Last updated: 12/1/2021

Debtors Claim For Property Exemptions {91C}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

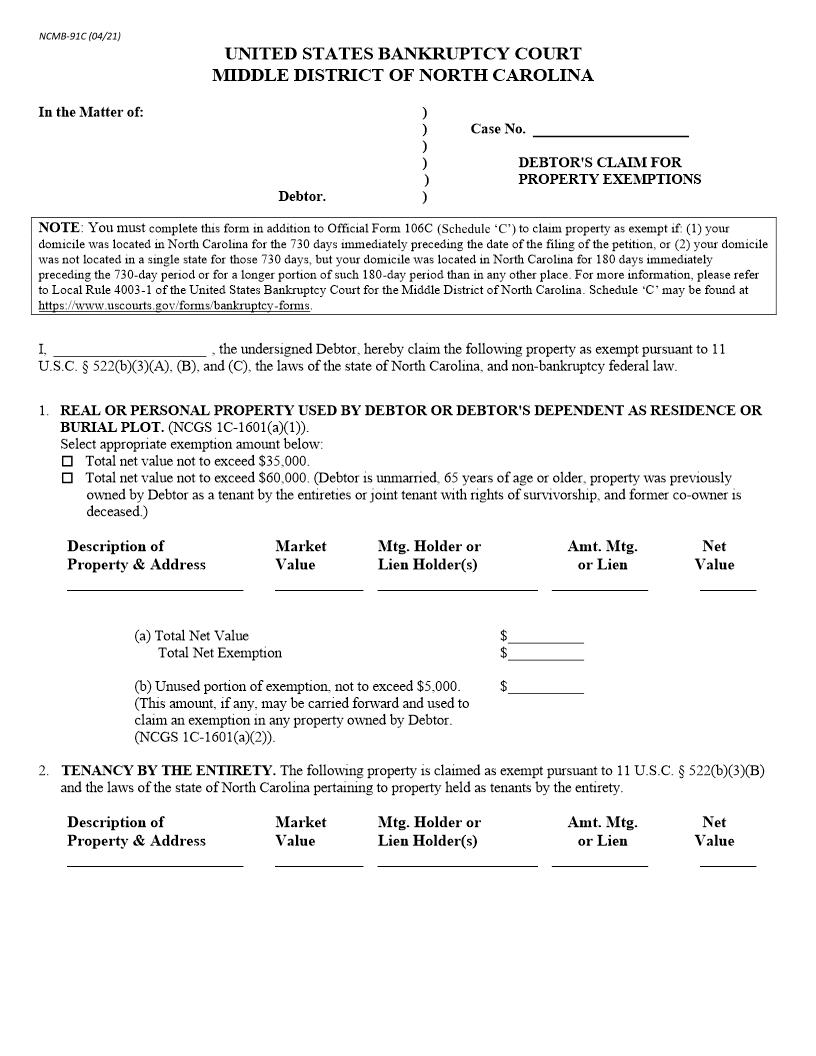

91C (12/09) UNITED STATES BANKRUPTCY COURT MIDDLE DISTRICT OF NORTH CAROLINA In the Matter of: ) ) ) ) ) ) Case No. DEBTOR'S CLAIM FOR PROPERTY EXEMPTIONS Debtor. I, , the undersigned debtor, hereby claim the following property as exempt pursuant to 11 U.S.C. '522(b)(3)(A), (B), and (C), the Laws of the State of North Carolina, and non-bankruptcy federal law. Check if the debtor claims as exempt any amount of interest that exceeds $125,000 in value in property that the debtor or a dependent of the debtor uses as a residence. 1. REAL OR PERSONAL PROPERTY USED BY DEBTOR OR DEBTOR'S DEPENDENT AS RESIDENCE OR BURIAL PLOT. (NCGS 1C-1601(a)(1). Select appropriate exemption amount below: Total net value not to exceed $35,000. Total net value not to exceed $60,000. (Debtor is unmarried, 65 years of age or older, property was previously owned by debtor as a tenant by the entireties or joint tenant with rights of survivorship, and former co-owner is deceased.) Description of Property & Address ______________________ Market Mtg. Holder or Value Lien Holder(s) ___________ ____________________ $ $ $ Amt. Mtg. or Lien _________ Net Value _______ (a) Total Net Value Total Net Exemption (b) Unused portion of exemption, not to exceed $5,000. (This amount, if any, may be carried forward and used to claim an exemption in any property owned by the debtor. (NCGS 1C-1601(a)(2)). 2. TENANCY BY THE ENTIRETY. The following property is claimed as exempt pursuant to 11 U.S.C. ' 522(b)(3)(B) and the laws of the State of North Carolina pertaining to property held as tenants by the entirety. Description of Property & Address ______________________ Market Mtg. Holder or Value Lien Holder(s) ___________ ____________________ Amt. Mtg. or Lien _________ Net Value _______ 3. MOTOR VEHICLE. (NCGS 1C-1601(a)(3). Only one vehicle allowed under this paragraph with net value claimed as exempt not to exceed $3,500.) Year, Make, Model of Auto ______________________ Market Value Lien Holder(s) ___________ ____________________ $ $ $ Net Value _______ Amt. Lien _________ 3,500 (a) Statutory allowance (b) Amount from 1(b) above to be used in this paragraph. (A part or all of 1(b) may be used as needed.) Total Net Exemption American LegalNet, Inc. www.FormsWorkFlow.com 91C (12/09) 4. TOOLS OF TRADE, IMPLEMENTS, OR PROFESSIONAL BOOKS. (NCGS 1C-1601(a)(5). Used by debtor or debtor's dependent. Total net value of all items claimed as exempt not to exceed $2,000.) Market Value Lien Holder(s) ___________ ____________________ ___________ ____________________ $ $ $ 2,000 Net Value _______ _______ Description ______________________ ______________________ Amt. Lien _________ _________ (a) Statutory allowance (b) Amount from 1(b) above to be used in this paragraph. (A part or all of 1 (b) may be used as needed.) Total Net Exemption 5. PERSONAL PROPERTY USED FOR HOUSEHOLD OR PERSONAL PURPOSES NEEDED BY DEBTOR OR DEBTOR'S DEPENDENTS. (NCGS 1C-1601(a)(4). Debtor's aggregate interest, not to exceed $5,000 in value for the debtor plus $1,000 for each dependent of the debtor, not to exceed $4,000 total for dependents.) Market Value ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ ___________ Net Value _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ Description Clothing & Personal Kitchen Appliances Stove Refrigerator Freezer Washing Machine Dryer China Silver Jewelry Living Room Furniture Den Furniture Bedroom Furniture Dining Room Furniture Lawn Furniture Television ( ) Stereo ( ) Radio Musical Instruments ( ) Piano ( ) Organ Air Conditioner Paintings & Art Lawn Mower Yard Tools Crops Animals Other ( ) Lien Holder(s) ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ Amt. Lien _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ $ Total Net Value (a) Statutory allowance for debtor (b) Statutory allowance for debtor's dependents: dependents at $1,000 each (not to exceed $4,000 total for dependents) (c) Amount from 1(b) above to be used in this paragraph. (A part or all of 1 (b) may be used as needed.) $ $ $ 5,000 Total Net Exemption $ American LegalNet, Inc. www.FormsWorkFlow.com 91C (12/09) 6. LIFE INSURANCE. (As provided in Article X, Section 5 of North Carolina Constitution.) Name of Insurance Company Name of Insured Name of Beneficiary 7. PROFESSIONALLY PRESCRIBED HEALTH AIDS (FOR DEBTOR OR DEBTOR'S DEPENDENTS). (NCGS 1C-1601(a)(7). No limit on value of number of items.) Description: __________________________________________________________________________________ 8. DEBTOR'S RIGHT TO RECEIVE FOLLOWING COMPENSATION: (NCGS 1C-1601(a)(8). No limit on number or amount.) A. $ B. $ C. $ __________ Compensation for personal injury to debtor or to person whom debtor was dependent for support. Compensation for death of person of whom debtor was dependent for support. Compensation from private disability policies or annuities. Policy No. Policy Date 9. INDIVIDUAL RETIREMENT PLANS AS DEFINED IN THE INTERNAL REVENUE CODE AND ANY PLAN TREATED IN THE SAME MANNER AS AN INDIVIDUAL RETIREMENT PLAN UNDER THE INTERNAL REVENUE CODE (NCGS 1C-1601(a)(9). No limit on number or amount.) AND OTHER RETIREMENT FUNDS DEFINED IN 11 U.S.C. § 522(b)(3)(c). Detailed Description Value 10. COLLEGE SAVINGS PLANS QUALIFIED UNDER SECTION 529 OF THE INTERNAL REVENUE CODE. (NCGS 1C-1601(a)(10). Total net value not to exceed $25,000 and may not include any funds placed in a colle