Last updated: 7/29/2020

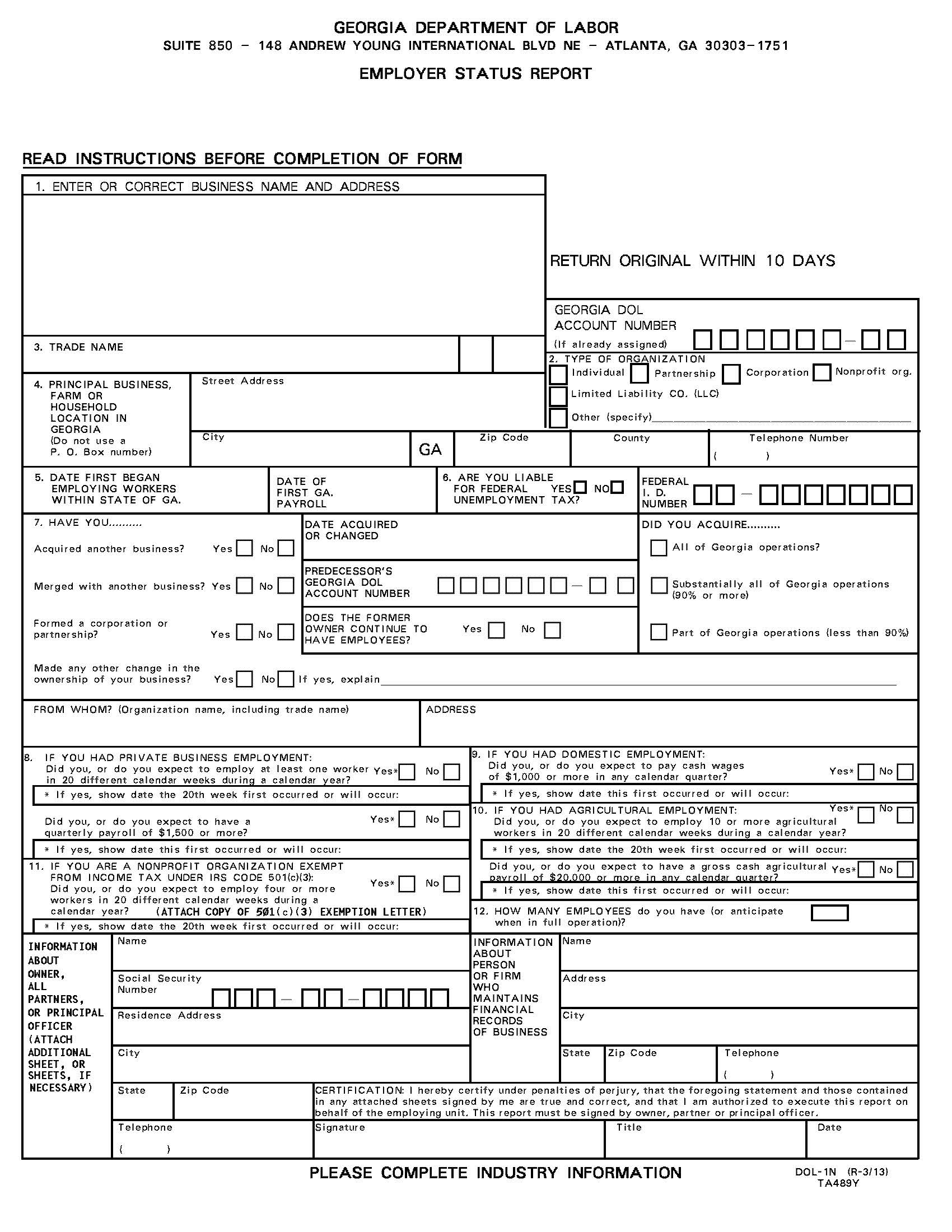

Employer Status Report {DOL-1N}

Start Your Free Trial $ 6.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

DOL-1N - EMPLOYER STATUS REPORT. This is a registration form issued by the Georgia Department of Labor (GDOL) for employers who have hired workers within the state. It establishes an employer’s liability under the Georgia Employment Security Law (O.C.G.A. § 34-8-121) and is used to assign a Georgia DOL account number for unemployment insurance (UI) tax purposes. The form must be completed and returned within ten days of hiring employees or acquiring a business with existing workers in Georgia. Employers must provide key details including their legal and trade names, business address, type of organization (individual, partnership, corporation, LLC, or nonprofit), date of first payroll, and federal identification number. The report also asks whether the employer is subject to the Federal Unemployment Tax Act (FUTA) and if it has acquired, merged, or changed ownership of another business. Additional sections determine liability for specific types of employment, including private business, domestic, agricultural, and nonprofit employment under IRS Code 501(c)(3). Employers must disclose when certain thresholds were met, such as paying $1,500 in a quarter or employing 10 or more agricultural workers for 20 weeks. The form requires information about the nature of business operations, including number of Georgia locations, industry type (e.g., manufacturing, retail trade, construction, or services), and percentage of income derived from each activity. Employers must also identify key individuals such as the owner, partners, or financial officer responsible for maintaining business records. This form is mandatory for all employing units operating in Georgia, regardless of duration or number of employees. It must be signed under penalty of perjury by an authorized officer, partner, or owner. www.FormsWorkflow.com