Last updated: 1/27/2021

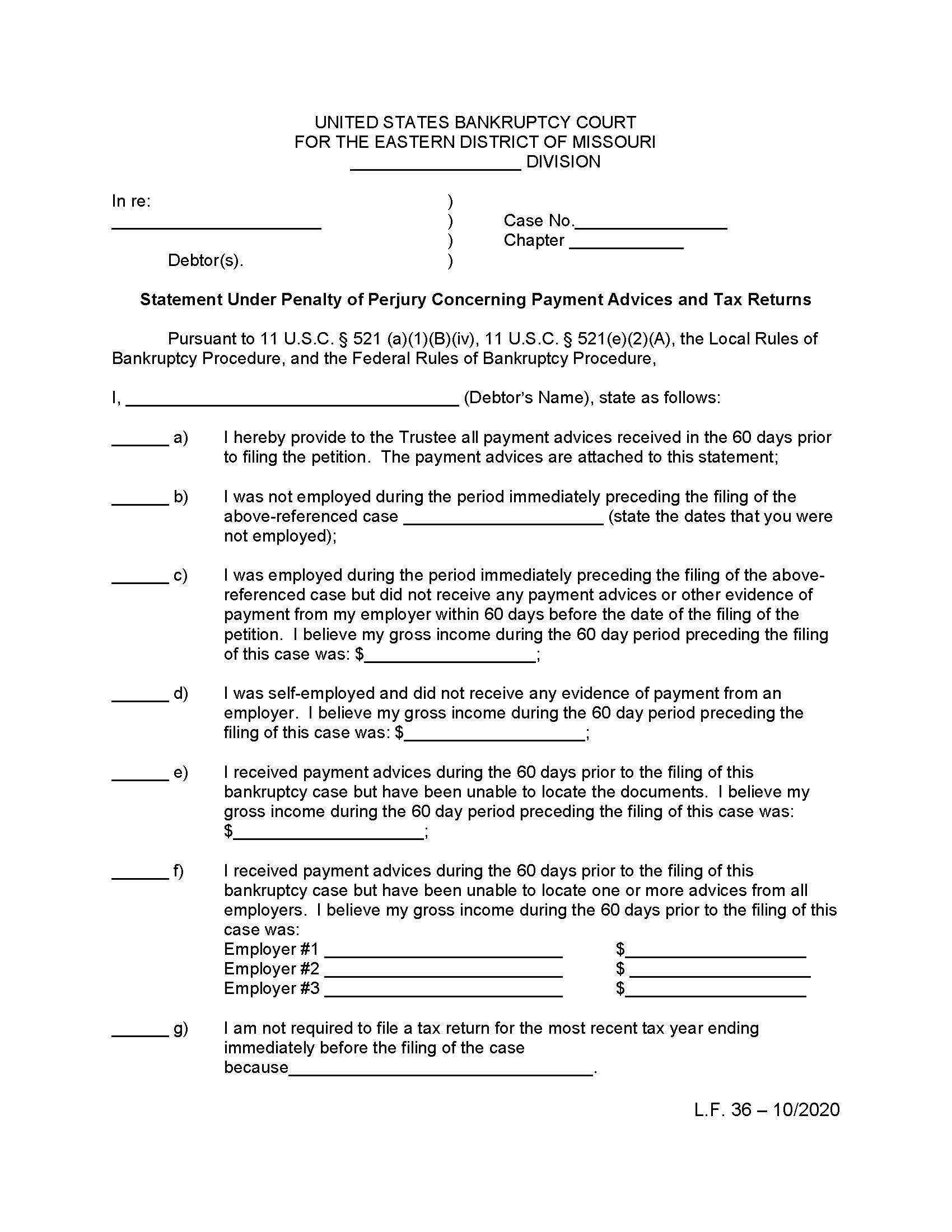

Statement Under Penalty Of Perjury Concerning Payment Advices And Tax Returns {LF36}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

