Last updated: 8/18/2021

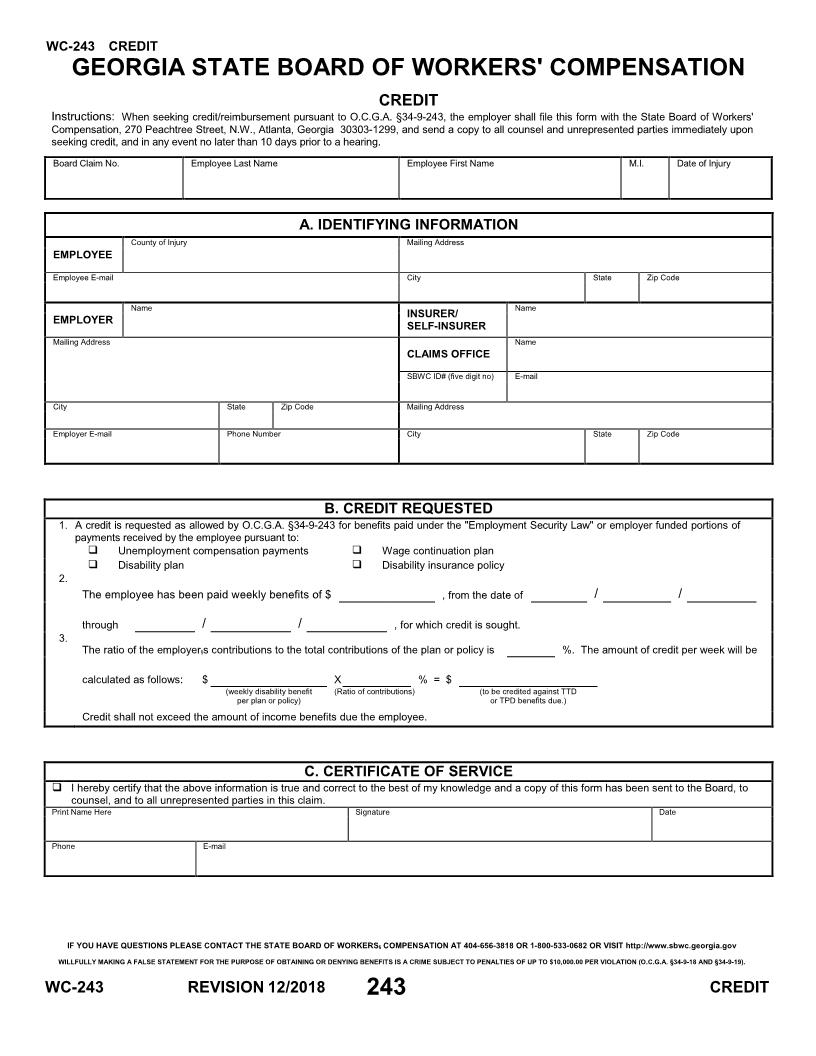

Credit {WC-243}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

WC - 243 CREDIT GEORGIA STATE BOARD OF WORKERS' COMPENSATION IF YOU HAVE QUESTIONS PLEASE CONTACT THE STATE BOARD OF WORKERS222 COMPENSATION AT 404-656-3818 OR 1-800-533-0682 OR VISIT http://www.sbwc.georgia.gov WILLFULLY MAKING A FALSE STATEMENT FOR THE PURPOSE OF OBTAINING OR DENYING BENEFITS IS A CRIME SUBJECT TO PENALTIES OF UP TO $10,000.00 PER VIOLATION (O.C.G.A. 24734-9-18 AND 24734-9-19). WC -243 REVISION 12/2018 243 CREDIT CREDIT Instructions: When seeking credit/reimbursement pursuant to O.C.G.A. 24734-9-243, the employer shall file this form with the State Board of Workers' Board Claim No. Employee Last Name Employee First Name M.I. Date of Injury A. IDENTIFYING INFORMATION EMPLOYEE County of Injury M ailing Address Employee E - mail City State Zip Code EMPLOYER Name INSURER/ SELF-INSURER Name M ailing Address CLAIMS OFFICE Name SBWC ID# (five digit no) E - mail City State Zip Code Mailing Address Employer E - mail Phone Numb er City State Zip Code B. CREDIT REQUESTED 1. A credit is requested as allowed by O.C.G.A. 247 34 - 9 - 243 for benefits paid under the "Employment Security Law" or employer funded portions of payments received by the employee pursuant to: Unemployment compensation payments Wage continuation plan 000211 Disability plan Disability insurance policy 2. The employee has been paid weekly benefits of $ , from the date of / / through / / , for which credit is sought. 3. The ratio of the employer222s contributions to the total contributions of the plan or policy is %. The amount of credit per week will be calculated as follows: $ X % = $ ( weekly disability benefit per plan or policy) (Ratio of contributions) (to be credited against TTD or TPD benefits due.) Credit shall not exceed the amount of income benefits due the employee. C. CERTIFICAT E OF SERVICE I hereby certify that the above information is true and correct to the best of my knowledge and a copy of this form has been sent to the Board, to counsel, and to all unrepresented parties in this claim. Print Name Here Signature Date Phone E - mail

