Last updated: 9/10/2012

Instructions To Personal Representative Of Unsupervised Estate {PR2}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

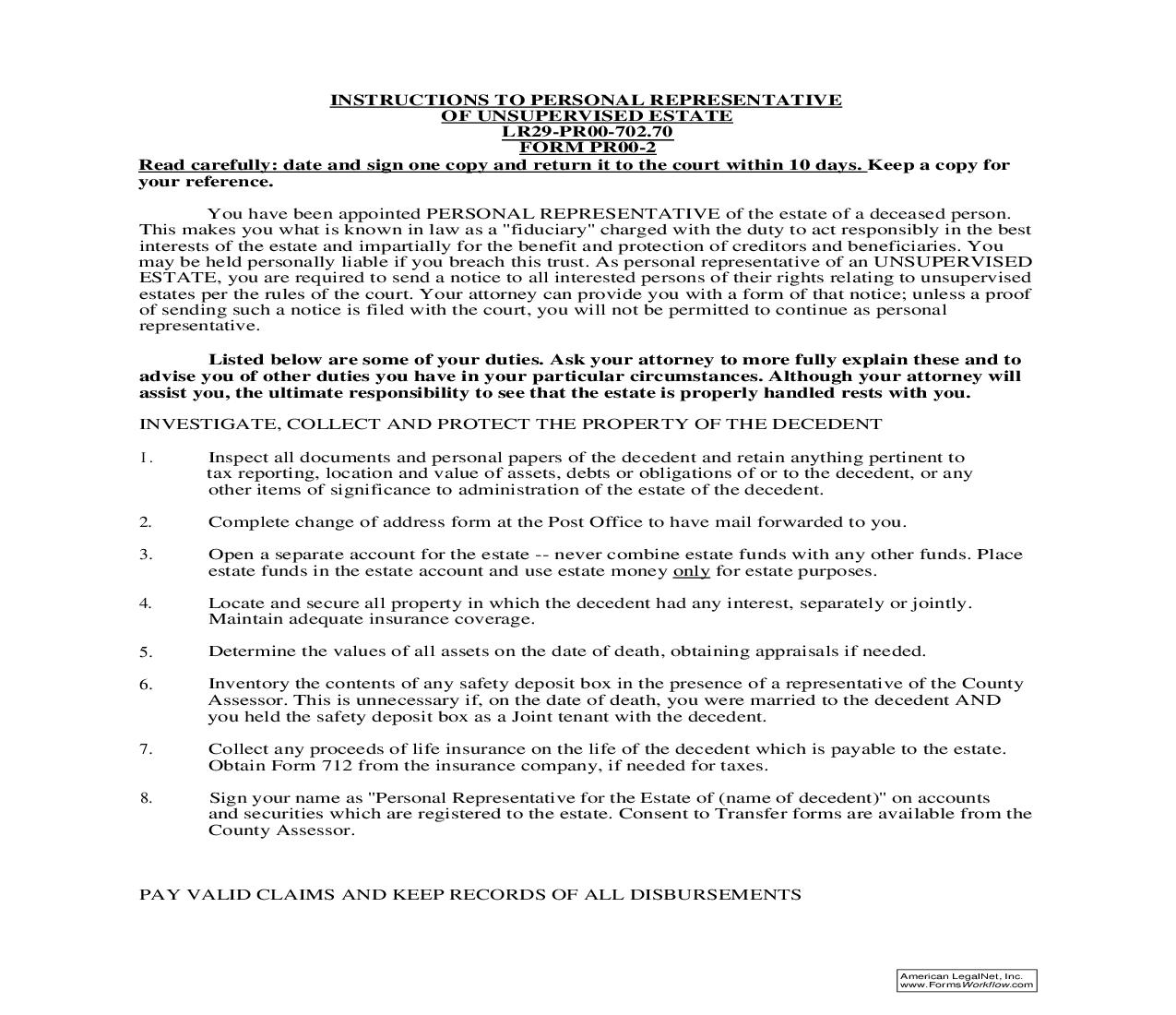

INSTRUCTIONS TO PERSONAL REPRESENTATIVE OF UNSUPERVISED ESTATE LR29-PR00-702.70 FORM PR00-2 Read carefully: date and sign one copy and return it to the court within 10 days. Keep a copy for your reference. You have been appointed PERSONAL REPRESENTATIVE of the estate of a deceased person. This makes you what is known in law as a ''fiduciary'' charged with the duty to act responsibly in the best interests of the estate and impartially for the benefit and protection of creditors and beneficiaries. You may be held personally liable if you breach this trust. As personal representative of an UNSUPERVISED ESTATE, you are required to send a notice to all interested persons of their rights relating to unsupervised estates per the rules of the court. Your attorney can provide you with a form of that notice; unless a proof of sending such a notice is filed with the court, you will not be permitted to continue as personal representative. Listed below are some of your duties. Ask your attorney to more fully explain these and to advise you of other duties you have in your particular circumstances. Although your attorney will assist you, the ultimate responsibility to see that the estate is properly handled rests with you. INVESTIGATE, COLLECT AND PROTECT THE PROPERTY OF THE DECEDENT I. Inspect all documents and personal papers of the decedent and retain anything pertinent to tax reporting, location and value of assets, debts or obligations of or to the decedent, or any other items of significance to administration of the estate of the decedent. Complete change of address form at the Post Office to have mail forwarded to you. Open a separate account for the estate -- never combine estate funds with any other funds. Place estate funds in the estate account and use estate money only for estate purposes. Locate and secure all property in which the decedent had any interest, separately or jointly. Maintain adequate insurance coverage. Determine the values of all assets on the date of death, obtaining appraisals if needed. Inventory the contents of any safety deposit box in the presence of a representative of the County Assessor. This is unnecessary if, on the date of death, you were married to the decedent AND you held the safety deposit box as a Joint tenant with the decedent. Collect any proceeds of life insurance on the life of the decedent which is payable to the estate. Obtain Form 712 from the insurance company, if needed for taxes. Sign your name as ''Personal Representative for the Estate of (name of decedent)'' on accounts and securities which are registered to the estate. Consent to Transfer forms are available from the County Assessor. 