Last updated: 10/9/2025

Personal Property Tax Petition Of Appeal

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

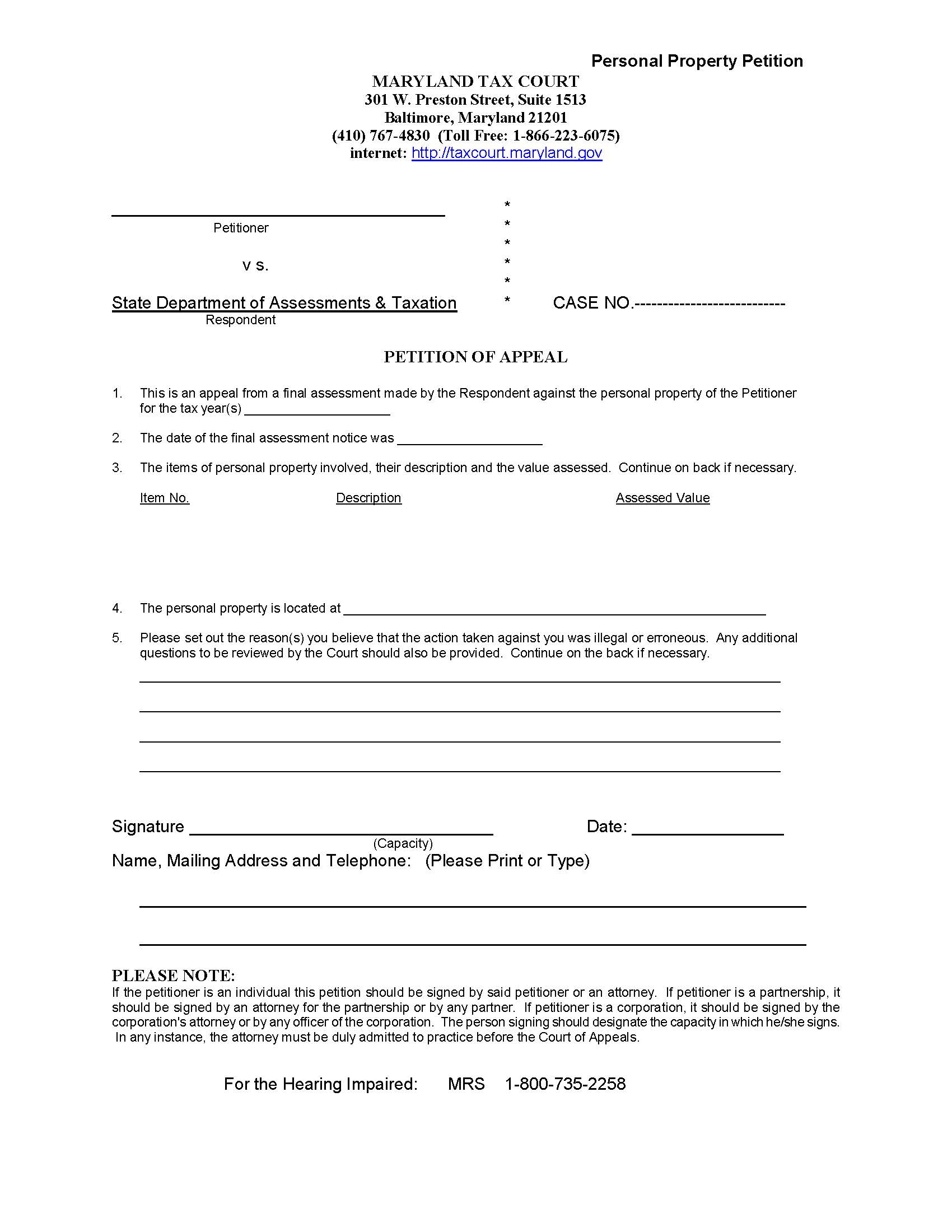

PERSONAL PROPERTY PETITION OF APPEAL.This is a Maryland Tax Court form used to challenge a final personal property tax assessment issued by the State Department of Assessments and Taxation (SDAT). Taxpayers use this form to appeal assessed property values for specific tax years, listing the items in dispute, their descriptions, and assessed values. The petition also allows filers to explain why the assessment was incorrect, illegal, or otherwise erroneous. It must be signed by the petitioner or an authorized attorney, partner, or corporate officer, depending on the type of taxpayer. Initial petitions must be filed by mail, courier, or personal delivery to the Maryland Tax Court in Baltimore. Electronic submission is not accepted. www.FormsWorkflow.com