Related forms

-

Request For Settlement Mediation

Request For Settlement Mediation

Georgia/Workers Comp/ -

Wage Statement

Wage Statement

Georgia/Workers Comp/ -

Request-Objection For Change Of Physician-Additional Treatment

Request-Objection For Change Of Physician-Additional Treatment

Georgia/Workers Comp/ -

Standard Coverage Form - Group Self Insurance Fund Members

Standard Coverage Form - Group Self Insurance Fund Members

Georgia/Workers Comp/ -

Attorney Fee Approval

Attorney Fee Approval

Georgia/Workers Comp/ -

Attorney Leave Of Absence

Attorney Leave Of Absence

Georgia/Workers Comp/ -

Change Of Physician-Additional Treatment By Consent

Change Of Physician-Additional Treatment By Consent

Georgia/Workers Comp/ -

Credit-Reduction In Benefits

Credit-Reduction In Benefits

Georgia/Workers Comp/ -

Job Analysis

Job Analysis

Georgia/Workers Comp/ -

Medical Report

Medical Report

Georgia/Workers Comp/ -

Notice Of Claim-Request For Hearing-Request For Mediation

Notice Of Claim-Request For Hearing-Request For Mediation

Georgia/Workers Comp/ -

Attorney Certification For No Liability Stipulations

Attorney Certification For No Liability Stipulations

Georgia/Workers Comp/ -

Rehab Objection

Rehab Objection

Georgia/Workers Comp/ -

Notice To Employee Of Medical Release To Return To Work

Notice To Employee Of Medical Release To Return To Work

Georgia/Workers Comp/ -

Credit

Credit

Georgia/Workers Comp/ -

Employers First Report Of Injury Or Occupational Disease

Employers First Report Of Injury Or Occupational Disease

Georgia/Workers Comp/ -

Notice To Controvert

Notice To Controvert

Georgia/Workers Comp/ -

Case Progress Report

Case Progress Report

Georgia/Workers Comp/ -

Standard Coverage Form

Standard Coverage Form

Georgia/6 Workers Comp/ -

Request For Documents To Parties

Request For Documents To Parties

Georgia/Workers Comp/ -

Motion-Objection To Motion

Motion-Objection To Motion

Georgia/Workers Comp/ -

Attorney Withdrawal Lien

Attorney Withdrawal Lien

Georgia/Workers Comp/ -

Change Of Physician Additional Treatment By Consent

Change Of Physician Additional Treatment By Consent

Georgia/Workers Comp/ -

Request Objection For Change Of Physician Additional Treatment

Request Objection For Change Of Physician Additional Treatment

Georgia/Workers Comp/ -

Request For Authorization Of Treatment Or Testing By Authorized Medical Provider

Request For Authorization Of Treatment Or Testing By Authorized Medical Provider

Georgia/Workers Comp/ -

Request To Become A Party At Interest

Request To Become A Party At Interest

Georgia/Workers Comp/ -

Notice To Employee Of Offer Of Suitable Employment

Notice To Employee Of Offer Of Suitable Employment

Georgia/Workers Comp/ -

Request To Become A Party Of Interest

Request To Become A Party Of Interest

Georgia/Workers Comp/ -

Wage Documentation

Wage Documentation

Georgia/Workers Comp/ -

Request For Rehab Conference

Request For Rehab Conference

Georgia/Workers Comp/ -

Catastrophic Rehabilitation Release

Catastrophic Rehabilitation Release

Georgia/Workers Comp/ -

Request For Change Of Address

Request For Change Of Address

