Last updated: 11/18/2021

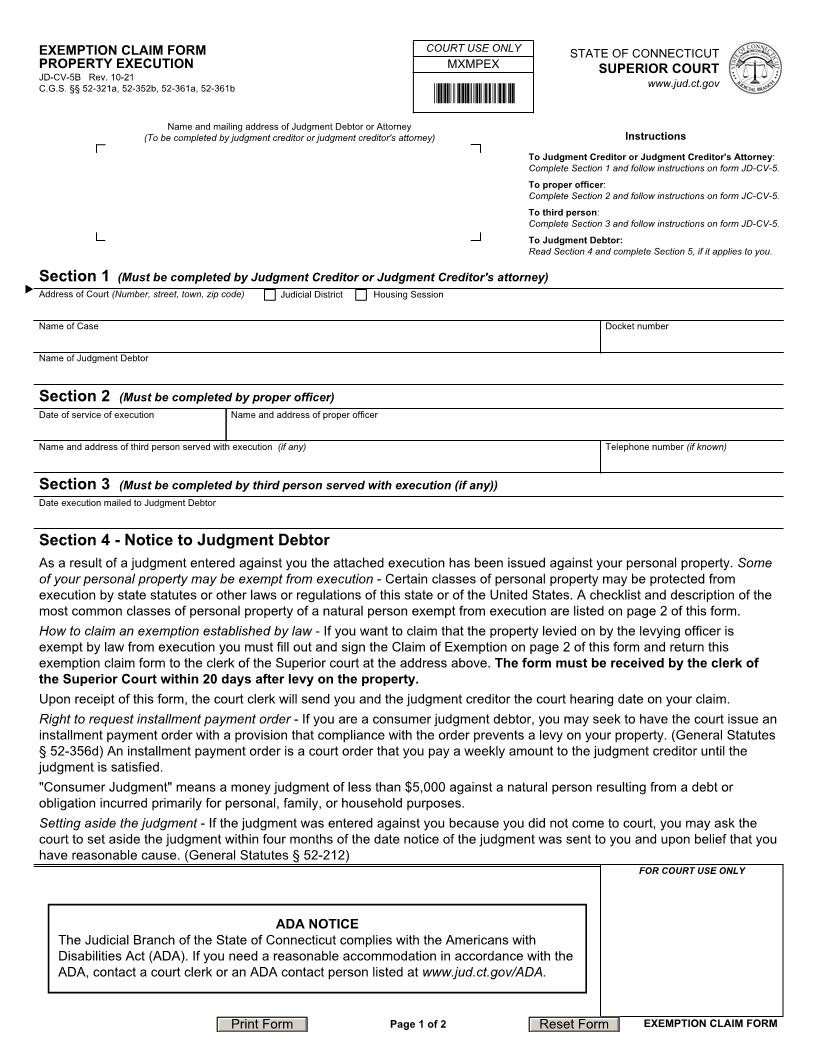

Exemption Claim Form Property Execution {JD-CV-5b}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

