Last updated: 2/26/2019

Waiver Of Accounting {7001-PR}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

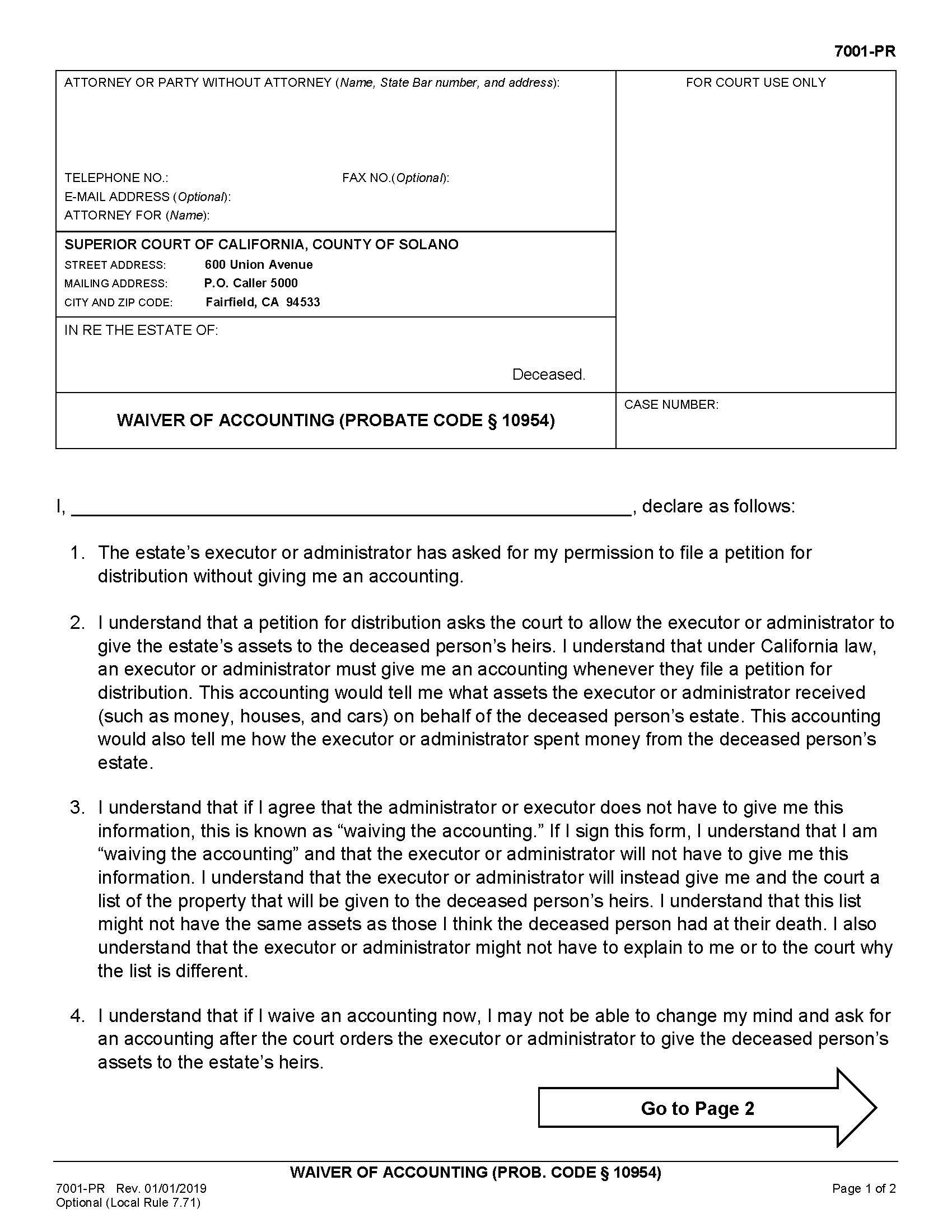

7001-PR WAIVER OF ACCOUNTING (PROB. CODE 247 10954) 7001-PR Rev. 01/01/2019 Page 1 of 2 Optional (Local Rule 7.71) I, , declare as follows: 1. The estate222s executor or administrator has asked for my permission to file a petition for distribution without giving me an accounting. 2. I understand that a petition for distribution asks the court to allow the executor or administrator to give the estate222s assets to the deceased person222s heirs. I understand that under California law, an executor or administrator must give me an accounting whenever they file a petition for distribution. This accounting would tell me what assets the executor or administrator received (such as money, houses, and cars) on behalf of the deceased person222s estate. This accounting would also tell me how the executor or administrator spent money from the deceased person222s estate. 3. I understand that if I agree that the administrator or executor does not have to give me this information, this is known as 223waiving the accounting.224 If I sign this form, I understand that I am 223waiving the accounting224 and that the executor or administrator will not have to give me this information. I understand that the executor or administrator will instead give me and the court a list of the property that will be given to the deceased person222s heirs. I understand that this list might not have the same assets as those I think the deceased person had at their death. I also understand that the executor or administrator might not have to explain to me or to the court why the list is different. 4. I understand that if I waive an accounting now, I may not be able to change my mind and ask for an accounting after the court orders the executor or administrator to give the deceased person222s assets to the estate222s heirs. ATTORNEY OR PARTY WITHOUT ATTORNEY (Name, State Bar number, and address): TELEPHONE NO.: FAX NO.