Last updated: 2/26/2025

Nonprofit Articles Of Organization For Limited Liability Company

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

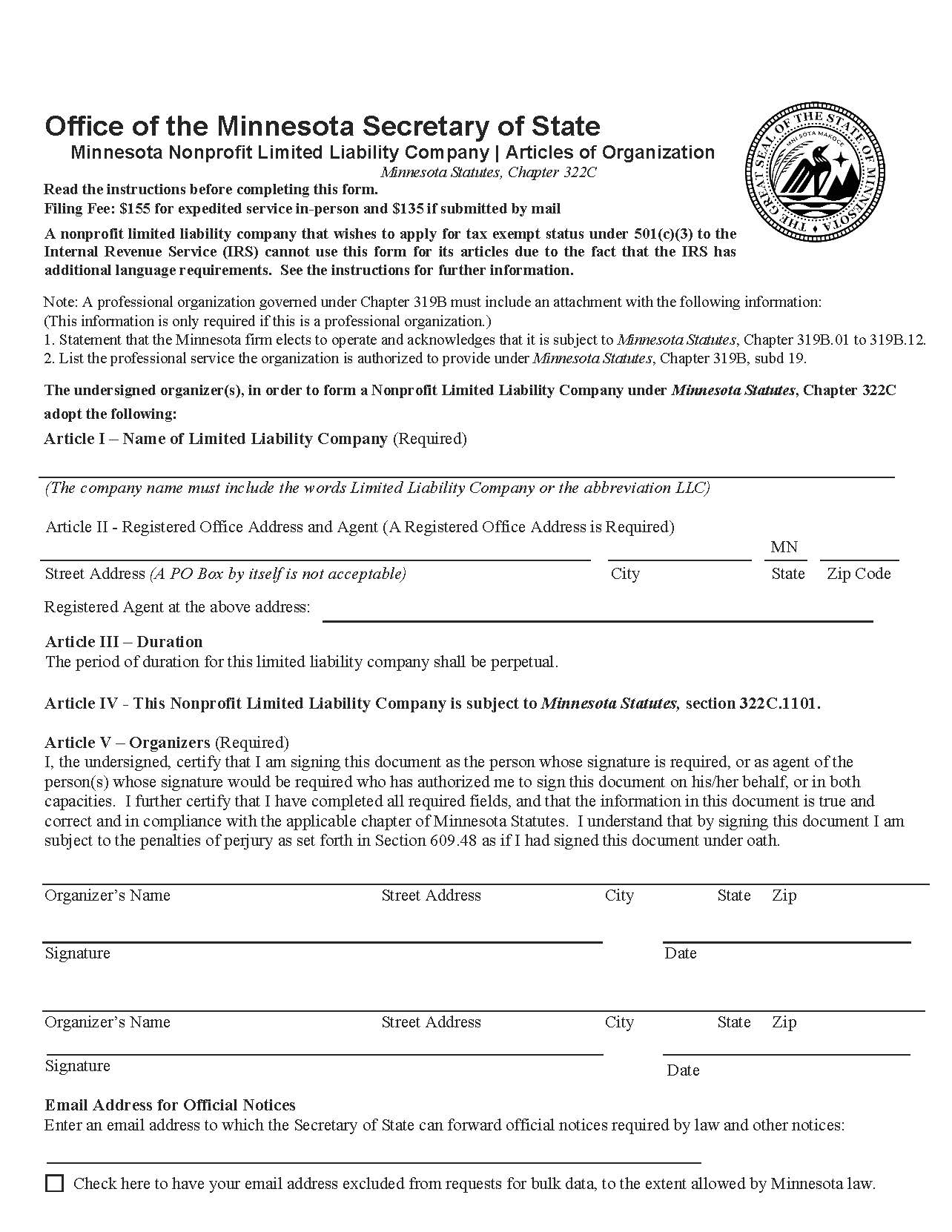

ARTICLES OF ORGANIZATION. This form is used to establish a nonprofit limited liability company (LLC) under Minnesota Statutes, Chapter 322C. This form officially creates the nonprofit LLC and provides essential details about the organization, such as its name, registered office address, duration, and organizers. However, it cannot be used by organizations seeking 501(c)(3) tax-exempt status with the IRS, as additional language requirements must be met for that designation. This form requires the LLC name to include "Limited Liability Company" or "LLC" and prohibits the use of "Corporation" or "Incorporated." The registered office must have a physical Minnesota address (not just a P.O. Box), and an agent may be designated but is not mandatory. The form also confirms the perpetual duration of the LLC unless otherwise specified. If the LLC qualifies as a professional organization under Minnesota Statutes, Chapter 319B, an additional statement must be attached, acknowledging compliance and specifying the type of professional services offered. At least one organizer (age 18 or older) must sign the document, certifying its accuracy under penalty of perjury. The form includes an optional Minnesota Business Snapshot survey, collecting non-mandatory demographic and economic data. Filing fees are $155 for expedited in-person service and $135 for mail submissions. The completed form must be submitted to the Minnesota Secretary of State’s Office. Businesses may need to comply with the Corporate Transparency Act (CTA), effective January 1, 2024, which requires reporting beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN). www.FormsWorkflow.com