Last updated: 10/15/2019

Small Estate Affidavit {DEK-SEA}

Start Your Free Trial $ 19.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

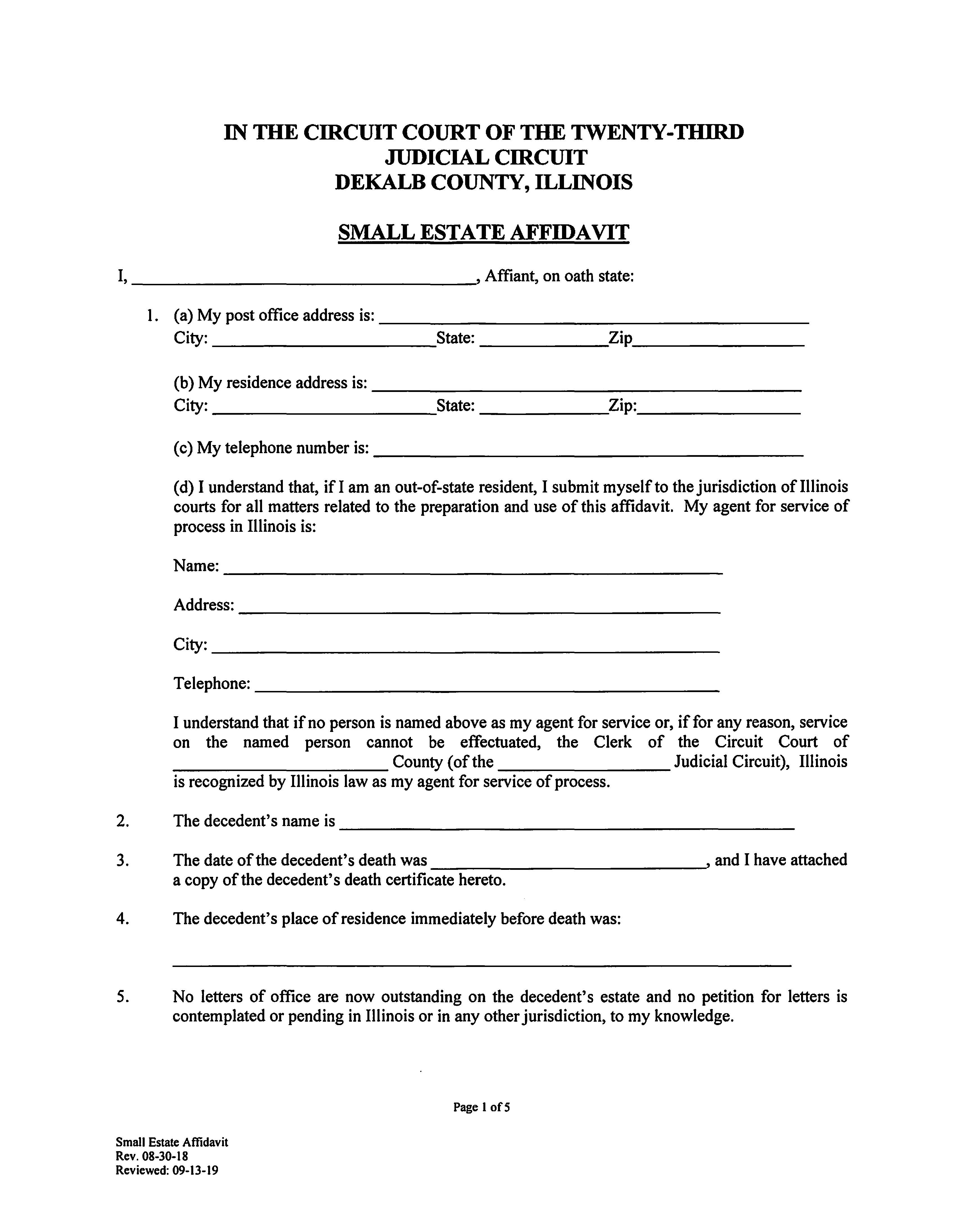

SMALL ESTATE AFFIDAVIT. This form is used in the Circuit Court of DeKalb County, Illinois, to facilitate the transfer of a deceased person's personal property without the need for formal probate proceedings, provided the total value of the estate does not exceed $100,000. This form is typically completed by a relative, heir, or representative of the decedent (called the affiant), who affirms under oath that they have the legal authority to collect and distribute the decedent’s assets. The affidavit includes detailed information about the affiant, the decedent (including their death date and last residence), and the estate’s contents. It confirms that no probate proceedings (such as letters of office) are pending, that all known debts and funeral expenses are either paid or clearly listed, and that the estate qualifies as a “small estate” under Illinois law. The affiant also lists the decedent’s heirs or legatees, whether the decedent left a will or died intestate, and how the property is to be distributed. If a will exists, a copy must be attached. The affidavit is legally binding and must be notarized. It allows financial institutions, businesses, and other third parties to release property (like bank accounts or personal effects) to the rightful recipients without court supervision. The affiant assumes responsibility for ensuring debts are paid before distributing the remaining assets and agrees to indemnify others relying on the affidavit if any loss occurs due to misstatements or omissions. www.FormsWorkflow.com

Related forms

-

Order Of Default

Order Of Default

Illinois/Local County/Dekalb/General/ -

Payment Order For The Reimbursement For A Court Appointed Attorney

Payment Order For The Reimbursement For A Court Appointed Attorney

Illinois/Local County/Dekalb/General/ -

Probation Order

Probation Order

Illinois/Local County/Dekalb/General/ -

