Last updated: 8/3/2016

Indiana Brewer Distiller Rectifier Vintner Excise Tax Return {55548}

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

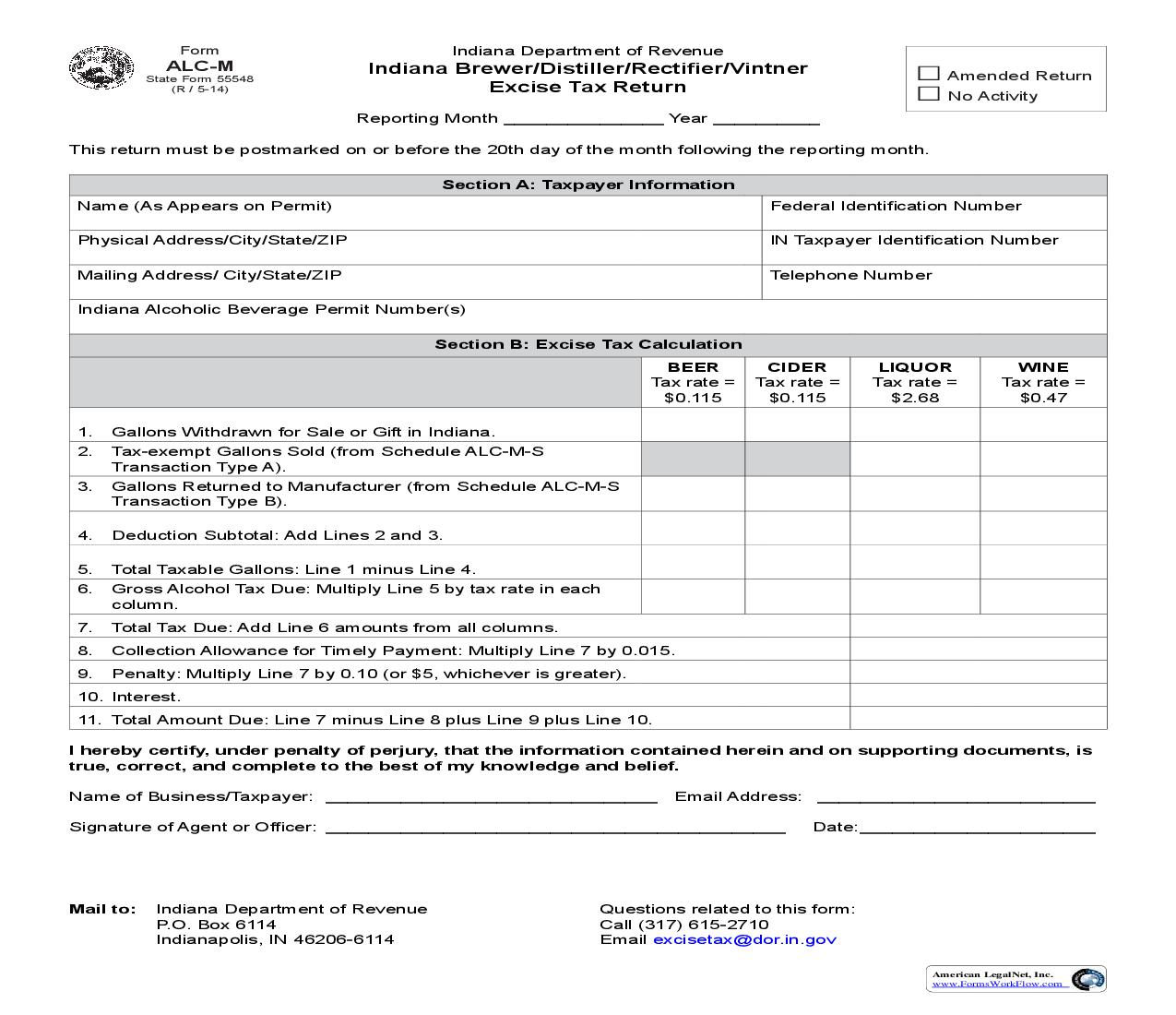

State Form 55548 (R / 5-14) ALC-M Form Indiana Brewer/Distiller/Rectifier/Vintner Excise Tax Return Reporting Month _______________ Year __________ Indiana Department of Revenue Amended Return No Activity This return must be postmarked on or before the 20th day of the month following the reporting month. Section A: Taxpayer Information Name (As Appears on Permit) Physical Address/City/State/ZIP Mailing Address/ City/State/ZIP Indiana Alcoholic Beverage Permit Number(s) Section B: Excise Tax Calculation BEER Tax rate = $0.115 1. Gallons Withdrawn for Sale or Gift in Indiana. 2. Tax-exempt Gallons Sold (from Schedule ALC-M-S Transaction Type A). 3. Gallons Returned to Manufacturer (from Schedule ALC-M-S Transaction Type B). 4. Deduction Subtotal: Add Lines 2 and 3. 5. Total Taxable Gallons: Line 1 minus Line 4. 6. Gross Alcohol Tax Due: Multiply Line 5 by tax rate in each column. 7. Total Tax Due: Add Line 6 amounts from all columns. 8. Collection Allowance for Timely Payment: Multiply Line 7 by 0.015. 9. Penalty: Multiply Line 7 by 0.10 (or $5, whichever is greater). 10. Interest. 11. Total Amount Due: Line 7 minus Line 8 plus Line 9 plus Line 10. I hereby certify, under penalty of perjury, that the information contained herein and on supporting documents, is true, correct, and complete to the best of my knowledge and belief. Name of Business/Taxpayer: _______________________________ Email Address: __________________________ Signature of Agent or Officer: ___________________________________________ Date: ______________________ CIDER Tax rate = $0.115 LIQUOR Tax rate = $2.68 WINE Tax rate = $0.47 Federal Identification Number IN Taxpayer Identification Number Telephone Number Mail to: Indiana Department of Revenue P.O. Box 6114 Indianapolis, IN 46206-6114 Questions related to this form: Call (317) 615-2710 Email excisetax@dor.in.gov American LegalNet, Inc. www.FormsWorkFlow.com Instructions for Completing Indiana Brewer/Distiller/Rectifier/Vintner Excise Tax Return What Is the ALC-M? The ALC-M return is used to report all transactions related to the production and sale of alcoholic beverages in Indiana. Who Must File? The holder of a brewer, distiller, rectifier, and/or vintner permit(s). Reporting Requirements The holder of a brewer, distiller, rectifier, and/or vintner permit(s) shall file a monthly return with the Indiana Department of Revenue on or before the 20th day of the month following the month in which the liability for the tax accrues. Payment of the excise tax due shall accompany the return. A return must be filed even if there is no activity within Indiana during the reporting period. To be considered timely filed, monthly returns must be filed on or before the 20th day of the month immediately following the last day of the month being reported. If the 20th day of the month falls on a Saturday, a Sunday, a national legal holiday, or a statewide holiday, the due date is the next succeeding day that is not a