EXEMPTION CLAIM FORM PROPERTY EXECUTION JD-CV-5b Rev. 4-13 C.G.S. 52-321a, 52-352b, 52-361a, 52-361b STATE OF CONNECTICUT SUPERIOR COURT www.jud.ct.gov MXMPEX *MXMPEX* Instructions To Judgment Creditor or Judgment Creditor's Attorney: Complete section 1 below and follow instructions on form JD-CV-5. To proper officer: Complete section 2 below and follow instructions on form JC-CV-5. To third person: Complete section 3 below and follow instructions on form JD-CV-5. To Judgment Debtor: Read section 4 below and complete section 5 if it applies to you. Name and mailing address of Judgment Debtor or Attorney (To be completed by judgment creditor or judgment creditor's attorney) Section 1 (Must be completed by Judgment Creditor or Judgment Creditor's attorney) X Address of Court (Number, street, town, zip code) Geographical Area Name of Case Judicial District Housing Session Docket number Name of Judgment Debtor Section 2 (Must be completed by proper officer) Date of service of execution Name and address of proper officer Name and address of third person served with execution (if any) Telephone number (if known) Section 3 (Must be completed by third person served with execution (if any)) Date execution mailed to Judgment Debtor Section 4 -- Notice To Judgment Debtor As a result of a judgment entered against you the attached execution has been issued against your personal property. Some of your personal property may be exempt from execution -- Certain classes of personal property may be protected from execution by state statutes or other laws or regulations of this state or of the United States. A checklist and description of the most common classes of personal property of a natural person exempt from execution are listed on page 2 of this form. How to claim an exemption established by law -- If you want to claim that the property levied on by the levying officer is exempt by law from execution you must fill out and sign the Claim of Exemption on page 2 of this form and return this exemption claim form to the clerk of the Superior court at the address above. The form must be received by the clerk of the Superior Court within 20 days after levy on the property. Upon receipt of this form, the court clerk will send you and the judgment creditor the date of the court hearing on your claim. Right to request installment payment order -- If you are a consumer judgment debtor, you may seek to have the court issue an installment payment order with a provision that compliance with the order prevents a levy on your property. (Section 52-356d of the Connecticut General Statutes.) An installment payment order is a court order that you pay a weekly amount to the judgment creditor until the judgment is satisfied. "Consumer Judgment" means a money judgment of less than $5,000 against a natural person resulting from a debt or obligation incurred primarily for personal, family, or household purposes. Setting aside the judgment -- If the judgment was rendered against you because you did not come to court, you may ask the court to set aside the judgment rendered against you within four months of the date judgment was rendered and upon belief that you have reasonable cause. (Section 52-212 of the Connecticut General Statutes.) FOR COURT USE ONLY ADA NOTICE The Judicial Branch of the State of Connecticut complies with the Americans with Disabilities Act (ADA). If you need a reasonable accommodation in accordance with the ADA, contact a court clerk or an ADA contact person listed at www.jud.ct.gov/ADA. Page 1 of 2 EXEMPTION CLAIM FORM American LegalNet, Inc. www.FormsWorkFlow.com Section 5 -- Claim Of Exemption Established By Law I claim and certify under penalty of false statement that the property described below is exempt from execution as follows: Name and address of person holding property Telephone number Property claimed to be exempt Describe basis for exemption as established by law Complete mailing address of Judgment Debtor Telephone number Signed (Judgment Debtor) Date signed Section 6 -- Notice Of Hearing On Exemption/Modification Claim Date of hearing Time of hearing Courtroom number __.M. By the Assistant Clerk Section 7 -- Order Of Court Ordered that the following item(s) are exempt from execution: Signed (Judge, Magistrate, Assistant Clerk) Date signed By Order of the Court Checklist And Description Of Common Exemptions Allowed By Law (Section 52-352b of the Connecticut General Statutes) (a) Necessary apparel, bedding, foodstuffs, household furniture and appliances; (b) Tools, books, instruments, farm animals and livestock feed, which are necessary to the exemptioner in the course of his or her occupation, profession, farming operation or farming partnership; (c) Burial plot for the exemptioner and his or her immediate family; (d) Public assistance payments and any wages earned by a public assistance recipient under an incentive earnings or similar program; (e) Health and disability insurance payments; (f) Health aids necessary to enable the exemptioner to work or to sustain health; (g) Worker's compensation, social security, veterans and unemployment benefits; (h) Court approved payments for child support; (i) Arms and military equipment, uniforms or musical instruments owned by any member of the militia or armed forces of the United States; (j) One motor vehicle to the value of $3,500, provided such value shall be determined as the fair market value of the motor vehicle less the amount of all liens and security interests which encumber it. (k) Wedding and engagement rings; (l) Residential utility deposits for one residence and one residential security deposit; (m) Any assets or interests of an exemptioner in, or payments received by the exemptioner from, a plan or arrangement described in section 52-321a; (n) Alimony and support, other than child support, but only to the extent that wages are exempt from execution under general statute section 52-361a; (o) An award under a crime reparations act; (p) All benefits allowed by any association of persons in this state towards the support of any of its members incapacitated by sickness or infirmity from attending to his usual business; and (q) All moneys due the exemptioner from any insurance company on any insurance policy issued on exempt property, to the same extent that the property was exempt. (r) Any interest of the exemptioner in any property not to exceed in value $1,000; (s) Any interest of the exemptioner not to exceed in value $4,000