Georgia/Workers Comp/ -

Subpoena

Subpoena

Georgia/Workers Comp/ -

WC-MCO Panel

WC-MCO Panel

Georgia/Workers Comp/ -

Request For Copy Of Board Records

Request For Copy Of Board Records

Georgia/Workers Comp/ -

Notice Of Claim

Notice Of Claim

Georgia/6 Workers Comp/ -

Request To Amend Information On A Form WC-14

Request To Amend Information On A Form WC-14

Georgia/Workers Comp/ -

Application For Lump Sum Advance Payment

Application For Lump Sum Advance Payment

Georgia/Workers Comp/ -

Request For Rehabilitation

Request For Rehabilitation

Georgia/Workers Comp/ -

Employees Request For Catastrophic Designation

Employees Request For Catastrophic Designation

Georgia/Workers Comp/ -

Rehabilitation Transmittal Form

Rehabilitation Transmittal Form

Georgia/Workers Comp/ -

Individualized Rehabilitation Plan

Individualized Rehabilitation Plan

Georgia/Workers Comp/ -

Request For Rehabilitation Closure

Request For Rehabilitation Closure

Georgia/Workers Comp/ -

Request To Change Information

Request To Change Information

Georgia/Workers Comp/ -

Panel Of Physicians

Panel Of Physicians

Georgia/Workers Comp/ -

Notice Of Payment Or Suspension Of Benefits

Notice Of Payment Or Suspension Of Benefits

Georgia/Workers Comp/ -

Notice Of Payment Or Suspension Of Death Benefits

Notice Of Payment Or Suspension Of Death Benefits

Georgia/Workers Comp/ -

Notice Of Election Or Rejection Of Workers Compensation Coverage

Notice Of Election Or Rejection Of Workers Compensation Coverage

Georgia/Workers Comp/ -

Consolidated Yearly Report Of Medical Only Cases

Consolidated Yearly Report Of Medical Only Cases

Georgia/Workers Comp/ -

Application For Permit To Write Insurance

Application For Permit To Write Insurance

Georgia/Workers Comp/ -

Annual Insurer Update

Annual Insurer Update

Georgia/Workers Comp/ -

Petition For Medical Treatment

Petition For Medical Treatment

Georgia/6 Workers Comp/ -

Renewal Rehab Supplier Registration

Renewal Rehab Supplier Registration

Georgia/Workers Comp/ -

New Rehab Supplier Registration

New Rehab Supplier Registration

Georgia/Workers Comp/ -

WC-MCO Panel (Spanish)

WC-MCO Panel (Spanish)

Georgia/Workers Comp/ -

Petition For Appointment Of Temporary Conservator For Legally Incapacitated Adult

Petition For Appointment Of Temporary Conservator For Legally Incapacitated Adult

Georgia/Workers Comp/ -

Notice Of Change Of TPA Servicing Agent

Notice Of Change Of TPA Servicing Agent

Georgia/Workers Comp/ -

Authorization And Consent To Release Information

Authorization And Consent To Release Information

Georgia/Workers Comp/ -

Petition For Medical Treatment

Petition For Medical Treatment

Georgia/6 Workers Comp/ -

Petition For Appointment Of Temporary Guardianship Of Minor

Petition For Appointment Of Temporary Guardianship Of Minor

Georgia/Workers Comp/ -

Associate Assessment Affidavit

Associate Assessment Affidavit

Georgia/Workers Comp/ -

Annual Report Of Self-Insurers Payroll

Annual Report Of Self-Insurers Payroll

Georgia/Workers Comp/ -

Annual Premium Writing Report

Annual Premium Writing Report

Georgia/Workers Comp/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!