Last updated: 10/1/2025

Application For Extension Of Time For Filing Form CT-706 NT {CT-706 NT EXT}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

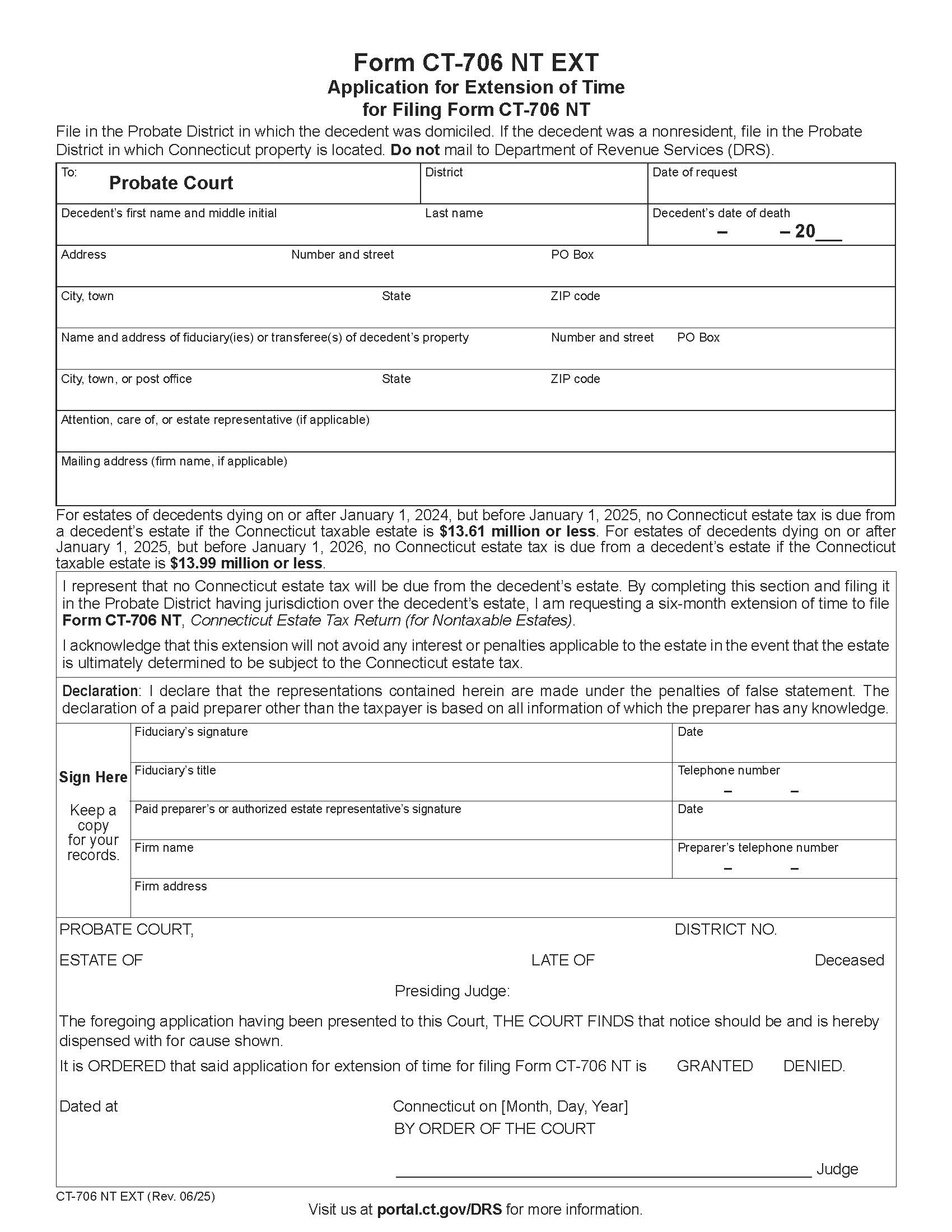

FORM CT-706 NT EXT - APPLICATION FOR EXTENSION OF TIME FOR FILING FORM CT-706 NT. Use Form CT-706 NT EXT, This form is used to request a six-month extension to file, where no Connecticut estate tax is due. For estates of decedents dying on or after January 1, 2023, but before January 1, 2024, no Connecticut estate tax is due from a decedent’s estate if the Connecticut taxable estate is $12.92 million or less. For estates of decedents dying on or after January 1, 2024, but before January 1, 2025, no Connecticut estate tax is due from a decedent’s estate if the Connecticut taxable estate is $13.61 million or less. If the Connecticut taxable estate is expected to be over $13.61 million, do not use this form. Instead, use Form CT-706/709 EXT, Application for Estate and Gift Tax Return Filing Extension and Estate Tax Payment Extension, to request an extension from the Department of Revenue Services (DRS). A copy must also be filed with the Probate Court. The granting of an extension of time for filing Form CT-706 NT, Connecticut Estate Tax Return (for Nontaxable Estates), by the Probate Court will not avoid any interest or penalties applicable to the estate tax in the event that it is ultimately determined that the estate is subject to the Connecticut estate tax. www.FormsWorkflow.com