Last updated: 3/20/2007

Accounting {JA-7}

Start Your Free Trial $ 19.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

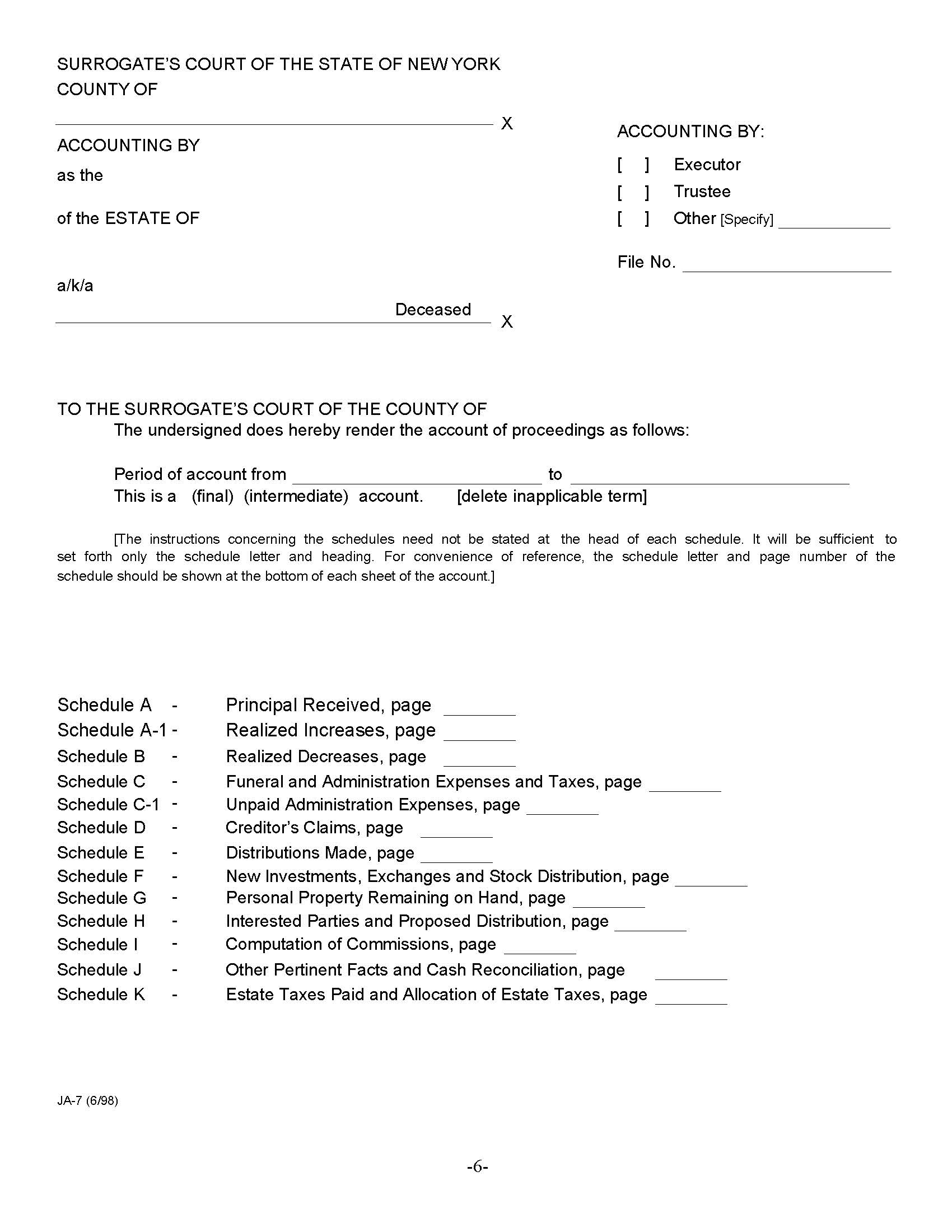

JA-7 - ACCOUNTING. This is a comprehensive form used in the New York Surrogate’s Court for fiduciaries—such as executors, trustees, or administrators—to file a detailed accounting of an estate or trust. It provides a complete record of all financial transactions and property under the fiduciary’s control during the accounting period. The form contains multiple schedules that itemize every aspect of estate administration, including receipts, disbursements, gains, losses, and distributions. These schedules include: Schedule A: Principal received. Schedule A-1: Realized increases in principal. Schedule A-2: Income collected. Schedule B: Realized decreases in principal. Schedule C/C-1: Funeral, administration, and unpaid expenses. Schedule D: Creditor claims. Schedule E: Distributions made. Schedule F: New investments or stock distributions. Schedule G: Assets remaining on hand. Schedule H: Interested parties and proposed distribution. Schedule I: Computation of commissions. Schedule J: Cash reconciliation and other pertinent facts. Schedule K: Estate taxes and allocations. It also includes an Affidavit of the Accounting Party, sworn before a notary, attesting that the schedules are complete and accurate. www.FormsWorkflow.com