Related forms

-

Exemption And Modification Claim Form Wage Execution

Exemption And Modification Claim Form Wage Execution

Connecticut/Statewide/Civil/ -

Interrogatories

Interrogatories

Connecticut/Statewide/Civil/ -

Motion For Continuance

Motion For Continuance

Connecticut/Statewide/Civil/ -

Petition For Examination Of Judgment Debtor And Notice Of Hearing

Petition For Examination Of Judgment Debtor And Notice Of Hearing

Connecticut/Statewide/Civil/ -

Withdrawal

Withdrawal

Connecticut/Statewide/Civil/ -

Foreclosure By Sale Committee Deed

Foreclosure By Sale Committee Deed

Connecticut/Statewide/Civil/ -

Foreclosure Worksheet

Foreclosure Worksheet

Connecticut/Statewide/Civil/ -

Notice Of Ex Parte Pre Judgment Remedy - Claim For Hearing To Dissolve Or Modify

Notice Of Ex Parte Pre Judgment Remedy - Claim For Hearing To Dissolve Or Modify

Connecticut/Statewide/Civil/ -

Property Execution Proceedings Application Order Execution

Property Execution Proceedings Application Order Execution

Connecticut/Statewide/Civil/ -

Property Execution Proceedings Claim For Determination Of Interests In Disputed Property

Property Execution Proceedings Claim For Determination Of Interests In Disputed Property

Connecticut/Statewide/Civil/ -

Consent Of Parties To Referral To Judge Trial Referee Civil Matters For Trial Judgment And Appeal

Consent Of Parties To Referral To Judge Trial Referee Civil Matters For Trial Judgment And Appeal

Connecticut/Statewide/Civil/ -

Sales Agreement Forclosure

Sales Agreement Forclosure

Connecticut/Statewide/Civil/ -

Request For Action Administrative And Tax Appeals

Request For Action Administrative And Tax Appeals

Connecticut/Statewide/Civil/ -

Expert Discovery Schedule Proposal Or Request For Scheduling Conference

Expert Discovery Schedule Proposal Or Request For Scheduling Conference

Connecticut/Statewide/Civil/ -

Mortgage Foreclosure Standing Order Federal Loss Mitigation Programs

Mortgage Foreclosure Standing Order Federal Loss Mitigation Programs

Connecticut/Statewide/Civil/ -

Application For Waiver Of Fees

Application For Waiver Of Fees

Connecticut/Statewide/Civil/ -

Statement Of Service (Delivery)

Statement Of Service (Delivery)

Connecticut/Statewide/Civil/ -

Continuation Of Parties

Continuation Of Parties

Connecticut/Statewide/Civil/ -

Foreclosure Mediation Notice To Homeowner Or Religious Organization

Foreclosure Mediation Notice To Homeowner Or Religious Organization

Connecticut/Statewide/Civil/ -

Application For Case Referral Land Use Litigation Docket

Application For Case Referral Land Use Litigation Docket

Connecticut/Statewide/Civil/ -

Request For Judicial Aletnative Dispute Resolution (J-ADR)

Request For Judicial Aletnative Dispute Resolution (J-ADR)

