Last updated: 4/18/2007

Claim For Refund Of Inheritance And Estate Taxes {IH-5}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

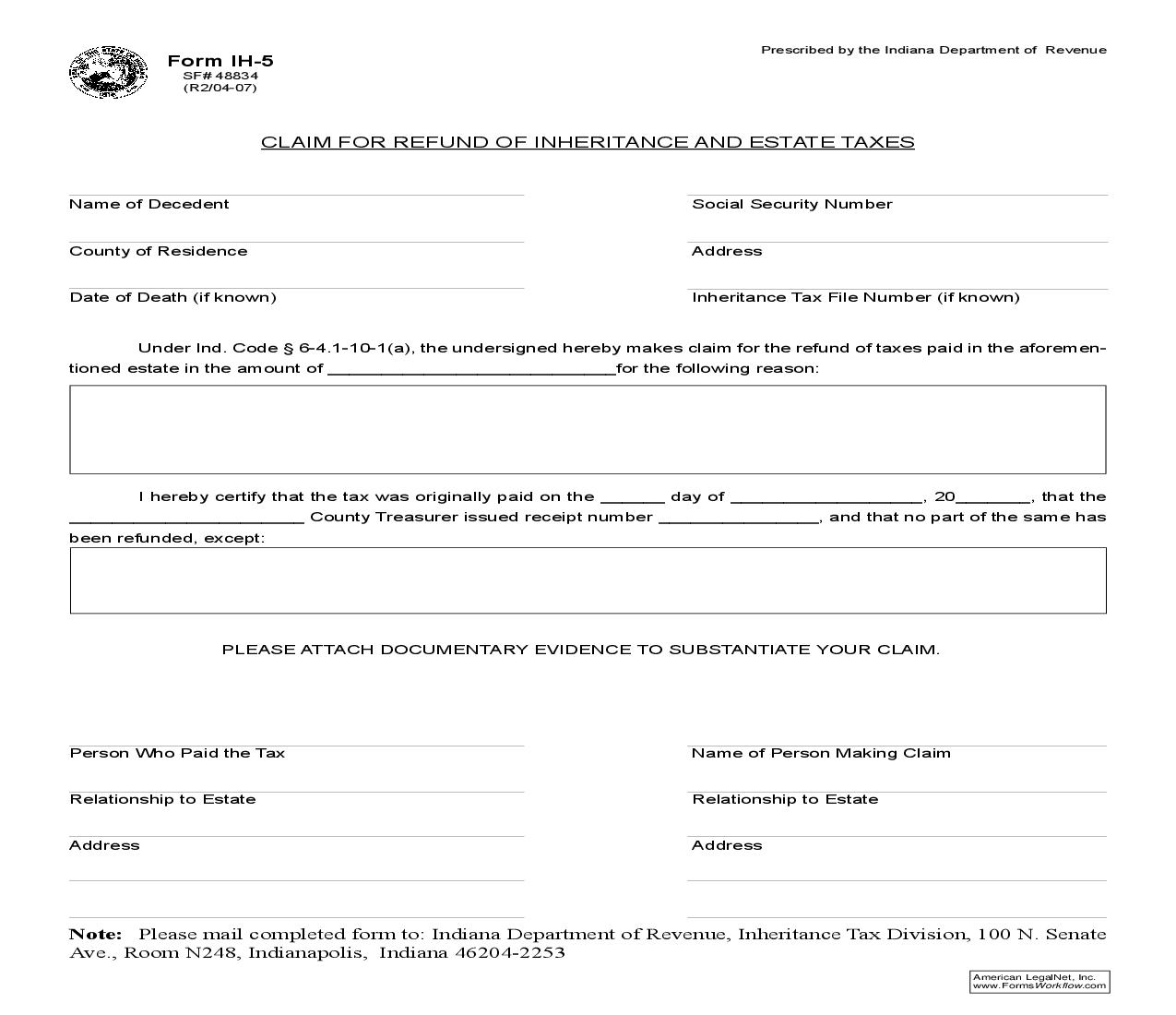

Prescribed by the Indiana Department of Revenue Form IH-5 SF# 48834 2-05 CLAIM FOR REFUND OF INHERITANCE AND ESTATE TAXES Name of decedent County of residence (or address) Date of death (if known) Pursuant to IC 6-4.1-10-1(a), the undersigned hereby makes claim for the refund of taxes paid in the above-indicated estate in the amount of for the following reason: I hereby certify that the tax was originally paid on the that the County Treasurer issued receipt number the same has been refunded, except: day of , 20 , , and that no part of PLEASE ATTACH DOCUMENTARY EVIDENCE TO SUPPORT YOUR CLAIM WHERE POSSIBLE Name of person making claim Address Person who paid the tax Address Note: Please mail completed form to: Indiana Department of Revenue, Inheritance Tax Division, P.O. Box 71, Indianapolis, IN 46206-0071 American LegalNet, Inc. www.FormsWorkflow.com