Last updated: 1/11/2013

Notice And Claim Form Support Income Withholding {JD-FM-68}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

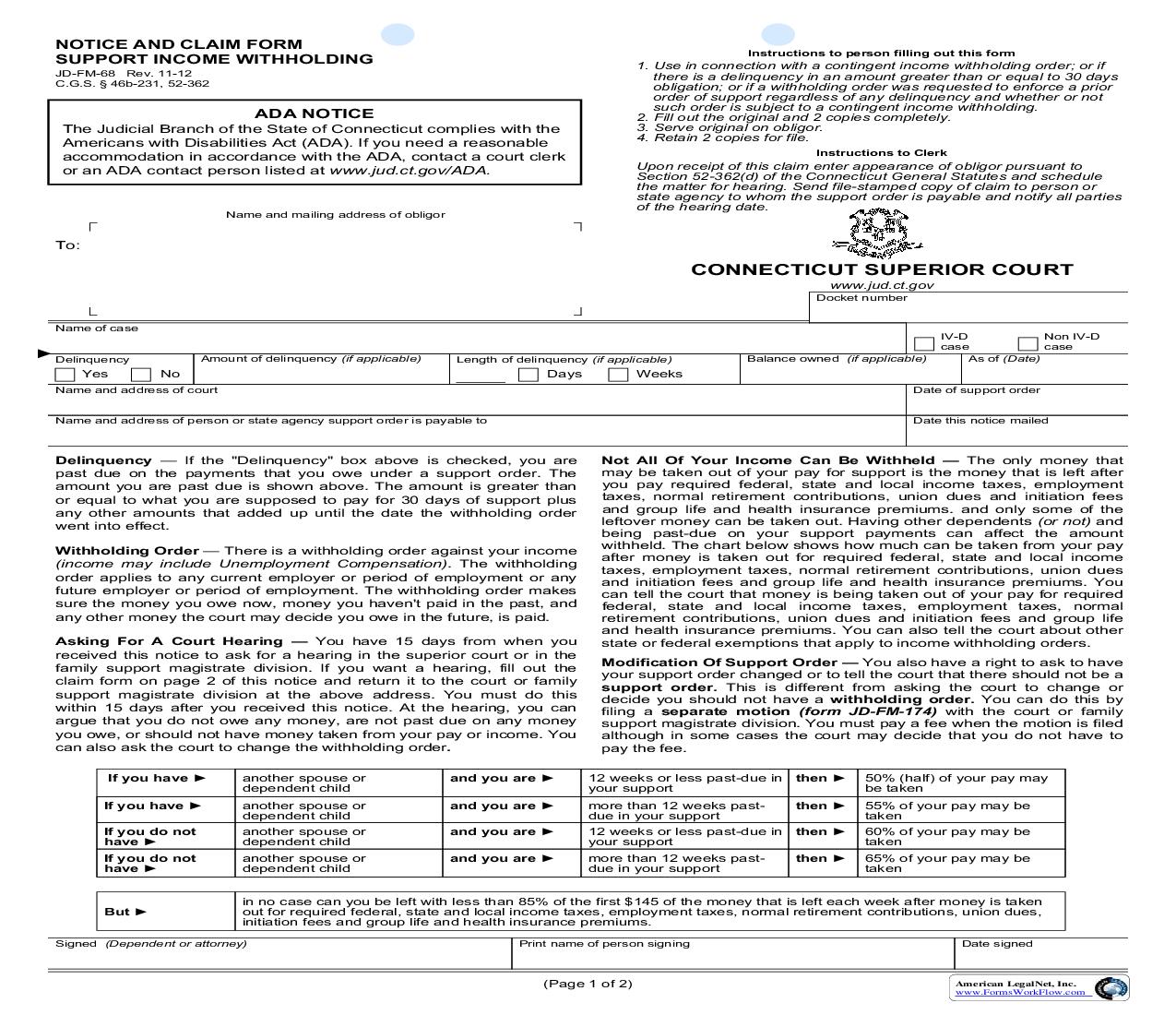

NOTICE AND CLAIM FORM SUPPORT INCOME WITHHOLDING JD-FM-68 Rev. 11-12 C.G.S. § 46b-231, 52-362 Instructions to person filling out this form ADA NOTICE The Judicial Branch of the State of Connecticut complies with the Americans with Disabilities Act (ADA). If you need a reasonable accommodation in accordance with the ADA, contact a court clerk or an ADA contact person listed at www.jud.ct.gov/ADA. 1. Use in connection with a contingent income withholding order; or if there is a delinquency in an amount greater than or equal to 30 days obligation; or if a withholding order was requested to enforce a prior order of support regardless of any delinquency and whether or not such order is subject to a contingent income withholding. 2. Fill out the original and 2 copies completely. 3. Serve original on obligor. 4. Retain 2 copies for file. Instructions to Clerk Name and mailing address of obligor Upon receipt of this claim enter appearance of obligor pursuant to Section 52-362(d) of the Connecticut General Statutes and schedule the matter for hearing. Send file-stamped copy of claim to person or state agency to whom the support order is payable and notify all parties of the hearing date. To: CONNECTICUT SUPERIOR COURT www.jud.ct.gov Docket number Name of case Delinquency Amount of delinquency (if applicable) Length of delinquency (if applicable) Balance owned (if applicable) IV-D Non IV-D case case As of (Date) Yes No Days Weeks Date of support order Name and address of court Name and address of person or state agency support order is payable to Date this notice mailed Delinquency -- If the "Delinquency" box above is checked, you are past due on the payments that you owe under a support order. The amount you are past due is shown above. The amount is greater than or equal to what you are supposed to pay for 30 days of support plus any other amounts that added up until the date the withholding order went into effect. Withholding Order -- There is a withholding order against your income (income may include Unemployment Compensation). The withholding order applies to any current employer or period of employment or any future employer or period of employment. The withholding order makes sure the money you owe now, money you haven't paid in the past, and any other money the court may decide you owe in the future, is paid. Asking For A Court Hearing -- You have 15 days from when you received this notice to ask for a hearing in the superior court or in the family support magistrate division. If you want a hearing, fill out the claim form on page 2 of this notice and return it to the court or family support magistrate division at the above address. You must do this within 15 days after you received this notice. At the hearing, you can argue that you do not owe any money, are not past due on any money you owe, or should not have money taken from your pay or income. You can also ask the court to change the withholding order. If you have If you have If you do not have If you do not have another spouse or dependent child another spouse or dependent child another spouse or dependent child another spouse or dependent child