Connecticut/Statewide/Civil/ -

Foreclosure Motion For Interim Committee Fees And Expenses

Foreclosure Motion For Interim Committee Fees And Expenses

Connecticut/Statewide/Civil/ -

Decree Of Foreclosure No Redemption

Decree Of Foreclosure No Redemption

Connecticut/Statewide/Civil/ -

Motion For Judgment Of Foreclosure By Market Sale

Motion For Judgment Of Foreclosure By Market Sale

Connecticut/Statewide/Civil/ -

Motion For Supplemental Judgment Foreclosure By Market Sale

Motion For Supplemental Judgment Foreclosure By Market Sale

Connecticut/Statewide/Civil/ -

Foreclosure By Market Sale Committee Deed

Foreclosure By Market Sale Committee Deed

Connecticut/Statewide/Civil/ -

Foreclosure Mediation Petition For Reinclusion

Foreclosure Mediation Petition For Reinclusion

Connecticut/Statewide/Civil/ -

Motion To Open Judgment

Motion To Open Judgment

Connecticut/Statewide/Civil/ -

Foreclosure Mediation Supplemental Information By Party

Foreclosure Mediation Supplemental Information By Party

Connecticut/Statewide/Civil/ -

Foreclosure Mediation Notice Of Community Based Resources

Foreclosure Mediation Notice Of Community Based Resources

Connecticut/Statewide/Civil/ -

Motion For First Order Of Notice - Foreclosure Action

Motion For First Order Of Notice - Foreclosure Action

Connecticut/Statewide/Civil/ -

First Order Of Upon Attachment Of Estate Of Nonresident

First Order Of Upon Attachment Of Estate Of Nonresident

Connecticut/Statewide/Civil/ -

Online Dispute Resolution Answer

Online Dispute Resolution Answer

Connecticut/1 Statewide/Civil/ -

Online Dispute Resolution Request To Return To Regular Docket

Online Dispute Resolution Request To Return To Regular Docket

Connecticut/1 Statewide/Civil/ -

Online Dispute Resolution Plaintiff Participation Notice

Online Dispute Resolution Plaintiff Participation Notice

Connecticut/1 Statewide/Civil/ -

Certificate Of Closed Pleadings

Certificate Of Closed Pleadings

Connecticut/Statewide/Civil/ -

Foreclosure Plaintiffs Bid At Foreclosure Sale And Committees Response

Foreclosure Plaintiffs Bid At Foreclosure Sale And Committees Response

Connecticut/Statewide/Civil/ -

Proceedings For Enforcement Of Municipal Regulations And Ordinances Including Parking

Proceedings For Enforcement Of Municipal Regulations And Ordinances Including Parking

Connecticut/Statewide/Civil/ -

Continuation Of Parties

Continuation Of Parties

Connecticut/Statewide/Civil/ -

Forclosure Mediation Objection

Forclosure Mediation Objection

Connecticut/Statewide/Civil/ -

Application For Civil Protection Order

Application For Civil Protection Order

Connecticut/Statewide/Civil/ -

Affidavit Civil Protection Order

Affidavit Civil Protection Order

Connecticut/Statewide/Civil/ -

Motion For Extension Of Civil Protection Order

Motion For Extension Of Civil Protection Order

Connecticut/Statewide/Civil/ -

Civil Protection Order Information Form

Civil Protection Order Information Form

Connecticut/Statewide/Civil/ -

Request For Arguement Non Arguable Civil Short Calendar Matter

Request For Arguement Non Arguable Civil Short Calendar Matter

Connecticut/Statewide/Civil/ -

Exemption Claim Form Property Execution

Exemption Claim Form Property Execution

Connecticut/Statewide/Civil/ -

Exemption Claim Form Financial Institution Execution

Exemption Claim Form Financial Institution Execution

Connecticut/Statewide/Civil/ -

Motion To Open Judgment (Small Claims And Housing Matters)

Motion To Open Judgment (Small Claims And Housing Matters)