2. 3. 4. 5. 6. 7. 8. PAY VALID CLAIMS AND KEEP RECORDS OF ALL DISBURSEMENTS American LegalNet, Inc. www.FormsWorkflow.com 9. Personally notify decedent's creditors whom you can reasonably ascertain. Others are notified by publication in the newspaper. Generally, creditors have three (3) months after the date of first publication to submit their claims. Pay legal debts and funeral bills and keep notations indicating the reason for each payment If there is a question of solvency of the estate, pay only priority claims timely filed. a. Do not pay bills which are doubtful, but refer them for court determination. b. Prepare and file appropriate state and federal income, estate and inheritance tax forms in a timely manner. Pay taxes due or claim applicable refunds. Pay court costs when due. Administration fees (attorney's fees and fees for you as personal representative) are a matter of contract between you and the interested persons of the estate and the attorney. Keep records of all receipts and all paid bills and canceled checks or other evidence of disbursement of any funds or assets of the estate for the Closing Statement filed with the court. 10. 11. 12. 13. DISTRIBUTE THE ASSETS OF THE ESTATE AND CLOSE THE ESTATE 14. 15. Do not make any distribution to any heir or beneficiary until at least three (3) months after the date of the first publication of notice. File a Closing Affidavit with the court within one (1) year from the date you received your letters from this court. The Federal Estate Tax Closing letter and the Indiana Inheritance Tax Closing letter (or countersigned receipt) or photocopy, showing payment of all Federal Estate and/or Indiana Inheritance Tax liability in the Estate shall be attached to the Closing Affidavit. Send a copy of the Closing Affidavit to all distributees of the estate and to all creditors or other claimants whose claims are neither paid nor barred. Furnish a full written account of the administration to the distributees. You cannot be discharged unless a minimum of three months have passed from the time of filing of the Closing Affidavit and no objections have been filed. JUDGE HAMILTON SUPERIOR COURT NO. I acknowledge receipt of a copy of the above instructions and have read and will follow these instructions carefully. Cause Number: Estate of Dated: Signature of Personal Representative Printed Name 9/1/97 16. American LegalNet, Inc. www.FormsWorkflow.com