Last updated: 9/24/2018

Direct Wine Shipper Permit Application {LIQ-LIC-113}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

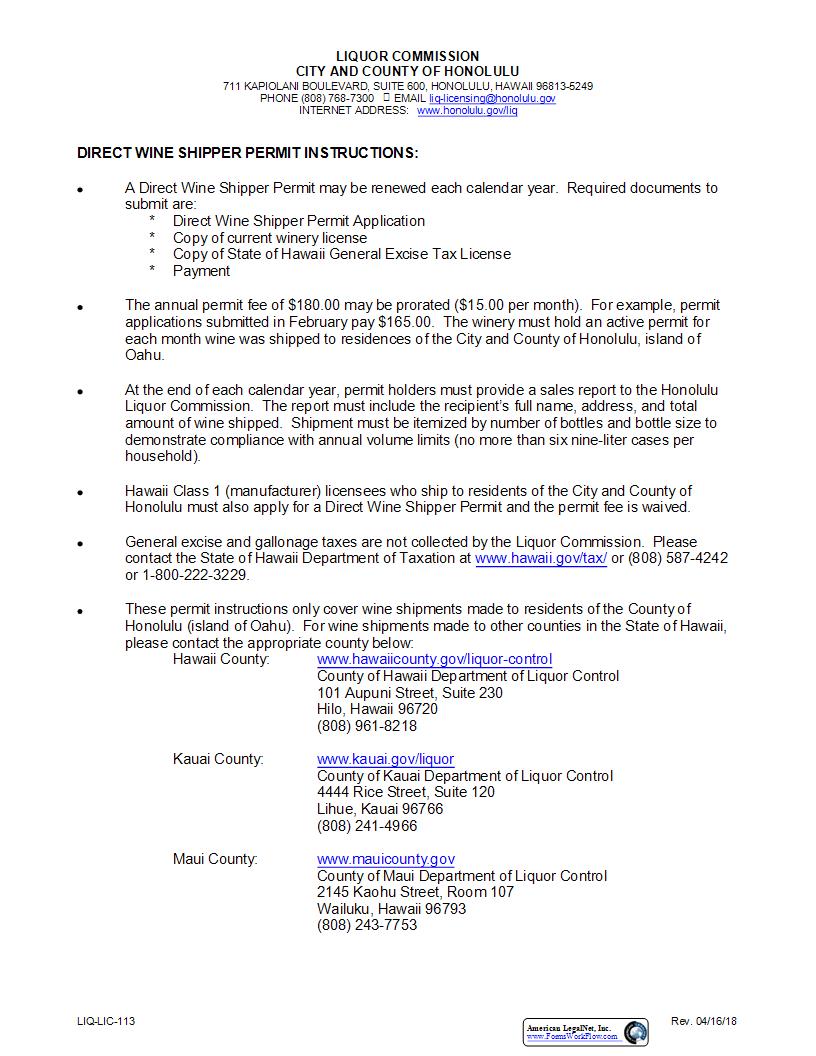

LIQ-LIC-113 Rev. 04/16/18 LIQUOR COMMISSION CITY AND COUNTY OF HONOLULU 711 KAPIOLANI BOULEVARD, SUITE 600, HONOLULU, HAWAII 96813-5249 PHONE (808) 768-7300 225 EMAIL liq-licensing@honolulu.gov INTERNET ADDRESS: www.honolulu.gov/liq DIRECT WINE SHIPPER PERMIT INSTRUCTIONS: A Direct Wine Shipper Permit may be renewed each calendar year. Required documents to submit are: * Direct Wine Shipper Permit Application * Copy of current winery license * Copy of State of Hawaii General Excise Tax License * Payment The annual permit fee of $180.00 may be prorated ($15.00 per month). For example, permit applications submitted in February pay $165.00. The winery must hold an active permit for each month wine was shipped to residences of the City and County of Honolulu, island of Oahu. At the end of each calendar year, permit holders must provide a sales report to the Honolulu Liquor Commission. The report must include the recipient222s full name, address, and total amount of wine shipped. Shipment must be itemized by number of bottles and bottle size to demonstrate compliance with annual volume limits (no more than six nine-liter cases per household). Hawaii Class 1 (manufacturer) licensees who ship to residents of the City and County of Honolulu must also apply for a Direct Wine Shipper Permit and the permit fee is waived. General excise and gallonage taxes are not collected by the Liquor Commission. Please contact the State of Hawaii Department of Taxation at www.hawaii.gov/tax/ or (808) 587-4242 or 1-800-222-3229. These permit instructions only cover wine shipments made to residents of the County of Honolulu (island of Oahu). For wine shipments made to other counties in the State of Hawaii, please contact the appropriate county below: Hawaii County: www.hawaiicounty.gov/liquor-control County of Hawaii Department of Liquor Control 101 Aupuni Street, Suite 230 Hilo, Hawaii 96720 (808) 961-8218 Kauai County: www.kauai.gov/liquor County of Kauai Department of Liquor Control 4444 Rice Street, Suite 120 Lihue, Kauai 96766 (808) 241-4966 Maui County: www.mauicounty.gov County of Maui Department of Liquor Control 2145 Kaohu Street, Room 107 Wailuku, Hawaii 96793 (808) 243-7753 American LegalNet, Inc. www.FormsWorkFlow.com LIQ-LIC-113 Rev. 04/16/18 CITY AND COUNTY OF HONOLULU LIQUOR COMMISSION DIRECT WINE SHIPPER PERMIT APPLICATION Submit this form to the Commission. Include with application: 711 Kapiolani Blvd., Suite 600 Honolulu, HI 96813 Phone: (808)768-7300 Fax: (808)768-7311 Email: liq-licensing@honolulu.gov Copy of current winery license Copy of State of Hawaii General Excise Tax (GET) License Payment of $180.00 in check or money order form, payable to 223City and County of Honolulu224 (NOTE: permit fee may be p rorated at $15 .00/month) INPUT P ERMIT YEAR PE RMIT NO. (for office use only) 1. APPLICANT (BUSINESS NAME) 2 . PHONE NUMBER (including area code) 3. TRADE NAME (DBA) 4. EMAIL 5 . MAILING ADDRESS (Street