Last updated: 8/18/2025

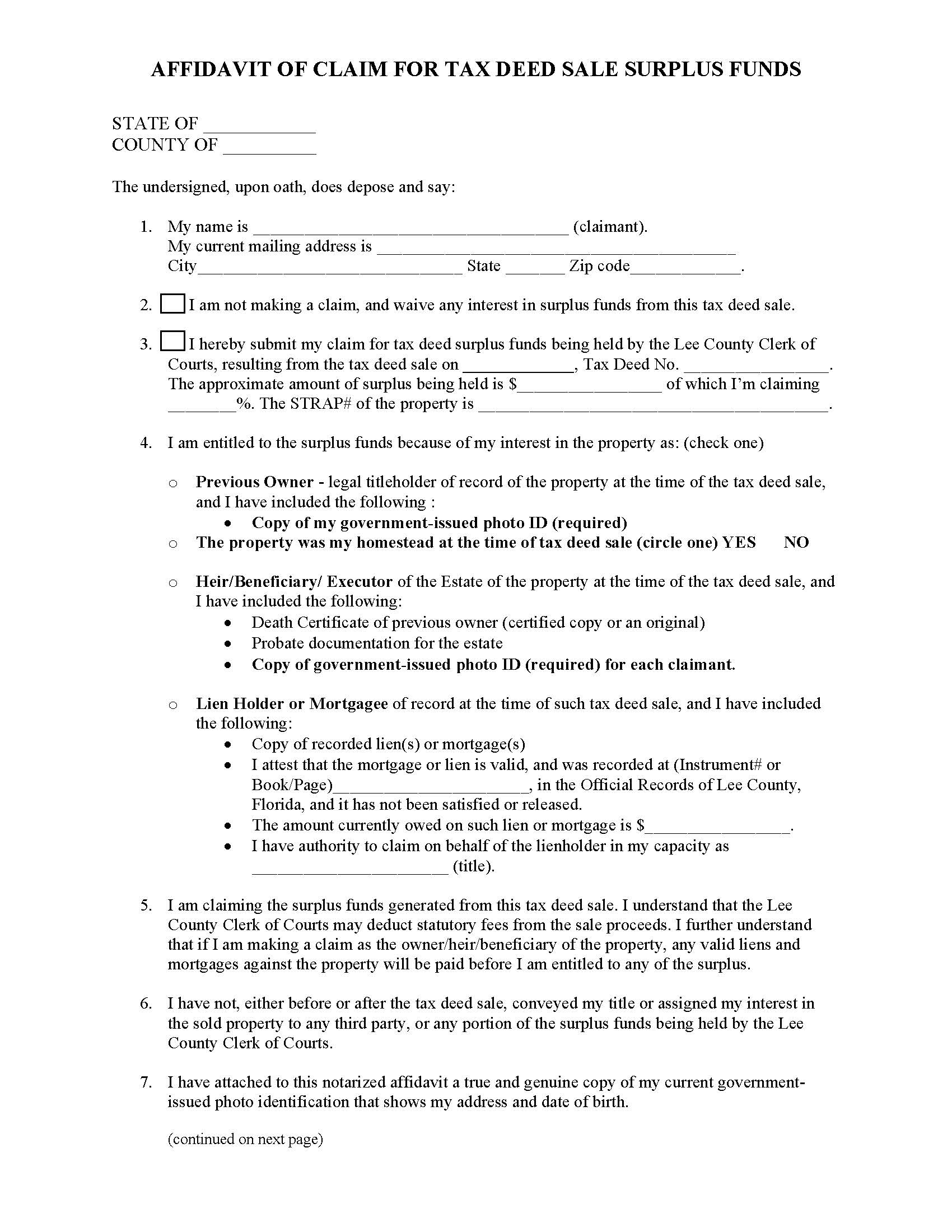

Affidavit Of Claim For Tax Deed Sale Surplus Funds

Start Your Free Trial $ 6.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

AFFIDAVIT OF CLAIM FOR TAX DEED SALE SURPLUS FUNDS. This form is used by individuals or entities to claim surplus funds that remain after a tax deed sale conducted by the Lee County Clerk of Courts. When a property is sold at a tax deed sale for unpaid property taxes, the sale price may exceed the amount owed in taxes, fees, and costs. Any excess money, called surplus funds, may be claimed by parties with a legal interest in the property. This affidavit allows claimants—such as the previous property owner, heirs or beneficiaries of a deceased owner, or lienholders/mortgagees of record—to formally request the release of those funds. The form requires claimants to provide identifying information, supporting documentation (such as a government-issued photo ID, death certificate, probate records, or lien documents), and to state their legal basis for entitlement. By signing, the claimant affirms under oath that they are legally entitled to the surplus and acknowledges responsibility for repayment if funds are later found to have been disbursed in error. The form must be notarized, witnessed, and accompanied by all required documentation to be valid. www.FormsWorkflow.com

