Last updated: 7/20/2025

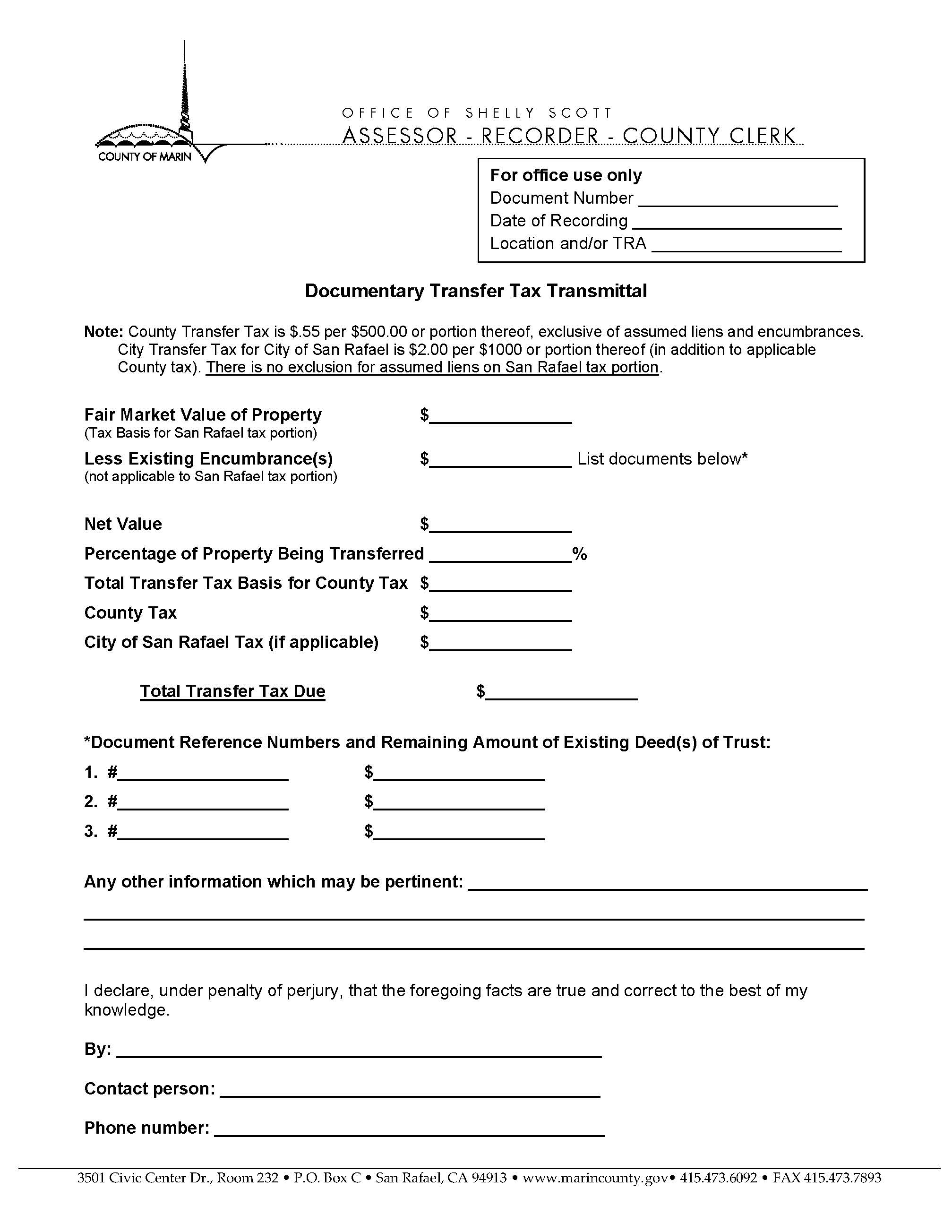

Documentary Transfer Tax Transmittal

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

DOCUMENTARY TRANSFER TAX TRANSMITTAL.This form is used in Marin County, California, specifically within the Office of the Assessor-Recorder-County Clerk, to calculate and report documentary transfer tax owed when real property is transferred. It assists in determining the amount of tax based on the fair market value of the property being transferred, minus any existing encumbrances, and accounts for the percentage of ownership being transferred. The form is also used to compute additional city tax if the property is located in San Rafael, which has its own separate tax rate. Details such as document reference numbers, deed of trust amounts, and contact information must be included. www.FormsWorkflow.com