Saturday, a Sunday, or such holiday. Penalty Taxpayers who fail to file timely are subject to a penalty of $5 or 10% of tax due, whichever is greater. Questions If you need further assistance, you can contact us at (317) 615-2710 or at excisetax@dor.in.gov. Section A: Taxpayer Information Indicate the month and year for which the return is being filed in the appropriate spaces provided. Name (As Appears on Permit) Indicate the entity name as it appears on the Indiana Alcoholic Beverage Permit. Physical Address Indicate the actual location of your business by providing the street address, city, state, and ZIP Code. Note: A post office box is not acceptable as a business location address. Mailing Address Indicate the mailing address for your business. Include the street address, post office box, city, state, and ZIP Code. Indiana Alcoholic Beverage Permit Number(s) Indicate the Indiana Alcoholic Beverage Permit Number(s) obtained from the Indiana Alcohol and Tobacco Commission. Federal Identification Number Indicate the nine-digit federal employer identification number (FEIN). Indiana Taxpayer Identification Number Indicate the ten-digit Indiana taxpayer identification number (TID). If you do not have an Indiana TID, leave the space blank and one will be assigned to you. Telephone Number Indicate the point of contact phone number for the person(s) responsible for completing this return. Include extension numbers when applicable. Section B: Excise Tax Calculation Line 1 Enter the number of gallons withdrawn for sale or gift during the reporting period. Round gallons to two decimal places (0.00). Line 2 The total gallons will be the amount reported on Line 10 of Schedule ALC-M-S. Use the appropriate column for the alcohol type being reported. Line 3 The total gallons will be the amount reported on Line 11 of Schedule ALC-M-S. Use the appropriate column for the alcohol type being reported. Line 4 Line 2 plus Line 3. Line 5 Line 1 minus Line 4. Line 6 Multiply Line 5 by the tax rate indicated for each column. (Beer: $0.115, Cider: $0.115, Liquor: $2.68, Wine: $0.47) Line 7 Add the Line 6 totals from each column. Line 8 If the return is filed on or before the due date, multiply Line 7 by 0.015. Line 9 If the return is filed after the due date, enter 10% of Line 7 or $5, whichever is greater. (The penalty is $5 if the return is late with no tax due.) American LegalNet, Inc. www.FormsWorkFlow.com Line 10 If your tax liability is not paid on or before the due date, you are subject to interest from the date the tax return was due until the date the tax return was postmarked. The interest rate is determined on a calendar-year basis and can change from year to year. Please refer to our website at www.in.gov/dor/files/dn03.pdf for the current interest rate. An example of an interest calculation follows: Tax due: Return due: Return filed: Days late: Interest rate: $5,000 08/15/2014 10/04/2014 50 3% (rate for year 2014) (50 days / 365 days) X 3% X $5,000 = $20.55 interest Line 11 If timely filed, subtract Line 8 from Line 7. If filed after the due date, add Line 7, Line 9, and Line 10. American LegalNet, Inc. www.FormsWorkFlow.com