Related forms

-

Notice Of Dropping Party By Plaintiff

Notice Of Dropping Party By Plaintiff

Florida/Local County/Lee/Civil/ -

Satisfaction Of Judgment

Satisfaction Of Judgment

Florida/2 Local County/Lee/Civil/ -

Notice Of Confidential Information Within Court Filing

Notice Of Confidential Information Within Court Filing

Florida/2 Local County/Lee/Civil/ -

Simplified Accounting (Guardianship Report) Of Guardian Of Property

Simplified Accounting (Guardianship Report) Of Guardian Of Property

Florida/2 Local County/Lee/Civil/ -

Statement Of Claim (Probate)

Statement Of Claim (Probate)

Florida/2 Local County/Lee/Civil/ -

Acknowledgment Of Proposed Guardian Of A Minors Property

Acknowledgment Of Proposed Guardian Of A Minors Property

Florida/2 Local County/Lee/Civil/ -

Acknowledgment Of Counsel For Proposed Guardian Of A Minors Property

Acknowledgment Of Counsel For Proposed Guardian Of A Minors Property

Florida/2 Local County/Lee/Civil/ -

Order Granting Leave To Withdraw As Attorney Of Record (Judge Fuller)

Order Granting Leave To Withdraw As Attorney Of Record (Judge Fuller)

Florida/2 Local County/Lee/Civil/ -

Order Rolling Trial To (Date After) Resumption Of Trials (Judge K Kyle)

Order Rolling Trial To (Date After) Resumption Of Trials (Judge K Kyle)

Florida/2 Local County/Lee/Civil/ -

Order Approving Settlement Dismissal With Prejudice Reserving Jurisdiction (Judge K Kyle)

Order Approving Settlement Dismissal With Prejudice Reserving Jurisdiction (Judge K Kyle)

Florida/2 Local County/Lee/Civil/ -

Stipulation For Pretrial Order And Pretrial Conference Order (Judge Steinbeck)

Stipulation For Pretrial Order And Pretrial Conference Order (Judge Steinbeck)

Florida/2 Local County/Lee/Civil/ -

Civil Pretrial Conference Catalogue (Uniform PC Order) (Judge Steinbeck)

Civil Pretrial Conference Catalogue (Uniform PC Order) (Judge Steinbeck)

Florida/2 Local County/Lee/Civil/ -

PIP Standard Stipulation Waive Pre-Trial Appearance PC Order (SC) (Judge Gagliardi)

PIP Standard Stipulation Waive Pre-Trial Appearance PC Order (SC) (Judge Gagliardi)

Florida/2 Local County/Lee/Civil/ -

Agreement And Order (Judge Paluck)

Agreement And Order (Judge Paluck)

Florida/2 Local County/Lee/Civil/ -

PIP Standard Stipulation Waive Pre-Trial Appearance PC Order (SC) (Judge Gill)

PIP Standard Stipulation Waive Pre-Trial Appearance PC Order (SC) (Judge Gill)

Florida/2 Local County/Lee/Civil/ -

Judgment For Possession Unlawful Detainer

Judgment For Possession Unlawful Detainer

Florida/2 Local County/Lee/Civil/ -

Uniform Order Setting Pretrial Conference (Approved Case Management Plan)

Uniform Order Setting Pretrial Conference (Approved Case Management Plan)

Florida/2 Local County/Lee/Civil/ -

Agreed Case Management Plan And Order

Agreed Case Management Plan And Order

Florida/2 Local County/Lee/Civil/ -

Uniform Order Setting Pretrial Conference (Notice For Trial)

Uniform Order Setting Pretrial Conference (Notice For Trial)

Florida/2 Local County/Lee/Civil/ -

Motion For Status Conference (Supervised Parenting Time) (Judge Schreiber)

Motion For Status Conference (Supervised Parenting Time) (Judge Schreiber)

Florida/2 Local County/Lee/Civil/ -

Order For Supervised Parenting Time And Appointing FRC (Judge Schreiber)

Order For Supervised Parenting Time And Appointing FRC (Judge Schreiber)

