proposal by the debtor in a bankruptcy case to repay creditors over a specified period. The plan outlines the debtor's monthly payments to the trustee and how these payments will be distributed to creditors, including the treatment of secured and unsecured claims. It details how arrears, particularly on mortgages or other secured debts, will be addressed, and includes provisions for adequate protection payments to secured creditors. The plan also addresses the curing of defaults, priority claims such as domestic support obligations, and the treatment of nonpriority unsecured claims. Additionally, the debtor must provide tax returns, and the plan may include nonstandard provisions that modify the treatment of certain claims. The debtor's attorney certifies the accuracy of the plan, and any creditor who disagrees with the proposed treatment of their claim must file an objection within a specified time frame. www.FormsWorkflow.com

Related forms

-

Creditor Change Of Address

Creditor Change Of Address

Arizona/Federal/Bankruptcy Court/ -

Debtor Change Of Address

Debtor Change Of Address

Arizona/Federal/Bankruptcy Court/ -

Motion For Order Authorizing Redemption Of Personal Property

Motion For Order Authorizing Redemption Of Personal Property

Arizona/Federal/Bankruptcy Court/ -

Notice Of Removal

Notice Of Removal

Arizona/Federal/Bankruptcy Court/ -

Notice Of Motion To Compel Abandonment

Notice Of Motion To Compel Abandonment

Arizona/Federal/Bankruptcy Court/ -

Notice Of Intent To Abandon

Notice Of Intent To Abandon

Arizona/Federal/Bankruptcy Court/ -

Attorney Address Change

Attorney Address Change

Arizona/Federal/Bankruptcy Court/ -

Order Setting Confirmation Hearing And Fixing Deadlines Subchapter V Cases

Order Setting Confirmation Hearing And Fixing Deadlines Subchapter V Cases

Arizona/4 Federal/Bankruptcy Court/ -

Chapter 13 Plan

Chapter 13 Plan

Arizona/Federal/Bankruptcy Court/ -

Motion To Vacate Order Of Dismissal

Motion To Vacate Order Of Dismissal

Arizona/Federal/Bankruptcy Court/ -

Chapter 7 Debtor Document Checklist

Chapter 7 Debtor Document Checklist

Arizona/Federal/Bankruptcy Court/ -

Chapter 7 Debtor Questionnaire

Chapter 7 Debtor Questionnaire

Arizona/Federal/Bankruptcy Court/ -

Verification Of Qualifications To Act As Mediator In The MMM Program

Verification Of Qualifications To Act As Mediator In The MMM Program

Arizona/Federal/Bankruptcy Court/ -

Motion For Referral To Mortgage Modification Mediation Program

Motion For Referral To Mortgage Modification Mediation Program

Arizona/Federal/Bankruptcy Court/ -

Lenders Consent To Attend And Participate In Mortgage Modification Mediation Program

Lenders Consent To Attend And Participate In Mortgage Modification Mediation Program

Arizona/Federal/Bankruptcy Court/ -

Lenders Objection To Selection Of Mortgage Modification Mediation Program Mediator

Lenders Objection To Selection Of Mortgage Modification Mediation Program Mediator

