Last updated: 8/17/2020

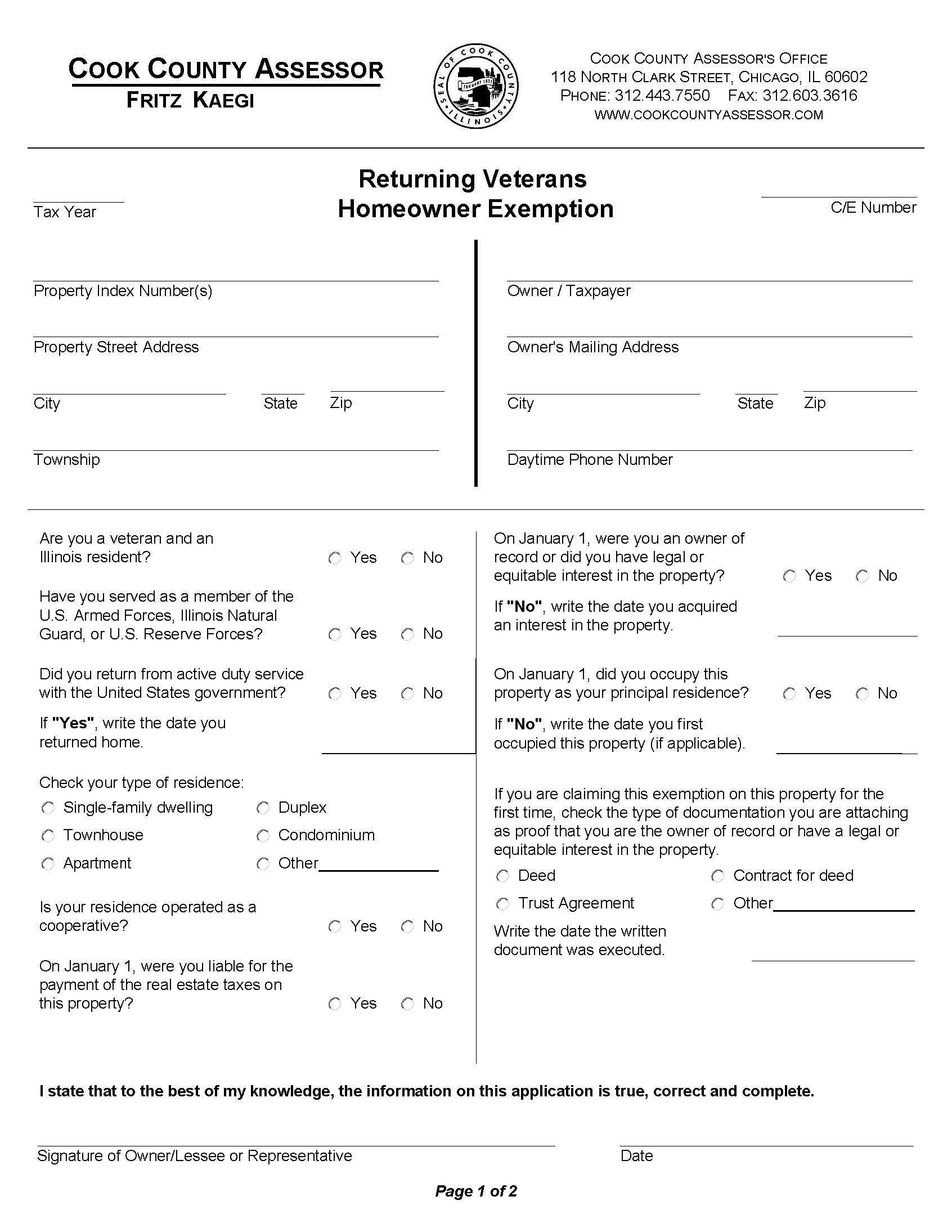

Returning Veterans Homeowner Exemption

Start Your Free Trial $ 14.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

RETURNING VETERANS HOMEOWNER EXEMPTION. This form from the Cook County Assessor’s Office is used by eligible Illinois veterans to apply for a one-time reduction of $5,000 in the equalized assessed value (EAV) of their primary residence for property tax purposes. This exemption is available for the tax year in which a veteran returns from active duty in an armed conflict involving the United States and also applies to the following tax year. To qualify, the applicant must be an Illinois resident, have served in the U.S. Armed Forces, Illinois National Guard, or U.S. Reserve Forces, and must own and occupy the home as their principal residence on January 1 of the assessment year. The veteran must also be legally or equitably responsible for the payment of property taxes on the residence. Applicants must provide supporting military documentation, such as a certified DD214 or DD220 form, proving their return from active duty. The form requires information about the veteran, the property, and ownership details, and must be filed with the Assessor’s Office for each year that eligibility applies. A representative may file on behalf of a deceased veteran who met the requirements. www.FormsWorkflow.com