Florida/2 Local County/Lee/Civil/ -

Pretrial-Prehearing Order For Evidentiary Hearings-Trials (Judge Schreiber)

Pretrial-Prehearing Order For Evidentiary Hearings-Trials (Judge Schreiber)

Florida/2 Local County/Lee/Civil/ -

Motion To Reopen And For Modification Of Permanency Order (Judge Swift)

Motion To Reopen And For Modification Of Permanency Order (Judge Swift)

Florida/2 Local County/Lee/Civil/ -

Designation Of Current Mailing And E-Mail Address

Designation Of Current Mailing And E-Mail Address

Florida/2 Local County/Lee/Civil/ -

Notice Regarding Foreclosure Lawsuits (To Be Served With Summons - Lee)

Notice Regarding Foreclosure Lawsuits (To Be Served With Summons - Lee)

Florida/2 Local County/Lee/Civil/ -

PIP Standard Stipulation Waive Pre-Trial Appearance PC Order (SC) (Judge Paluck)

PIP Standard Stipulation Waive Pre-Trial Appearance PC Order (SC) (Judge Paluck)

Florida/2 Local County/Lee/Civil/ -

Order Granting Motion For Telephonic Hearing (Judge Laboda)

Order Granting Motion For Telephonic Hearing (Judge Laboda)

Florida/2 Local County/Lee/Civil/ -

Eviction Summons For Possession And Damages

Eviction Summons For Possession And Damages

Florida/2 Local County/Lee/Civil/ -

Eviction Summons For Back Rent And Damages

Eviction Summons For Back Rent And Damages

Florida/2 Local County/Lee/Civil/ -

Subpoena Duces Tecum For Trial

Subpoena Duces Tecum For Trial

Florida/Local County/Lee/Civil/ -

Subpoena For Trial

Subpoena For Trial

Florida/Local County/Lee/Civil/ -

Eviction Summons - Residential

Eviction Summons - Residential

Florida/Local County/Lee/Civil/ -

Crossclaim Summons

Crossclaim Summons

Florida/Local County/Lee/Civil/ -

Subpoena Duces Tecum For Deposition

Subpoena Duces Tecum For Deposition

Florida/Local County/Lee/Civil/ -

Summons General Form

Summons General Form

Florida/Local County/Lee/Civil/ -

Subpoena For Deposition

Subpoena For Deposition

Florida/Local County/Lee/Civil/ -

Subpoena Duces Tecum Without Deposition

Subpoena Duces Tecum Without Deposition

Florida/Local County/Lee/Civil/ -

Order-Referral To Nonbinding Arbitration (Judge K Kyle)

Order-Referral To Nonbinding Arbitration (Judge K Kyle)

Florida/2 Local County/Lee/Civil/ -

Affidavit Of Non-Military Service (Unlawful Detainer)

Affidavit Of Non-Military Service (Unlawful Detainer)

Florida/2 Local County/Lee/Civil/ -

Complaint For Unlawful Detainer

Complaint For Unlawful Detainer

Florida/2 Local County/Lee/Civil/ -

Motion For Default

Motion For Default

Florida/2 Local County/Lee/Civil/ -

Unlawful Detainer Summons (Claim For Possession Of Premises)

Unlawful Detainer Summons (Claim For Possession Of Premises)

Florida/2 Local County/Lee/Civil/ -

Writ Of Possession

Writ Of Possession

Florida/2 Local County/Lee/Civil/ -

Order (Blank Family)

Order (Blank Family)

Florida/Local County/Lee/Civil/ -

Request To Remove Information From Public Inspection

Request To Remove Information From Public Inspection

Florida/Local County/Lee/Civil/ -

Motion To Determine Confidentiality Of Court Records

Motion To Determine Confidentiality Of Court Records

Florida/Local County/Lee/Civil/ -

Notice Of Confidential Crime Victim Information Within Court Filing

Notice Of Confidential Crime Victim Information Within Court Filing

Florida/Local County/Lee/Civil/ -

Order Of Referral To Magistrate (Judge Adams)

Order Of Referral To Magistrate (Judge Adams)

Florida/Local County/Lee/Civil/ -

Petition And Affidavit Seeking Ex Parte Order Requiring Involuntary Examination

Petition And Affidavit Seeking Ex Parte Order Requiring Involuntary Examination

Florida/Local County/Lee/Civil/ -

Summons To Appear For Pretrial Conference-Mediation

Summons To Appear For Pretrial Conference-Mediation

Florida/Local County/Lee/Civil/ -

Stipulation To Conduct Non-Binding Arbitration Via Remote Means And Order

Stipulation To Conduct Non-Binding Arbitration Via Remote Means And Order

Florida/Local County/Lee/Civil/ -

Stipulation To Conduct Mediation Via Remote Means And Order

Stipulation To Conduct Mediation Via Remote Means And Order

Florida/Local County/Lee/Civil/ -

Order Setting Evidentiary Hearing (Judge K Kyle)