New Case Information Sheet

New Case Information Sheet

Illinois/Local County/Dekalb/General/ -

Order For Installment Payment of Judgment

Order For Installment Payment of Judgment

Illinois/Local County/Dekalb/General/ -

Annual Report And Accounting On Minor

Annual Report And Accounting On Minor

Illinois/Local County/Dekalb/General/ -

New Case Probate Information Sheet

New Case Probate Information Sheet

Illinois/Local County/Dekalb/General/ -

Annual Report Order

Annual Report Order

Illinois/Local County/Dekalb/General/ -

Quit Claim Deed Joint Tenancy

Quit Claim Deed Joint Tenancy

Illinois/Local County/Dekalb/General/ -

Quit Claim Deed Statutory

Quit Claim Deed Statutory

Illinois/Local County/Dekalb/General/ -

Satisfaction Or Release Of Mechanics Lien

Satisfaction Or Release Of Mechanics Lien

Illinois/Local County/Dekalb/General/ -

Statement Of Claim For Mechanics Lien

Statement Of Claim For Mechanics Lien

Illinois/Local County/Dekalb/General/ -

Warranty Deed Joint Tenancy

Warranty Deed Joint Tenancy

Illinois/Local County/Dekalb/General/ -

Warranty Deed Statutory

Warranty Deed Statutory

Illinois/Local County/Dekalb/General/ -

Warranty Deed Tenancy By The Entirety

Warranty Deed Tenancy By The Entirety

Illinois/Local County/Dekalb/General/ -

Affidavit For Wage Deduction Order

Affidavit For Wage Deduction Order

Illinois/Local County/Dekalb/General/ -

Statement Of Right To Discharge Guardian Or Modify Guardianship Order

Statement Of Right To Discharge Guardian Or Modify Guardianship Order

Illinois/Local County/Dekalb/General/ -

Notice Of Rights Of Respondent

Notice Of Rights Of Respondent

Illinois/Local County/Dekalb/General/ -

Bond (Sureties Waived)

Bond (Sureties Waived)

Illinois/Local County/Dekalb/General/ -

Order Appointing Guardian Ad Litem For Alleged Disabled Person Or Minor

Order Appointing Guardian Ad Litem For Alleged Disabled Person Or Minor

Illinois/Local County/Dekalb/General/ -

Physicians Report

Physicians Report

Illinois/Local County/Dekalb/General/ -

Bond (Surety)

Bond (Surety)

