Last updated: 7/29/2020

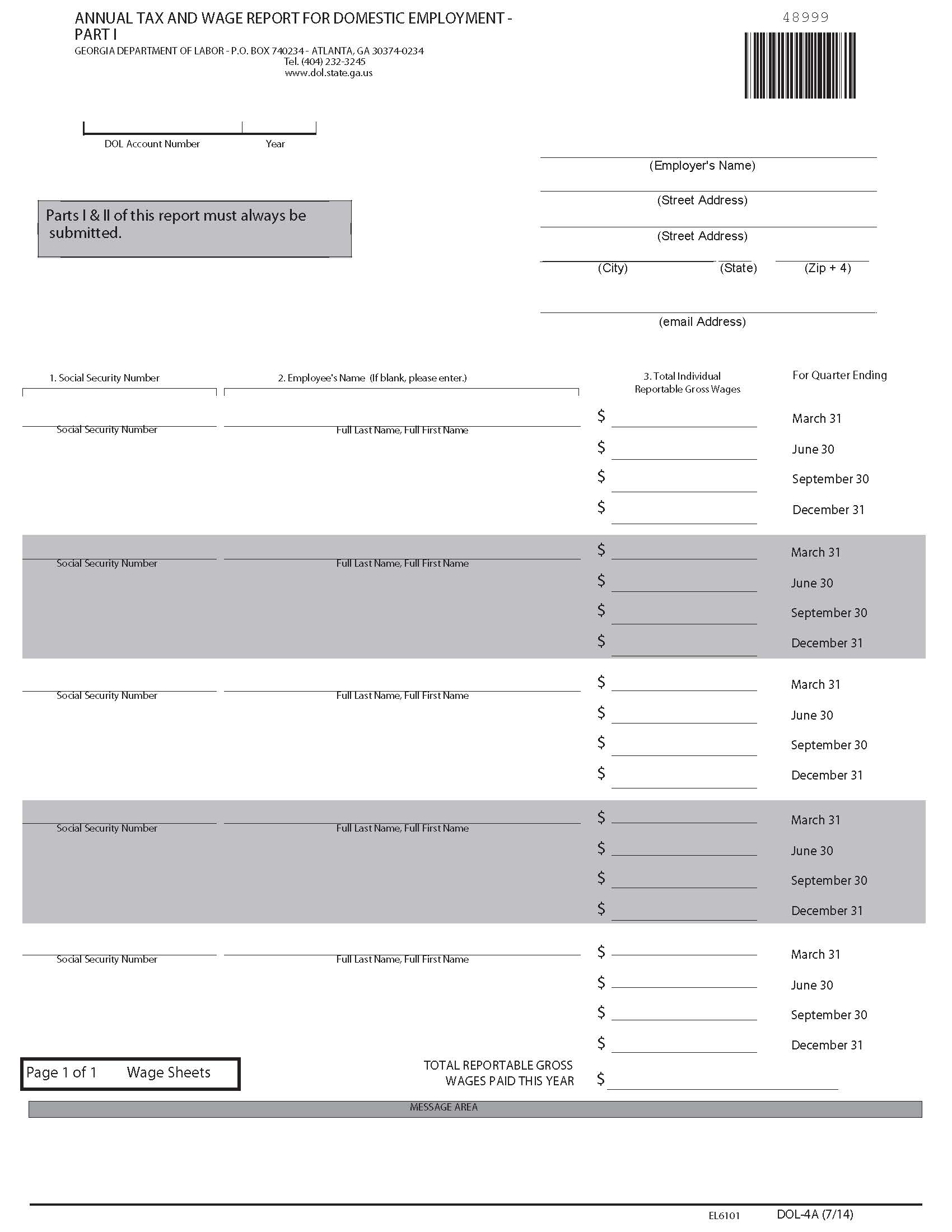

Annual Tax And Wage Report For Domestic Employment {DOL-4A}

Start Your Free Trial $ 6.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

DOL-4A - ANNUAL TAX AND WAGE REPORT FOR DOMESTIC EMPLOYMENT - PART I AND II. This form is issued by the Georgia Department of Labor for household or domestic employers to report wages and pay unemployment insurance taxes. It is due by January 31 each year and includes two required sections: Part I (Employee Wage Detail) and Part II (Tax Calculation and Payment Summary). Employers must list each domestic worker’s Social Security number, name, and quarterly gross wages, then compute taxable wages, contribution tax, and administrative assessment. Current tax rates (as of 2017) are 2.64% for new employers and 0.06% (0.0006) for the administrative assessment. Interest and penalties apply for late filing—1.5% per month and a minimum $20 or 0.05% of wages. www.FormsWorkflow.com