Order Setting Evidentiary Hearing (Judge K Kyle)

Florida/2 Local County/Lee/Civil/ -

Pretrial Conference Order (Uniform)

Pretrial Conference Order (Uniform)

Florida/Local County/Lee/Civil/ -

Pretrial Conference-Trial Order (Judge Kyle)

Pretrial Conference-Trial Order (Judge Kyle)

Florida/Local County/Lee/Civil/ -

Order Scheduling Case Management Conference

Order Scheduling Case Management Conference

Florida/2 Local County/Lee/Civil/ -

Order (Blank Civil)

Order (Blank Civil)

Florida/2 Local County/Lee/Civil/ -

Bidder Deposit Form

Bidder Deposit Form

Florida/Local County/Lee/Civil/ -

Claim Of Exemption And Request For Hearing

Claim Of Exemption And Request For Hearing

Florida/Local County/Lee/Civil/ -

Owners Claim For Mortgage Foreclosure Surplus

Owners Claim For Mortgage Foreclosure Surplus

Florida/Local County/Lee/Civil/ -

Out Of County Service Request Form

Out Of County Service Request Form

Florida/Local County/Lee/Civil/ -

Complaint To Quiet Title (Wild Deed)

Complaint To Quiet Title (Wild Deed)

Florida/Local County/Lee/Civil/ -

Affidavit Of Diligent Search (To Quiet Title Fraudulent Conveyance)

Affidavit Of Diligent Search (To Quiet Title Fraudulent Conveyance)

Florida/Local County/Lee/Civil/ -

Complaint To Quiet Title (Forged Deed)

Complaint To Quiet Title (Forged Deed)

Florida/Local County/Lee/Civil/ -

Notice Of Action (To Quiet Title Based On Fraudulent Conveyance)

Notice Of Action (To Quiet Title Based On Fraudulent Conveyance)

Florida/Local County/Lee/Civil/ -

Order To Quiet Title Based On A Fraudulent Conveyance

Order To Quiet Title Based On A Fraudulent Conveyance

Florida/Local County/Lee/Civil/ -

Value Of Real Property Or Mortgage Foreclosure Claim

Value Of Real Property Or Mortgage Foreclosure Claim

Florida/Local County/Lee/Civil/ -

Motion (Blank - County Civil)

Motion (Blank - County Civil)

Florida/Local County/Lee/Civil/ -

Complaint For Replevin For Goods Held By A Secondhand Dealer

Complaint For Replevin For Goods Held By A Secondhand Dealer

Florida/Local County/Lee/Civil/ -

Affidavit Of Ownership Notice To Parties Affidavit Of Owner And Consent

Affidavit Of Ownership Notice To Parties Affidavit Of Owner And Consent

Florida/Local County/Lee/Civil/ -

Motion For Default For Failure To Deposit Rent Residential Eviction

Motion For Default For Failure To Deposit Rent Residential Eviction

Florida/Local County/Lee/Civil/ -

Motion To Disburse Rent

Motion To Disburse Rent

Florida/Local County/Lee/Civil/ -

Order Granting Motion To Disburse Rent

Order Granting Motion To Disburse Rent

Florida/Local County/Lee/Civil/ -

Notice Of Dismissal By Plaintiff (Eviction)

Notice Of Dismissal By Plaintiff (Eviction)

Florida/Local County/Lee/Civil/ -

Petition For Issuance Of Vehicular Title

Petition For Issuance Of Vehicular Title

Florida/Local County/Lee/Civil/ -

Clerks Certificate Of Mailing (Eviction Summons And Complaint)

Clerks Certificate Of Mailing (Eviction Summons And Complaint)

Florida/Local County/Lee/Civil/ -

Statement Of Claim For Return Of Property From Pawnbroker

Statement Of Claim For Return Of Property From Pawnbroker

Florida/Local County/Lee/Civil/ -

Summons For Complaint To Quiet Title Fraudulent Conveyance. (Personal Service)pdf

Summons For Complaint To Quiet Title Fraudulent Conveyance. (Personal Service)pdf

Florida/Local County/Lee/Civil/ -

Affidavit (Balance Due On Stipulation Or CDS Agreement Small Claims)