LF 36 - STATEMENT UNDER PENALTY OF PERJURY CONCERNING PAYMENT ADVICES AND TAX RETURNS. This form is used in bankruptcy proceedings to comply with 11 U.S.C. § 521(a)(1)(B)(iv) and 11 U.S.C. § 521(e)(2)(A). It requires debtors to disclose their employment and income history, specifically providing payment advices (pay stubs) received in the 60 days before filing for bankruptcy. If the debtor was unemployed, self-employed, or did not receive payment advices, they must declare that information. Additionally, the form addresses tax return filings, requiring debtors to confirm whether they have filed their most recent tax return or explain why they have not. This statement, signed under penalty of perjury, must be provided to the bankruptcy trustee before the § 341 meeting of creditors. www.FormsWorkflow.com

Related forms

-

Notice of Chapter 11 Disclosure Statement And Hearing Thereon

Notice of Chapter 11 Disclosure Statement And Hearing Thereon

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Order-Chapter 11

Order-Chapter 11

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Adversary Proceeding Cover Sheet

Adversary Proceeding Cover Sheet

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Motion For Relief From Automatic Stay To Negotiate Mortgage Loan Modification

Motion For Relief From Automatic Stay To Negotiate Mortgage Loan Modification

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Motion For Relief From Automatic Stay To Enter Into Loan Modification Agreement

Motion For Relief From Automatic Stay To Enter Into Loan Modification Agreement

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Debtors Request For Clerk To Send Notice Of Transfer Of Claim

Debtors Request For Clerk To Send Notice Of Transfer Of Claim

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Objection to Claim

Objection to Claim

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Omnibus Objection to Claims

Omnibus Objection to Claims

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Sample Caption

Sample Caption

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Chapter 13 Plan

Chapter 13 Plan

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Notice Of Hearing And Summary Of Application For Compensation And Reimbursement Of Expenses

Notice Of Hearing And Summary Of Application For Compensation And Reimbursement Of Expenses

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Order Approving Disclosure Statement And Notice Of Confirmation Hearing

Order Approving Disclosure Statement And Notice Of Confirmation Hearing

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Order For Payment Of Unclaimed Funds

Order For Payment Of Unclaimed Funds

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Report Of Mediator

Report Of Mediator

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Settlement Conference Report

Settlement Conference Report

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Statement Under Penalty Of Perjury Concerning Payment Advices And Tax Returns

Statement Under Penalty Of Perjury Concerning Payment Advices And Tax Returns

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Notice Of Withdrawal Of Counsel

Notice Of Withdrawal Of Counsel

Missouri/4 Federal/Bankruptcy Court/Eastern District/ -

Notice Of Withdrawal Of Counsel And Notice Of Appearance

Notice Of Withdrawal Of Counsel And Notice Of Appearance

Missouri/4 Federal/Bankruptcy Court/Eastern District/ -

Notice Of Corrected Or Undeliverable Address

Notice Of Corrected Or Undeliverable Address

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Plaintiffs (Or Defendants) Index Of Exhibits

Plaintiffs (Or Defendants) Index Of Exhibits

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Section 341 Minute Report

Section 341 Minute Report

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Summary And Notice Of Application For Compensation And Reimbursement Of Expenses

Summary And Notice Of Application For Compensation And Reimbursement Of Expenses

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Verification Of Creditor Matrix

Verification Of Creditor Matrix

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Notice And Motion To Avoid Judicial Lien

Notice And Motion To Avoid Judicial Lien

Missouri/4 Federal/Bankruptcy Court/Eastern District/ -

Certification Of No Response

Certification Of No Response

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Consent To Entry Of Judgment And Orders By Bankruptcy Court

Consent To Entry Of Judgment And Orders By Bankruptcy Court

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Verified Motion For Admission Pro Hac Vice

Verified Motion For Admission Pro Hac Vice

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Application To Pay Filing Fees In Installments

Application To Pay Filing Fees In Installments

Missouri/Federal/Bankruptcy Court/Eastern District/ -

Objection To Claim (Chapter 13)

Objection To Claim (Chapter 13)

Missouri/Federal/Bankruptcy Court/Eastern District/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!