Connecticut/Statewide/Civil/ -

Answer Small Claims

Answer Small Claims

Connecticut/Statewide/Civil/ -

Foreclosure Motion For Approval Of Committee Sale Approval Of Committee Deed Acceptance Of Comittee Report

Foreclosure Motion For Approval Of Committee Sale Approval Of Committee Deed Acceptance Of Comittee Report

Connecticut/Statewide/Civil/ -

Foreclosure Return Of Sale With Proceeds

Foreclosure Return Of Sale With Proceeds

Connecticut/Statewide/Civil/ -

Foreclosure Motion For Possession

Foreclosure Motion For Possession

Connecticut/Statewide/Civil/ -

Foreclosure Motion For Advice

Foreclosure Motion For Advice

Connecticut/Statewide/Civil/ -

Forclosure Return Of Sale No Proceeds

Forclosure Return Of Sale No Proceeds

Connecticut/Statewide/Civil/ -

First Order Of Notice In Foreclosure Action

First Order Of Notice In Foreclosure Action

Connecticut/Statewide/Civil/ -

Application For Examination Of Judgment Debtor And Notice Of Remote Hearing

Application For Examination Of Judgment Debtor And Notice Of Remote Hearing

Connecticut/Statewide/Civil/ -

Small Claims Motion To Modify Order Of Payments

Small Claims Motion To Modify Order Of Payments

Connecticut/Statewide/Civil/ -

Request For Nondisclosure Of Location Information Civil Protection Order

Request For Nondisclosure Of Location Information Civil Protection Order

Connecticut/1 Statewide/Civil/ -

Request For Additional TIme For Service Of Ex Parte Civil Protection Order

Request For Additional TIme For Service Of Ex Parte Civil Protection Order

Connecticut/Statewide/Civil/ -

Petition For Writ Of Habeas Corpus Conviction Proceeding Sentence Calculation

Petition For Writ Of Habeas Corpus Conviction Proceeding Sentence Calculation

Connecticut/Statewide/Civil/ -

Petition For Writ Of Habeas Corpus Conditions Of Confinement Medical Treatment

Petition For Writ Of Habeas Corpus Conditions Of Confinement Medical Treatment

Connecticut/Statewide/Civil/ -

Petition For Writ Of Habeas Corpus Disciplinary Action

Petition For Writ Of Habeas Corpus Disciplinary Action

Connecticut/Statewide/Civil/ -

Small Claims Motion For Order Of Payments

Small Claims Motion For Order Of Payments

Connecticut/Statewide/Civil/ -

Small Claims Motion To Order Judgment Satisfied

Small Claims Motion To Order Judgment Satisfied

Connecticut/Statewide/Civil/ -

Satisfaction Of Judgment

Satisfaction Of Judgment

Connecticut/Statewide/Civil/ -

Scheduling Order

Scheduling Order

Connecticut/Statewide/Civil/ -

Wage Execution Proceedings Application Order Execution

Wage Execution Proceedings Application Order Execution

Connecticut/Statewide/Civil/ -

Financial Institution Execution Proceedings - Judgment Debtor Who Is Natural Person - Application And Execution

Financial Institution Execution Proceedings - Judgment Debtor Who Is Natural Person - Application And Execution

Connecticut/Statewide/Civil/ -

Financial Institution Execution Proceedings - Judgement Debtor Who Is Not Natural Person - Application And Execution

Financial Institution Execution Proceedings - Judgement Debtor Who Is Not Natural Person - Application And Execution

Connecticut/Statewide/Civil/ -

Petition For Order Re Commission On Human Right And Opportunities And Notice Of Hearing

Petition For Order Re Commission On Human Right And Opportunities And Notice Of Hearing

Connecticut/Statewide/Civil/ -

Affidavit Of Service Petition For Order Re Commission On Human Rights

Affidavit Of Service Petition For Order Re Commission On Human Rights

Connecticut/Statewide/Civil/ -

Answer To Complaint Civil Cases Only

Answer To Complaint Civil Cases Only

Connecticut/Statewide/Civil/ -

Application For Referral Of Case To The Individual Calendaring Program

Application For Referral Of Case To The Individual Calendaring Program

Connecticut/Statewide/Civil/ -

Application For Referral Of Case To The Complex Litigation Docket (CLD)