Affidavit (Balance Due On Stipulation Or CDS Agreement Small Claims)

Florida/Local County/Lee/Civil/ -

Counterclaim (Small Claims)

Counterclaim (Small Claims)

Florida/Local County/Lee/Civil/ -

Statement Of Claim (Small Claims)

Statement Of Claim (Small Claims)

Florida/Local County/Lee/Civil/ -

Order Granting Leave To Withdraw And Setting CMC (Judge K. Kyle)

Order Granting Leave To Withdraw And Setting CMC (Judge K. Kyle)

Florida/Local County/Lee/Civil/ -

Order Directing Zoom Hearing (Judge Laboda)

Order Directing Zoom Hearing (Judge Laboda)

Florida/Local County/Lee/Civil/ -

Order Granting Leave To Withdraw As Attorney Of Record (Judge Shenko)

Order Granting Leave To Withdraw As Attorney Of Record (Judge Shenko)

Florida/Local County/Lee/Civil/ -

Motion For Contempt (Baker Act)

Motion For Contempt (Baker Act)

Florida/Local County/Lee/Civil/ -

Quit Claim Deed

Quit Claim Deed

Florida/Local County/Lee/Civil/ -

Declaration Of Domicile

Declaration Of Domicile

Florida/Local County/Lee/Civil/ -

Default As To Failure To Deposit Rent Residential Eviction

Default As To Failure To Deposit Rent Residential Eviction

Florida/Local County/Lee/Civil/ -

Statement Of Claim Replevin Action Alternatively Claim For Damages

Statement Of Claim Replevin Action Alternatively Claim For Damages

Florida/Local County/Lee/Civil/ -

Assignment Of Interest In Tax Deed Sale Surplus Proceeds

Assignment Of Interest In Tax Deed Sale Surplus Proceeds

Florida/Local County/Lee/Civil/ -

Affidavit Of Surviving Spouse Claim For Tax Deed Sale Surplus Funds

Affidavit Of Surviving Spouse Claim For Tax Deed Sale Surplus Funds

Florida/Local County/Lee/Civil/ -

Notice Of Hearing (Motion To Reopen Permanency Order) (Judge Perez)

Notice Of Hearing (Motion To Reopen Permanency Order) (Judge Perez)

Florida/2 Local County/Lee/Civil/ -

Order Of Referral To General Magistrate (Civil)

Order Of Referral To General Magistrate (Civil)

Florida/Local County/Lee/Civil/ -

Motion To Reopen And For Modification Of Permanency Order (Judge Perez)

Motion To Reopen And For Modification Of Permanency Order (Judge Perez)

Florida/2 Local County/Lee/Civil/ -

Notice Of Hearing (Motion To Reopen Permanency Order) (Judge Swift)

Notice Of Hearing (Motion To Reopen Permanency Order) (Judge Swift)

Florida/2 Local County/Lee/Civil/ -

Notice Order Setting Evidentiary Final Hearing-Trial (Default) (Judge K Kyle)

Notice Order Setting Evidentiary Final Hearing-Trial (Default) (Judge K Kyle)

Florida/2 Local County/Lee/Civil/ -

Order Granting Leave To Withdraw As Attorney Of Record (Judge K. Kyle)

Order Granting Leave To Withdraw As Attorney Of Record (Judge K. Kyle)

Florida/2 Local County/Lee/Civil/ -

Order Granting Leave To Withdraw As Attorney Of Record (Judge Laboda)

Order Granting Leave To Withdraw As Attorney Of Record (Judge Laboda)

Florida/2 Local County/Lee/Civil/ -

Order Of Referral To Magistrate (Family)

Order Of Referral To Magistrate (Family)

Florida/2 Local County/Lee/Civil/ -

Recording Transmittal

Recording Transmittal

Florida/2 Local County/Lee/Civil/ -

Summons - Personal Service On Natural Person

Summons - Personal Service On Natural Person

Florida/Local County/Lee/Civil/ -

Third Party Summons

Third Party Summons

Florida/Local County/Lee/Civil/ -

Uniform Pretrial Conference Trial Order

Uniform Pretrial Conference Trial Order

Florida/2 Local County/Lee/Civil/ -

Request To Release Redacted Information On Recorded Documents

Request To Release Redacted Information On Recorded Documents

Florida/Local County/Lee/Civil/ -

Affidavit Of Claim For Tax Deed Sale Surplus Funds

Affidavit Of Claim For Tax Deed Sale Surplus Funds

Florida/Local County/Lee/Civil/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!