Related forms

-

Demolition Affidavit

Demolition Affidavit

Illinois/Local County/Cook/Assessors Office/ -

Rent Roll For Industrial Commercial

Rent Roll For Industrial Commercial

Illinois/Local County/Cook/Assessors Office/ -

Owner Occupancy Affidavit (For Appeals Only)

Owner Occupancy Affidavit (For Appeals Only)

Illinois/Local County/Cook/Assessors Office/ -

Property Location Correction Form

Property Location Correction Form

Illinois/Local County/Cook/Assessors Office/ -

Taxpayer Exemption Application (Homeowner And Senior Citizen)

Taxpayer Exemption Application (Homeowner And Senior Citizen)

Illinois/Local County/Cook/Assessors Office/ -

Appeal Data Cover Form A

Appeal Data Cover Form A

Illinois/Local County/Cook/Assessors Office/ -

Appeal Data Cover Form B

Appeal Data Cover Form B

Illinois/Local County/Cook/Assessors Office/ -

Petition For Division And Or Consolidation (For Tax Year 2021)

Petition For Division And Or Consolidation (For Tax Year 2021)

Illinois/Local County/Cook/Assessors Office/ -

Residential Appeal Narrative Additional Documentation Form

Residential Appeal Narrative Additional Documentation Form

Illinois/2 Local County/Cook/Assessors Office/ -

Vacancy Affidavit For 10 Or More Stories

Vacancy Affidavit For 10 Or More Stories

Illinois/2 Local County/Cook/Assessors Office/ -

Non-Attorney Code Request Form

Non-Attorney Code Request Form

Illinois/2 Local County/Cook/Assessors Office/ -

General Affidavit Industrial Commercial)

General Affidavit Industrial Commercial)

Illinois/2 Local County/Cook/Assessors Office/ -

Rent Roll For Apartments

Rent Roll For Apartments

Illinois/Local County/Cook/Assessors Office/ -

Hearing Waiver (Department Of Erroneous Exemption Administration Hearings)

Hearing Waiver (Department Of Erroneous Exemption Administration Hearings)

Illinois/2 Local County/Cook/Assessors Office/ -

Motion To Continue (Department Of Erroneous Exemption Administration Hearings)

Motion To Continue (Department Of Erroneous Exemption Administration Hearings)

Illinois/2 Local County/Cook/Assessors Office/ -

Appearance (Department Of Erroneous Exemption Administration Hearings)

Appearance (Department Of Erroneous Exemption Administration Hearings)