Illinois/Local County/Dekalb/General/ -

Summons For Appointment Of Guardian For Disabled Person

Summons For Appointment Of Guardian For Disabled Person

Illinois/Local County/Dekalb/General/ -

Small Estate Affidavit

Small Estate Affidavit

Illinois/Local County/Dekalb/General/ -

Order For Appointment Temporary Limited Plenary Guardian Alleged Disabled Person

Order For Appointment Temporary Limited Plenary Guardian Alleged Disabled Person

Illinois/Local County/Dekalb/General/ -

Claim Against Estate

Claim Against Estate

Illinois/2 Local County/Dekalb/General/ -

Oath Of Representative-Office

Oath Of Representative-Office

Illinois/Local County/Dekalb/General/ -

Order Appointing Guardian For Minor (Probate03)

Order Appointing Guardian For Minor (Probate03)

Illinois/2 Local County/Dekalb/General/ -

Petition For Appointment Of Guardian For Disabled Person

Petition For Appointment Of Guardian For Disabled Person

Illinois/Local County/Dekalb/General/ -

Petition For Probate Of Will And For Letters Testamentary

Petition For Probate Of Will And For Letters Testamentary

Illinois/Local County/Dekalb/General/ -

Petition For Letters Of Administration

Petition For Letters Of Administration

Illinois/Local County/Dekalb/General/ -

Petition For Admission Of Will And Summary Administration

Petition For Admission Of Will And Summary Administration

Illinois/Local County/Dekalb/General/ -

Affidavit Of Heirship - Surviving Spouse Or Descendant

Affidavit Of Heirship - Surviving Spouse Or Descendant

Illinois/Local County/Dekalb/General/ -

Affidavit Of Heirship - No Surviving Spouse Or Descendant

Affidavit Of Heirship - No Surviving Spouse Or Descendant

Illinois/Local County/Dekalb/General/ -

Final Report Of Independent Representative

Final Report Of Independent Representative

Illinois/Local County/Dekalb/General/ -

Inventory

Inventory

Illinois/Local County/Dekalb/General/ -

Certificate Of Mailing Or Publication

Certificate Of Mailing Or Publication

Illinois/Local County/Dekalb/General/ -

Qualifications Of The Principal And The Personal Sureties

Qualifications Of The Principal And The Personal Sureties

Illinois/Local County/Dekalb/General/ -

Appearance To Appointment Of Administrator

Appearance To Appointment Of Administrator

Illinois/Local County/Dekalb/General/ -

Appearance And Consent To Admission Of Will And Issuance Of Letters

Appearance And Consent To Admission Of Will And Issuance Of Letters

Illinois/Local County/Dekalb/General/ -

Acceptance By Corporate Fiduciary

Acceptance By Corporate Fiduciary

Illinois/Local County/Dekalb/General/ -

Order Declaring Heirship

Order Declaring Heirship

Illinois/Local County/Dekalb/General/ -

Order Admitting Will To Probate And Appointing Representative

Order Admitting Will To Probate And Appointing Representative

Illinois/Local County/Dekalb/General/ -

Order Appointing Administrator

Order Appointing Administrator

Illinois/Local County/Dekalb/General/ -

Certification Of Corporate Surety

Certification Of Corporate Surety

Illinois/Local County/Dekalb/General/ -

Refunding Bond And Receipt

Refunding Bond And Receipt

Illinois/Local County/Dekalb/General/ -

Voucher Certificate

Voucher Certificate

Illinois/Local County/Dekalb/General/ -

Receipt On Distribution

Receipt On Distribution

Illinois/Local County/Dekalb/General/ -

Order Approving Final Report(s) Or Report Of Distribution

Order Approving Final Report(s) Or Report Of Distribution

Illinois/Local County/Dekalb/General/ -

Notice Of Right To Petition For Construction Of Testamentary Trust

Notice Of Right To Petition For Construction Of Testamentary Trust

Illinois/Local County/Dekalb/General/ -

Petition To Terminate Independent Administration

Petition To Terminate Independent Administration

Illinois/Local County/Dekalb/General/ -

Independent Administration Publication Notice

Independent Administration Publication Notice

Illinois/Local County/Dekalb/General/ -

Independent Administration Mailed Notice To Creditors

Independent Administration Mailed Notice To Creditors