Arizona/Federal/Bankruptcy Court/ -

Order On Motion For Deferral To Mortgage Modification Mediation Program

Order On Motion For Deferral To Mortgage Modification Mediation Program

Arizona/Federal/Bankruptcy Court/ -

Third Party Consent To Attend And Participate In MMM Program

Third Party Consent To Attend And Participate In MMM Program

Arizona/Federal/Bankruptcy Court/ -

Motion To Approve Final Loan Modification Agreement

Motion To Approve Final Loan Modification Agreement

Arizona/Federal/Bankruptcy Court/ -

Motion To Approve Trial Loan Modification Agreement

Motion To Approve Trial Loan Modification Agreement

Arizona/Federal/Bankruptcy Court/ -

Order Approving Trial Loan Modification Agreement

Order Approving Trial Loan Modification Agreement

Arizona/Federal/Bankruptcy Court/ -

Final Report MMM Program Mediator

Final Report MMM Program Mediator

Arizona/Federal/Bankruptcy Court/ -

Interim Report Of MMM Program Mediator

Interim Report Of MMM Program Mediator

Arizona/Federal/Bankruptcy Court/ -

Motion To Approve Trial Loan Modification Agreement

Motion To Approve Trial Loan Modification Agreement

Arizona/Federal/Bankruptcy Court/ -

Order Approving Trial Loan Modification Agreement

Order Approving Trial Loan Modification Agreement

Arizona/Federal/Bankruptcy Court/ -

Motion To Approve Final Loan Modification Agreement

Motion To Approve Final Loan Modification Agreement

Arizona/Federal/Bankruptcy Court/ -

Notice Of Inability To Serve As Mediator

Notice Of Inability To Serve As Mediator

Arizona/Federal/Bankruptcy Court/ -

Request For Removal From MMM Program Registry Of Mediators

Request For Removal From MMM Program Registry Of Mediators

Arizona/Federal/Bankruptcy Court/ -

Order Approving Stipulation Assigning Successor Mortgage Modification Mediator

Order Approving Stipulation Assigning Successor Mortgage Modification Mediator

Arizona/Federal/Bankruptcy Court/ -

Notice Of Hearing Motion For Selection Of Successor Mortgage Modification Mediator

Notice Of Hearing Motion For Selection Of Successor Mortgage Modification Mediator

Arizona/Federal/Bankruptcy Court/ -

Order Approving Final Loan Modification Agreement

Order Approving Final Loan Modification Agreement

Arizona/Federal/Bankruptcy Court/ -

Order Approving Final Loan Modificaiton Agreement

Order Approving Final Loan Modificaiton Agreement

Arizona/Federal/Bankruptcy Court/ -

Motion For Selection Of Successor Mortgage Modification Mediation Mediator

Motion For Selection Of Successor Mortgage Modification Mediation Mediator

Arizona/Federal/Bankruptcy Court/ -

Stipulation Assigning Successor Mortgage Modification Mediator

Stipulation Assigning Successor Mortgage Modification Mediator

Arizona/Federal/Bankruptcy Court/ -

Notice Of Hearing On Pro Se Motion To Approve Final Loan Agreement

Notice Of Hearing On Pro Se Motion To Approve Final Loan Agreement

Arizona/Federal/Bankruptcy Court/ -

Order Approving Selection Of Successor Mortgage Modification Mediation Mediator

Order Approving Selection Of Successor Mortgage Modification Mediation Mediator

Arizona/Federal/Bankruptcy Court/ -

Notice Of Hearing On Request For Mortgage Modification Mediation Status Conference

Notice Of Hearing On Request For Mortgage Modification Mediation Status Conference

Arizona/Federal/Bankruptcy Court/ -

Request For Mortgage Modification Mediation Status Conference

Request For Mortgage Modification Mediation Status Conference

Arizona/Federal/Bankruptcy Court/ -

Application For MMM Compensation And Reimbursement Of MMM Expenses

Application For MMM Compensation And Reimbursement Of MMM Expenses

Arizona/Federal/Bankruptcy Court/ -

Order Approving Application For MMM Compensation And Reimbursement MMM Expenses

Order Approving Application For MMM Compensation And Reimbursement MMM Expenses

Arizona/Federal/Bankruptcy Court/ -

Order Granting Motion For Release Of Funds

Order Granting Motion For Release Of Funds

Arizona/Federal/Bankruptcy Court/ -

Motion For Release Of Funds

Motion For Release Of Funds

Arizona/Federal/Bankruptcy Court/ -

Order Approving Interim Application For MMM Compensation And Reimbursement MMM Expenses

Order Approving Interim Application For MMM Compensation And Reimbursement MMM Expenses

Arizona/Federal/Bankruptcy Court/ -

Order Approving Application For MMM Compensation And Reimbursement Of MMM Expenses

Order Approving Application For MMM Compensation And Reimbursement Of MMM Expenses

Arizona/Federal/Bankruptcy Court/ -

Interim Application For MMM Compensation And Reimbursement Of MMM Expenses

Interim Application For MMM Compensation And Reimbursement Of MMM Expenses

Arizona/Federal/Bankruptcy Court/ -

Application For Unclaimed Funds

Application For Unclaimed Funds

-

Archive Retrieval Form

Archive Retrieval Form

Arizona/Federal/Bankruptcy Court/ -

Notice Of Motion To Avoid Lien

Notice Of Motion To Avoid Lien

Arizona/Federal/Bankruptcy Court/ -

Pro Hac Vice Application

Pro Hac Vice Application

Arizona/Federal/Bankruptcy Court/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!