Application For Referral Of Case To The Complex Litigation Docket (CLD)

Connecticut/Statewide/Civil/ -

Foreclosure Mediation Motion To Request Later Mediation

Foreclosure Mediation Motion To Request Later Mediation

Connecticut/Statewide/Civil/ -

Small Claims Motion To Transfer To The Regular Docket

Small Claims Motion To Transfer To The Regular Docket

Connecticut/Statewide/Civil/ -

Affidavit In Support Of Small Claims Motion To Transfer To Regular Docket

Affidavit In Support Of Small Claims Motion To Transfer To Regular Docket

Connecticut/Statewide/Civil/ -

Affidavit Of Debt Re Motion For Default For Failure To Appear Judgment And Order For

Affidavit Of Debt Re Motion For Default For Failure To Appear Judgment And Order For

Connecticut/Statewide/Civil/ -

Foreclosure By Sale Committee Report

Foreclosure By Sale Committee Report

Connecticut/Statewide/Civil/ -

Certificate Of Judgment Strict Foreclosure

Certificate Of Judgment Strict Foreclosure

Connecticut/Statewide/Civil/ -

Certificate Of Judgment Foreclosure By Sale

Certificate Of Judgment Foreclosure By Sale

Connecticut/Statewide/Civil/ -

Foreclosure By Sale Fact Sheet - Notice To Bidders

Foreclosure By Sale Fact Sheet - Notice To Bidders

Connecticut/Statewide/Civil/ -

Scheduling Order By Agreement

Scheduling Order By Agreement

Connecticut/Statewide/Civil/ -

Motion For Default For Failure To Appear Order For Weekly Payment

Motion For Default For Failure To Appear Order For Weekly Payment

Connecticut/Statewide/Civil/ -

Application For Issuance Of Subpoena

Application For Issuance Of Subpoena

Connecticut/Statewide/Civil/ -

Foreclosure Mediation Certificate

Foreclosure Mediation Certificate

Connecticut/Statewide/Civil/ -

Post Judgment Remedies Interrogatories

Post Judgment Remedies Interrogatories

Connecticut/Statewide/Civil/ -

Request For Judgment Upon Filing Following Civil Penalty

Request For Judgment Upon Filing Following Civil Penalty

Connecticut/Statewide/Civil/ -

Small Claims Writ And Notice Of Suit

Small Claims Writ And Notice Of Suit

Connecticut/Statewide/Civil/ -

Notice Of Application For Prejudgment Remedy - Claim For Hearing To Contest Application Or Claim Exemption

Notice Of Application For Prejudgment Remedy - Claim For Hearing To Contest Application Or Claim Exemption

Connecticut/Statewide/Civil/ -

Notice Of Coerced Debt Review

Notice Of Coerced Debt Review

Connecticut/Statewide/Civil/ -

Summons Civil

Summons Civil

Connecticut/Statewide/Civil/ -

Administrative Appeal Under 4-183 Notice Of Filing

Administrative Appeal Under 4-183 Notice Of Filing

Connecticut/Statewide/Civil/ -

Administrative Appeal Under 4-183 Citation

Administrative Appeal Under 4-183 Citation

Connecticut/Statewide/Civil/ -

Application And Execution For Ejectment Mortgage Foreclosure

Application And Execution For Ejectment Mortgage Foreclosure

Connecticut/Statewide/Civil/ -

Caseflow Request

Caseflow Request

Connecticut/Statewide/Civil/ -

Request For Adjudication Of Discovery Or Deposition Dispute

Request For Adjudication Of Discovery Or Deposition Dispute

Connecticut/Statewide/Civil/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!