Last updated: 11/4/2025

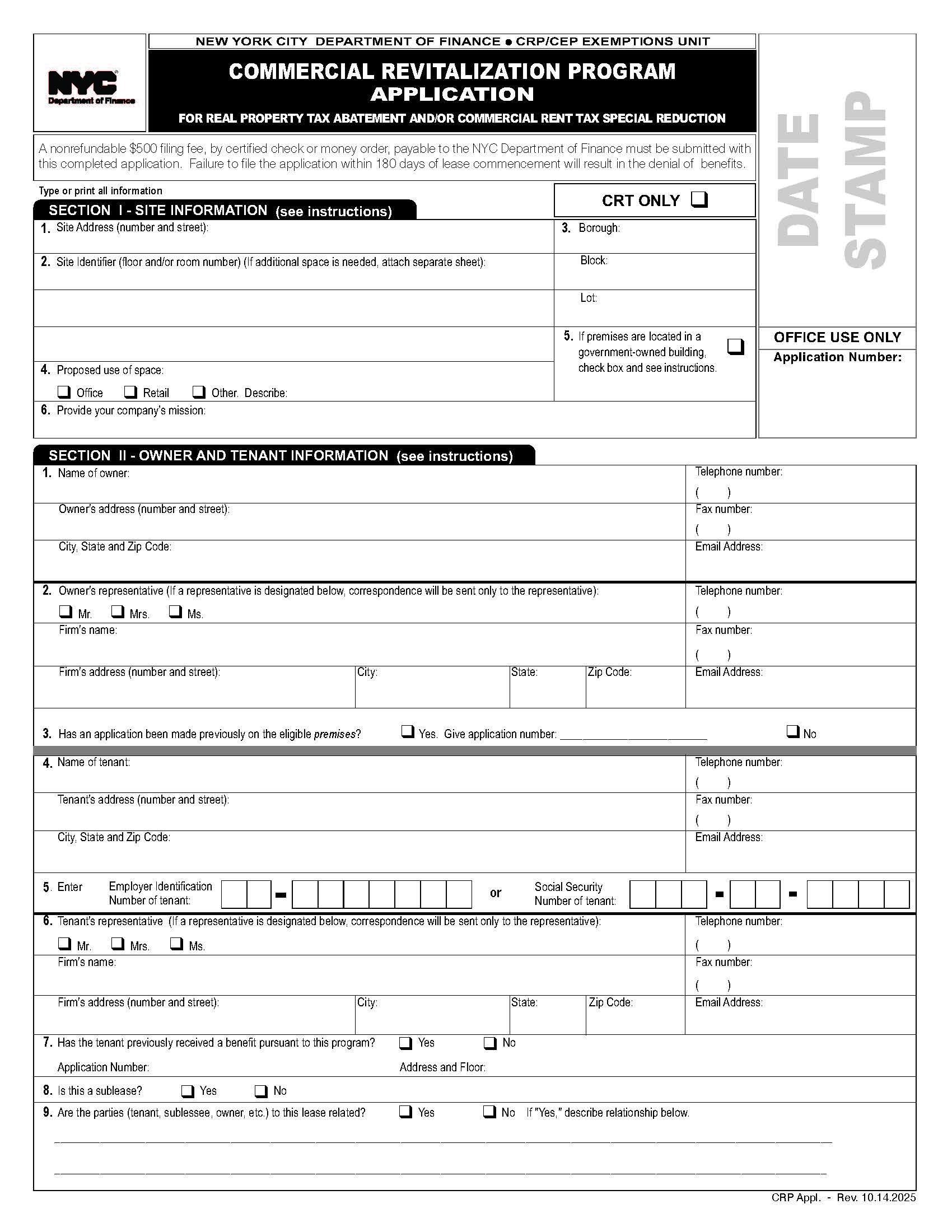

Commercial Revitalization Program Application

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

COMMERCIAL REVITA LIZATION PROGRAM APPLICATION. This form enables eligible tenants and property owners in Lower Manhattan to apply for Real Property Tax Abatement and/or a Commercial Rent Tax (CRT) Special Reduction through the New York City Department of Finance, CRP/CEP Exemptions Unit. The program supports economic growth and revitalization by encouraging commercial tenancy and reducing building vacancy in the designated abatement zone — generally the area bounded by Murray Street, Frankfort Street, South Street, Battery Place, and West Street. To qualify, the leased premises must be located in an eligible building within the abatement zone and used for office or retail purposes. Applicants must file the completed form, with original signatures from both the owner and tenant, and a non-refundable $500 fee within 180 days of the lease commencement date. Leases must meet minimum term and improvement expenditure requirements based on the number of employees and lease length. The CRP provides three-, five-, or ten-year tax abatement benefits, with specific eligibility standards outlined under Section 499 of the New York State Real Property Tax Law. The application also allows eligible tenants in government-owned buildings to apply for the Commercial Rent Tax Special Reduction even without abatement eligibility. Supporting documentation, including executed leases, expenditure proof, and lease abstracts, must accompany the submission. www.FormsWorkflow.com