Last updated: 5/29/2024

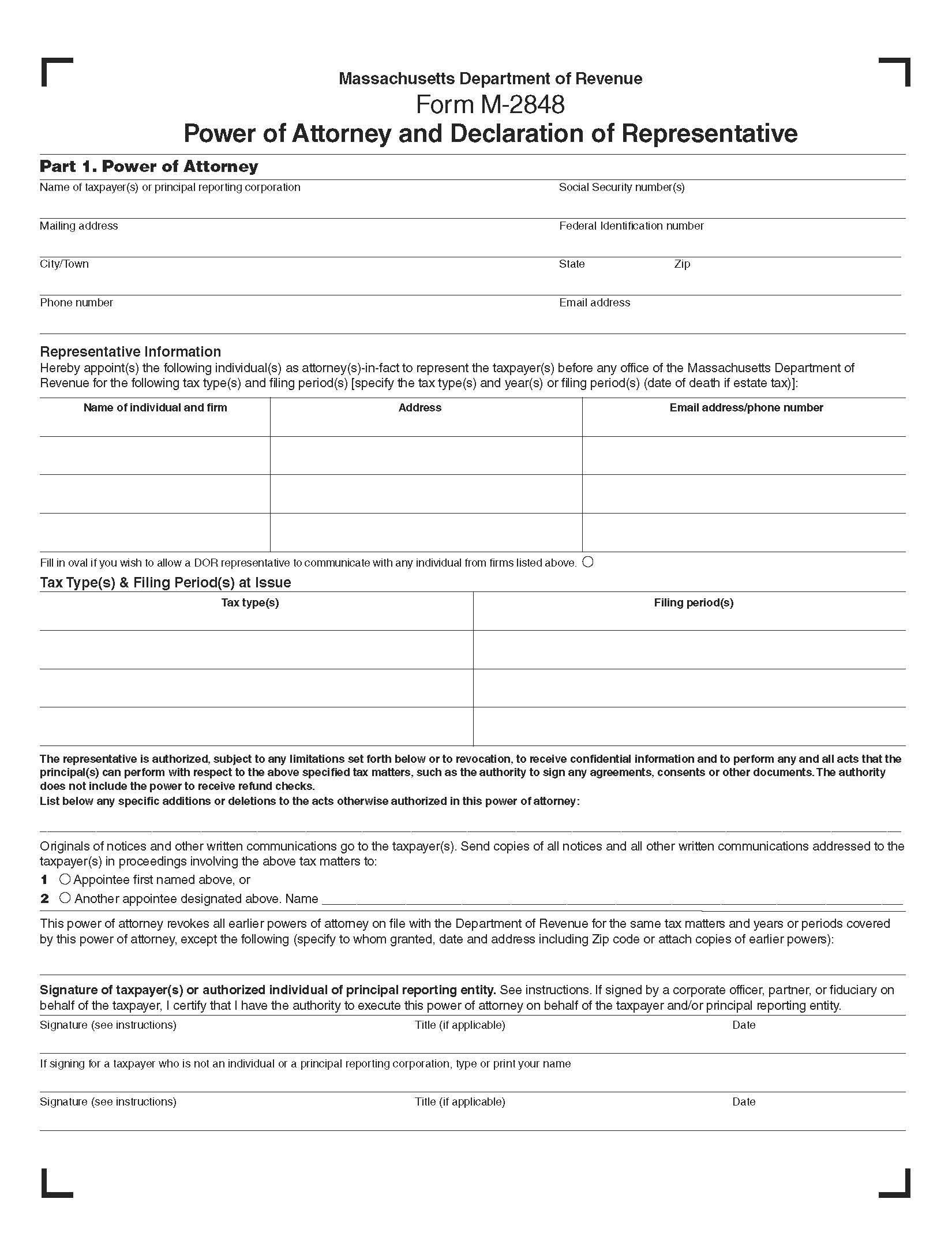

Power Of Attorney And Declaration Of Representative {M-2848}

Start Your Free Trial $ 28.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Form M-2848 - POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE. To protect the confidentiality of tax records, Massachusetts law generally pro-hibits the Department of Revenue (DOR) from disclosing information con-tained in tax returns or other documents filed with it to persons other than the taxpayer or the taxpayer’s representative. For your protection, the Department requires that you file a Power of Attorney (POA) before it will release tax in-formation to your representative. The POA also allows your representative to act on your behalf to the extent you indicate. Use Form M-2848, Power of Attorney and Declaration of Representative, for this purpose if you choose. You may file a POA without using Form M-2848, but it must contain the same information as Form M-2848 would. You may use Form M-2848 to appoint one or more individuals to represent you in tax matters before the DOR. You may use Form M-2848 for any matters affecting any tax imposed by the Commonwealth, and the power granted is limited to these tax matters. www.FormsWorkflow.com