Last updated: 3/21/2022

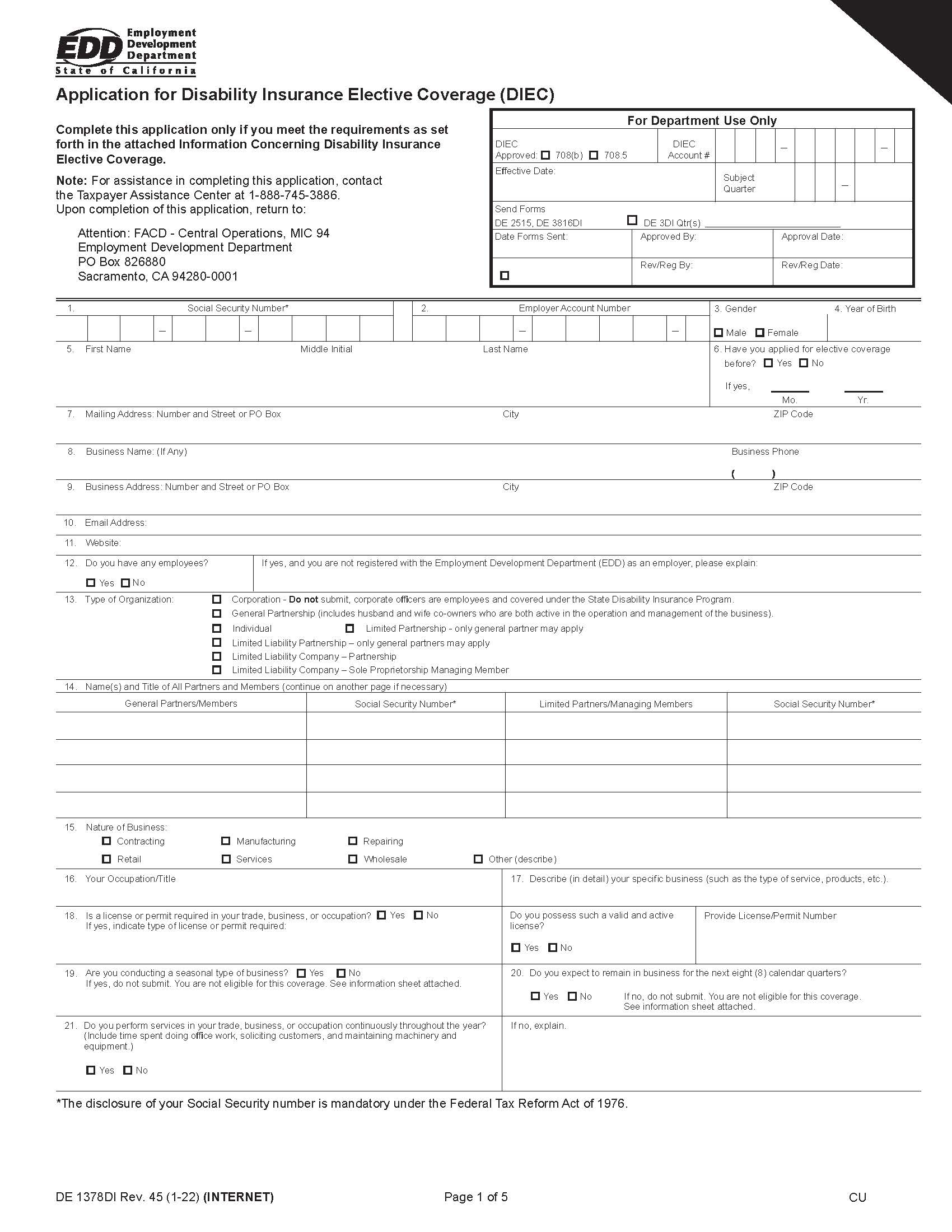

Application For Disability Insurance Elective Coverage {DE 1378DI}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

DE 1378DI, Application for Disability Insurance Elective Coverage (DIEC), This form is used by self-employed individuals and other workers who are not automatically covered by the State Disability Insurance (SDI) program to apply for voluntary coverage under the program. The DIEC form allows individuals to apply for SDI coverage, which provides partial wage replacement benefits to workers who are unable to work due to a non-work-related illness or injury. This coverage is designed to provide temporary financial assistance to eligible workers during a period of disability. To apply for DIEC, an individual must complete the form and provide information about their occupation, earnings, and business activities. The EDD will review the application and notify the individual whether they have been approved for coverage. Persons Eligible to Elect Coverage: • Section 708(b) of the California Unemployment Insurance Code (CUIC) pro-vides that an individual who is an employer under section 675 of the CUIC, or two or more individuals who have so qualified, may elect coverage. Each individual who applies must provide evidence of an annual net profit of at least $4,600 or average $1,150 per quarter if in business for less than one year. ○ Qualifying employers include sole proprietors, general partners, managing members of Limited Liability Companies (LLC) treated as sole-proprietors for federal income tax purposes, and members of LLCs treated as partnerships for federal income tax reporting purposes. It is not required that all active general partners or members be included in the election. An active general partnership also includes a husband and wife co-ownership in which both spouses are active in the operation and management of the business. Limited partners and corporate officers are considered to be employees subject to the compulsory provisions of the CUIC, the same as all other employees, and are not eligible to elect self-coverage. • Section 708.5 of the CUIC provides that self-employed individuals who receive the major portion of their remuneration from the trade, business, or occupation in which they are self-employed, may elect coverage. Annual net profit must be at least $4,600 or average $1,150 per quarter if in business for less than one year. www.FormsWorkflow.com