Illinois/Local County/Dekalb/General/ -

Notice Of Rights Of Interested Persons During Independent Administration

Notice Of Rights Of Interested Persons During Independent Administration

Illinois/Local County/Dekalb/General/ -

Supervised Administration Mailed Notice To Creditors

Supervised Administration Mailed Notice To Creditors

Illinois/Local County/Dekalb/General/ -

Independent Administration Publication Notice

Independent Administration Publication Notice

Illinois/Local County/Dekalb/General/ -

Supervised Administration Mailed Notice To Interested Parties

Supervised Administration Mailed Notice To Interested Parties

Illinois/Local County/Dekalb/General/ -

Jury Demand

Jury Demand

Illinois/Local County/Dekalb/General/ -

Order For Body Attachment

Order For Body Attachment

Illinois/Local County/Dekalb/General/ -

Satisfaction Of Judgment

Satisfaction Of Judgment

Illinois/Local County/Dekalb/General/ -

Stipulation And Order To Dismiss

Stipulation And Order To Dismiss

Illinois/Local County/Dekalb/General/ -

Annual Report On Ward

Annual Report On Ward

Illinois/Local County/Dekalb/General/ -

Address Change Report

Address Change Report

Illinois/2 Local County/Dekalb/General/ -

Case Management Order

Case Management Order

Illinois/Local County/Dekalb/General/ -

Subpoena - Subpoena Duces Tecum

Subpoena - Subpoena Duces Tecum

Illinois/Local County/Dekalb/General/ -

Subpoena For Deposition

Subpoena For Deposition

Illinois/Local County/Dekalb/General/ -

Request For Emergency Hearing

Request For Emergency Hearing

Illinois/2 Local County/Dekalb/General/ -

Petition For Appointment Of Guardian Of A Minor

Petition For Appointment Of Guardian Of A Minor

Illinois/2 Local County/Dekalb/General/ -

Summons

Summons

Illinois/2 Local County/Dekalb/General/ -

Order For Replevin (Without Notice)

Order For Replevin (Without Notice)

Illinois/2 Local County/Dekalb/General/ -

Tax Objection Complaint

Tax Objection Complaint

Illinois/2 Local County/Dekalb/General/ -

Notice Of Confidential Information WIthin Court FIling

Notice Of Confidential Information WIthin Court FIling

Illinois/2 Local County/Dekalb/General/ -

Address Change Request (Assessment Office)

Address Change Request (Assessment Office)

Illinois/Local County/Dekalb/General/ -

Turn Over Order

Turn Over Order

Illinois/Local County/Dekalb/General/ -

Self Represented Litigants (SRL) Complaint For Administrative Review And Summons

Self Represented Litigants (SRL) Complaint For Administrative Review And Summons

Illinois/2 Local County/Dekalb/General/ -

Memorandum Of Judgment

Memorandum Of Judgment

Illinois/Local County/Dekalb/General/ -

Release Deed

Release Deed

Illinois/Local County/Dekalb/General/ -

Third Party Respondent Answer To Citation Proceedings

Third Party Respondent Answer To Citation Proceedings

Illinois/Local County/Dekalb/General/ -

Order For Replevin (Notice Served)

Order For Replevin (Notice Served)

Illinois/Local County/Dekalb/General/ -

Trial Order

Trial Order

Illinois/Local County/Dekalb/General/ -

Rule To Show Cause

Rule To Show Cause

Illinois/Local County/Dekalb/General/ -

Plat Act Affidavit

Plat Act Affidavit

Illinois/Local County/Dekalb/General/ -

Supplementary Registration - Assumed Name Addition Withdrawal Dissolution

Supplementary Registration - Assumed Name Addition Withdrawal Dissolution

Illinois/2 Local County/Dekalb/General/ -

Assumed Name - Confidential Address Request

Assumed Name - Confidential Address Request

Illinois/2 Local County/Dekalb/General/ -

Assumed Name Registration

Assumed Name Registration

Illinois/2 Local County/Dekalb/General/ -

Lis Pendens Notice

Lis Pendens Notice

Illinois/Local County/Dekalb/General/ -

Assumed Name Change Of Address Owner Name

Assumed Name Change Of Address Owner Name

Illinois/2 Local County/Dekalb/General/ -

Address Change Request (Real Property)

Address Change Request (Real Property)

Illinois/2 Local County/Dekalb/General/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!