and you are and you are and you are and you are Not All Of Your Income Can Be Withheld -- The only money that may be taken out of your pay for support is the money that is left after you pay required federal, state and local income taxes, employment taxes, normal retirement contributions, union dues and initiation fees and group life and health insurance premiums. and only some of the leftover money can be taken out. Having other dependents (or not) and being past-due on your support payments can affect the amount withheld. The chart below shows how much can be taken from your pay after money is taken out for required federal, state and local income taxes, employment taxes, normal retirement contributions, union dues and initiation fees and group life and health insurance premiums. You can tell the court that money is being taken out of your pay for required federal, state and local income taxes, employment taxes, normal retirement contributions, union dues and initiation fees and group life and health insurance premiums. You can also tell the court about other state or federal exemptions that apply to income withholding orders. Modification Of Support Order -- You also have a right to ask to have your support order changed or to tell the court that there should not be a support order. This is different from asking the court to change or decide you should not have a withholding order. You can do this by filing a separate motion (form JD-FM-174) with the court or family support magistrate division. You must pay a fee when the motion is filed although in some cases the court may decide that you do not have to pay the fee. 12 weeks or less past-due in then your support more than 12 weeks pastdue in your support then 50% (half) of your pay may be taken 55% of your pay may be taken 60% of your pay may be taken 65% of your pay may be taken 12 weeks or less past-due in then your support more than 12 weeks pastdue in your support then But in no case can you be left with less than 85% of the first $145 of the money that is left each week after money is taken out for required federal, state and local income taxes, employment taxes, normal retirement contributions, union dues, initiation fees and group life and health insurance premiums. Print name of person signing Date signed Signed (Dependent or attorney) (Page 1 of 2) American LegalNet, Inc. www.FormsWorkFlow.com Claim Form Instructions to Obligor 1. If you want a court hearing to argue that you are not behind on your payments, if any, and/or to argue that your pay or income should not be withheld, ask to have your Withholding Order changed, or claim any lawful exemption with respect to your earnings, fill out Part 1 below completely and return this claim form to the clerk of the court or family support magistrate division, at the address indicated on page 1, within 15 days of when you received this notice. A hearing will be scheduled and you will be notified when to come to court. 2. If you want to seek modification of the Support Order, see Part 2 below. Part 1. -- Defenses And Exemptions I request a hearing to: ("x" all that apply) ask to have the withholding order changed (You may not use this form to ask to have the support order changed. See Part 2 below). argue that I am not behind on my support order and/or that money should not