Illinois/2 Local County/Cook/Assessors Office/ -

Affidavit Claiming Long-Time Occupant Homestead Exemption Due To Deceased

Affidavit Claiming Long-Time Occupant Homestead Exemption Due To Deceased

Illinois/2 Local County/Cook/Assessors Office/ -

Occupancy Affidavit

Occupancy Affidavit

Illinois/2 Local County/Cook/Assessors Office/ -

Affidavit Of Use

Affidavit Of Use

Illinois/2 Local County/Cook/Assessors Office/ -

Appraisal Summary Sheet

Appraisal Summary Sheet

Illinois/2 Local County/Cook/Assessors Office/ -

Attorney-Representative Authorization Form

Attorney-Representative Authorization Form

Illinois/2 Local County/Cook/Assessors Office/ -

New Construction Property Additions Or Improvements

New Construction Property Additions Or Improvements

Illinois/2 Local County/Cook/Assessors Office/ -

Report Of Destroyed Or Uninhabitable Improvement Destructions

Report Of Destroyed Or Uninhabitable Improvement Destructions

Illinois/2 Local County/Cook/Assessors Office/ -

Affidavit Regarding Termination Of Lease

Affidavit Regarding Termination Of Lease

Illinois/2 Local County/Cook/Assessors Office/ -

Class 4 Classification Not-For-Profit Affidavit

Class 4 Classification Not-For-Profit Affidavit

Illinois/2 Local County/Cook/Assessors Office/ -

Property Age Change Affidavit

Property Age Change Affidavit

Illinois/2 Local County/Cook/Assessors Office/ -

Request For Assessment By Legal Description

Request For Assessment By Legal Description

Illinois/Local County/Cook/Assessors Office/ -

Affidavit Of Person Claiming Senior Freeze Due To Deceased Taxpayer

Affidavit Of Person Claiming Senior Freeze Due To Deceased Taxpayer

Illinois/2 Local County/Cook/Assessors Office/ -

Disabled Persons Homeowner Exemption

Disabled Persons Homeowner Exemption

Illinois/2 Local County/Cook/Assessors Office/ -

Senior Freeze (Senior Citizens Assessment Freeze Homestead Exemption)

Senior Freeze (Senior Citizens Assessment Freeze Homestead Exemption)

Illinois/2 Local County/Cook/Assessors Office/ -

Senior Exemption Certificate Of Error (C-E) Application

Senior Exemption Certificate Of Error (C-E) Application

Illinois/2 Local County/Cook/Assessors Office/ -

Returning Veterans Homeowner Exemption

Returning Veterans Homeowner Exemption

Illinois/2 Local County/Cook/Assessors Office/ -

Veterans With Disabilities Standard Homeowner Exemption

Veterans With Disabilities Standard Homeowner Exemption

Illinois/2 Local County/Cook/Assessors Office/ -

Assessment Inquiry-Report

Assessment Inquiry-Report

Illinois/2 Local County/Cook/Assessors Office/ -

Field Check Request Letter

Field Check Request Letter

Illinois/2 Local County/Cook/Assessors Office/ -

Certificate Of Error Application For Exempt Property

Certificate Of Error Application For Exempt Property

Illinois/2 Local County/Cook/Assessors Office/ -

Condominium De-Conversion Document Request Form

Condominium De-Conversion Document Request Form

Illinois/2 Local County/Cook/Assessors Office/ -

Certificate Of Error Application For Omitted Assessments

Certificate Of Error Application For Omitted Assessments

Illinois/2 Local County/Cook/Assessors Office/ -

Withdrawal And-Or Substitution Of Representation Form

Withdrawal And-Or Substitution Of Representation Form

Illinois/2 Local County/Cook/Assessors Office/ -

Triennial Report Affidavit For Incentive Properties

Triennial Report Affidavit For Incentive Properties

Illinois/2 Local County/Cook/Assessors Office/ -

Exemption Removal Waiver

Exemption Removal Waiver

Illinois/2 Local County/Cook/Assessors Office/ -

Sales Questionnaire (Industrial-Commercial)

Sales Questionnaire (Industrial-Commercial)

Illinois/Local County/Cook/Assessors Office/ -

Real Estate Assessed Valuation Appeal Condo Coop

Real Estate Assessed Valuation Appeal Condo Coop

Illinois/2 Local County/Cook/Assessors Office/ -

Property Summary Sheet

Property Summary Sheet

Illinois/2 Local County/Cook/Assessors Office/ -

Real Estate Assessed Valuation Appeal Residential

Real Estate Assessed Valuation Appeal Residential

Illinois/2 Local County/Cook/Assessors Office/ -

Real Estate Assessed Valuation Appeal Vacant Land

Real Estate Assessed Valuation Appeal Vacant Land

Illinois/2 Local County/Cook/Assessors Office/ -

Vacancy Occupancy Affidavit

Vacancy Occupancy Affidavit

Illinois/Local County/Cook/Assessors Office/ -

Real Estate Assessed Valuation Appeal Industrial Commercial

Real Estate Assessed Valuation Appeal Industrial Commercial

Illinois/2 Local County/Cook/Assessors Office/ -

Certificate Of Error Application For Taxable Properties

Certificate Of Error Application For Taxable Properties

Illinois/2 Local County/Cook/Assessors Office/ -

Continued Ownership And Use Declaration After PIN Division

Continued Ownership And Use Declaration After PIN Division

Illinois/2 Local County/Cook/Assessors Office/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!