number and name, city, state and zip cod e) 6 . PREMISES ADDRESS (Street number and name, city, state and zip code) 7 . STATE WHERE CURRENTLY LICENSED 8 . LICENSE NUMBER 9 . EXPIRATION DATE 10 . TYPE OF LICENSE ISSUED (i.e. winegrower) 11 . AUTHORIZED SIGNATURE 1 2 . PRINTE D NAME 1 3 . DATE SIGNED FOR HLC USE ONLY COMMENTS RECOMMENDATION Approved Denied STAFF INITIAL DATE Rule 2473-82-33.6 Direct Shipment of Wine by Wineries. (a) Any manufacturer of wine who desires to ship wines to residents of the County of Honolulu shall obtain a Direct Wine Shipper Permit from the Liquor Commission, City and County of Honolulu. The permit may be granted by the Administrator to any person holding: 1. A general excise tax license from the State of Hawaii Department of Taxation; and 2. Either: A. A Class 1 license to manufacture wine under Section 281-31, HRS; or B. A license to manufacture wine issued by another state. (b) The term of the permit shall be for one calendar year. The applicant for a permit shall submit: 1. An application form; 2. Copy of the State of Hawaii Department of Taxation general excise tax license; 3. Copy of the Class 1 license to manufacture wine under Section 281-31, HRS, or the license to manufact ure wine issued by another state and 4. Payment of an annual permit fee of $180.00; provided that the annual permit fee for a manufacturer of wine licensed under Section 281-31, HRS, shall be inclusive and part of its annual license fee. For purposes of this rule, permit fees shall be prorated. No permit shall be issued unless the applicant has met the foregoing requirements. (c) The holder of a Direct Wine Shipper Permit may sell and annually ship to any person twenty-one years of age or older in this county no more than six nine-liter cases of wine per household for personal use only and not for resale and shall: 1. Ship wine directly to the person only in containers that are conspicuously labeled with the words containing or similar to: 223CONTAINS ALCOHOL: SIGNATURE OF PERSON AGE 21 YEARS OR OLDER REQUIRED FOR DELIVERY.224 2. Require that the carrier of the shipment obtain the signature of any person twenty-one years of age or older before delivering the shipment; 3. Report no later than January 31 of each year to the Liquor Commission, the total amount of wine shipped to persons in this county during the preceding calendar year; 4. Pay all applicable general excise and gallonage taxes. For gallonage tax purposes, all wine sold under a Direct Wine Shipper Permit shall be deemed to be wine sold in the state; and, 5. Be subject to audit by the Liquor Commission. (d) The holder of a license to manufacture wine issued by another state shall annually renew a Direct Wine Shipper Permit by providing the Liquor Commission with a renewal application, a copy of the current license to manufacture wine, and payment of the annual fee. (e) The sale and shipment of wine directly to a person in this state by a person that does not possess a valid Direct Wine Shipper Permit is prohibited. Knowingly violating this law is a misdemeanor. American LegalNet, Inc. www.FormsWorkFlow.com