(Optional): E-MAIL ADDRESS (Optional): ATTORNEY FOR (Name): FOR COURT USE ONLY SUPERIOR COURT OF CALIFORNIA, COUNTY OF SOLANO STREET ADDRESS: 600 Union Avenue MAILING ADDRESS: P.O. Caller 5000 CITY AND ZIP CODE: Fairfield, CA 94533 IN RE THE ESTATE OF: Deceased. WAIVER OF ACCOUNTING (PROBATE CODE 247 10954) CASE NUMBER: Go to P age 2 American LegalNet, Inc. www.FormsWorkFlow.com 7001-PR WAIVER OF ACCOUNTING (PROB. CODE 247 10954) 7001-PR Rev. 01/01/2019 Page 2 of 2 Optional (Local Rule 7.71) 5. I am a competent adult. I have read this entire form and I understand it. I am signing this form (check one): a. On my own behalf as a person entitled to receive assets from this estate. b. On behalf of an entity or organization entitled to receive assets from this estate. I have attached proof to this form that I am authorized to execute this waiver on behalf of this entity or organization. c. On behalf of a minor entitled to receive assets from this estate. I declare I am authorized to receive money or property belonging to the minor. If I am receiving this property as guardian of the estate of the minor, a copy of my guardianship letters is attached to this form. d. On behalf of a conserved person entitled to receive assets from this estate. I declare I am the conservator of the person222s estate and am authorized to waive an account on behalf of the conservatee. A copy of my conservatorship letters is attached to this form. e. As the trustee of a trust entitled to receive assets from this estate. By signing this form, I declare that I have accepted the duties of trustee of the trust. f. As the court-appointed personal representative of the estate of a deceased heir or beneficiary entitled to receive assets from this estate. A copy of the letters appointing me as personal representative of that estate is attached to this form. g. As a guardian ad litem appointed by the court to represent (1) a person entitled to distribution who is incapacitated, unborn, or unascertained, (2) a person whose identity or address is unknown, or (3) a designated class of persons who are not ascertained or are not in being, who is entitled to receive assets from this estate. h. As the agent under a power of attorney for a person entitled to receive assets from this estate. A copy of the power of attorney authorizing me to waive the accounting is attached to this form. I hereby waive the requirement for the executor or administrator to file an accounting with the court. I declare under penalty of perjury under the laws of the State of California that the contents of this waiver and all attachments to it are true and correct. Date Signature IN RE THE ESTATE OF: CASE NUMBER: American LegalNet, Inc. www.FormsWorkFlow.com