Last updated: 6/10/2016

Residential Mortgage Foreclosure Diversion Program Financial Worksheet {14}

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

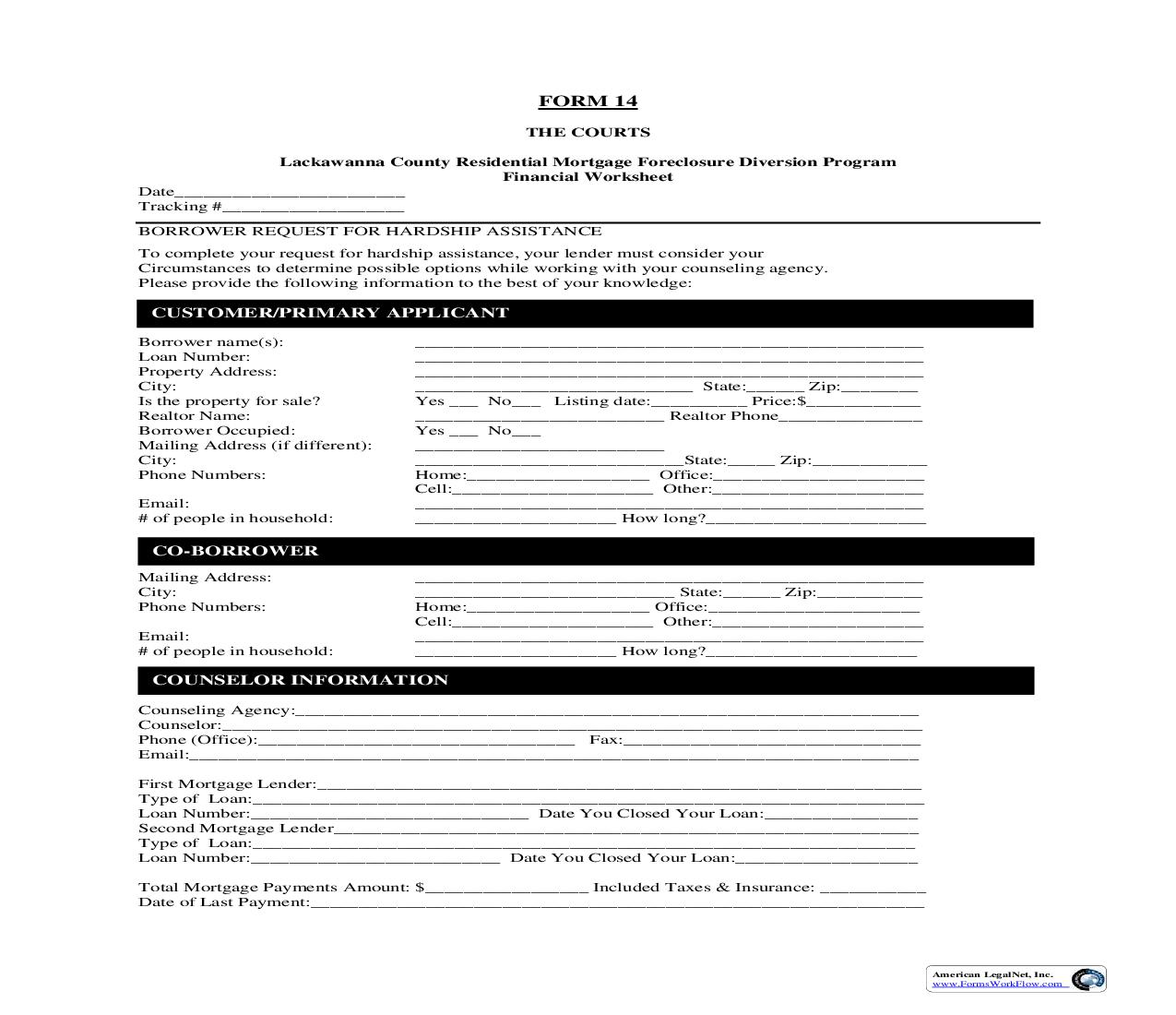

FORM 14 THE COURTS Lackawanna County Residential Mortgage Foreclosure Diversion Program Financial Worksheet Date________________________ Tracking #___________________ BORROWER REQUEST FOR HARDSHIP ASSISTANCE To complete your request for hardship assistance, your lender must consider your Circumstances to determine possible options while working with your counseling agency. Please provide the following information to the best of your knowledge: CUSTOMER/PRIMARY APPLICANT Borrower name(s): Loan Number: Property Address: City: Is the property for sale? Realtor Name: Borrower Occupied: Mailing Address (if different): City: Phone Numbers: Email: # of people in household: _____________________________________________________ _____________________________________________________ _____________________________________________________ _____________________________ State:______ Zip:________ Yes ___ No___ Listing date:__________ Price:$____________ __________________________ Realtor Phone_______________ Yes ___ No___ __________________________ ____________________________State:_____ Zip:____________ Home:___________________ Office:______________________ Cell:_____________________ Other:______________________ _____________________________________________________ _____________________ How long?_______________________ CO-BORROWER Mailing Address: City: Phone Numbers: Email: # of people in household: _____________________________________________________ ___________________________ State:______ Zip:___________ Home:___________________ Office:______________________ Cell:_____________________ Other:______________________ _____________________________________________________ _____________________ How long?______________________ COUNSELOR INFORMATION Counseling Agency:_________________________________________________________________ Counselor:_________________________________________________________________________ Phone (Office):_________________________________ Fax:_______________________________ Email:____________________________________________________________________________ First Mortgage Lender:_______________________________________________________________ Type of Loan:______________________________________________________________________ Loan Number:_____________________________ Date You Closed Your Loan:________________ Second Mortgage Lender_____________________________________________________________ Type of Loan:_____________________________________________________________________ Loan Number:__________________________ Date You Closed Your Loan:___________________ Total Mortgage Payments Amount: $_________________ Included Taxes & Insurance: ___________ Date of Last Payment:________________________________________________________________ American LegalNet, Inc. www.FormsWorkFlow.com THE COURTS Primary Reason for Default: _____________________________________________________________________________________ Is the loan in Bankruptcy? Yes ____ No _____ If yes, provide name, location of court, case number & attorney: _________________________________ Assets Home: Other Real Estate: Retirement Funds: Investments: Checking: Savings: Other: Amount Owed: $___________ $___________ $___________ $___________ $___________ $___________ $___________ Value: $___________ $___________ $___________ $___________ $___________ $___________ $___________ Automobile #1: Model: __________________________________ Year:___________ Amount owed: ____________________________ Value:_________________ Automobile #2: Model:__________________________________ Year: ___________ Amount owed: ____________________________ Value:_________________ Other transportation (automobiles, boats, motorcycles): Model:______________________________ Year: _________ Amount owed: ____________ Value: __________________ Monthly Income Name of Employers: 1. _____________________________________________________________________________ 2. _____________________________________________________________________________ 3. _____________________________________________________________________________ Additional Income Description (not wages): 1. _______________________________ monthly amount: ________________________ 2. _______________________________ monthly amount: ________________________ Borrower Pay Days: ____________________ Co-Borrower Pay Days: _________________________ Monthly Expenses: (Please only include expenses you are currently paying) EXPENSE Mortgage 2nd Mortgage Car Payment(s) Auto Insurance Auto fuel/repairs Install. Loan Payments Child Support/Alim. Day/Child Care/Tuit. AMOUNT EXPENSE Food Utilities Condo/Neigh. Fees Med. (not covered) Other prop. Payment Cable TV Spending Money Other Expenses AMOUNT Amount Available for Monthly Mortgage Payments Based on Income & Expenses: _________________ American LegalNet, Inc. www.FormsWorkFlow.com THE COURTS AUTHORIZATION I/We, _______________________________________, authorize the above-named agency to use/refer this information to my lender/servicer for the sole purpose of evaluating my financial situation for possible mortgage options. I/We understand that I/we am/are under no obligation to use the counseling services provided by the above-named agency. ____________________________________________ Borrower Signature ______________________________ Date ____________________________________________ Co-Borrower Signature ______________________________ Date Please forward this page along with the following information to lender: Proof of income Past 2 bank statements Proof of any expected income for the last 45 days Copy of a current utility bill Letter explaining reason for delinquency and any supporting documentation (hardship letter) Listing agreement (if property is currently on the market) In an effort to evaluate all of the workout options available to you, a counselor staff will work with your lender(s) and servicing company to determine eligibility. Lender's Contact (Name): ________________________________ Phone: ______________________ Non Profit Counselor Contact: ____________________________ Phone: ______________________ American LegalNet, Inc. www.FormsWorkFlow.com HOUSING AFFORDABILITY WORKSHEET Borrower Name: ___________________________________________________________ Property Address: __________________________________________________________ Lender: ________________________________________ Loan #:____________________ Arrears (principal, interest, escrows, no late fees): _____