Last updated: 11/26/2025

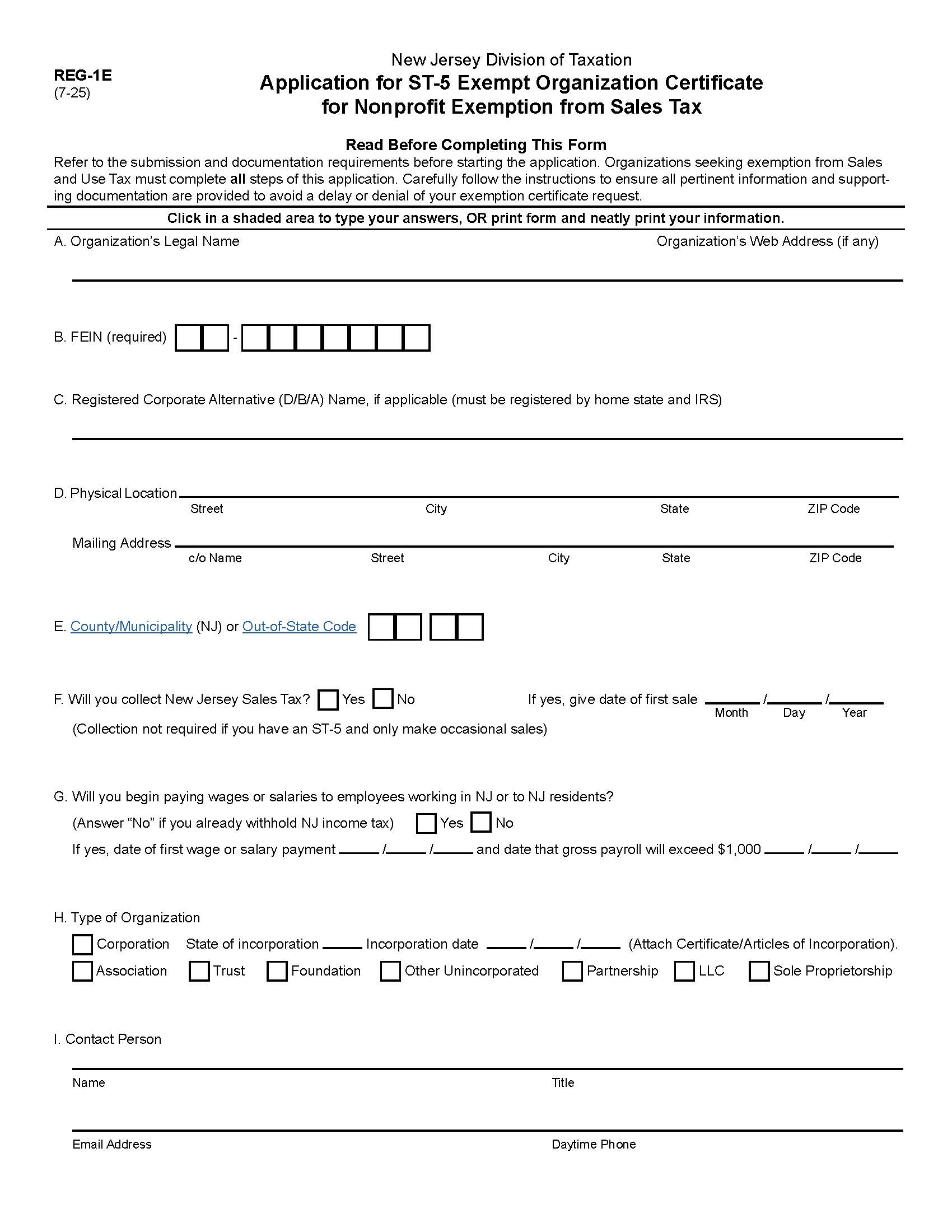

Application For ST-5 Exempt Organization Certificate Nonprofit From Exemption Sales Tax {REG-1E}

Start Your Free Trial $ 14.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

REG-1E - APPLICATION FOR ST-5 EXEMPT ORGANIZATION CERTIFICATE FOR NONPROFIT EXEMPTION FROM SALES TAX. This form is used by eligible nonprofit organizations to request exemption from New Jersey Sales and Use Tax. Administered by the New Jersey Division of Taxation, the form requires organizations to provide their FEIN, legal name, location, corporate structure, responsible officers, and a summary of their primary purpose and activities. Entities must identify their exemption category—such as 501(c)(3) charities, religious organizations, PTAs/PTOs, veterans’ groups, volunteer emergency squads, or qualifying schools. The application also requires supporting documentation, including IRS determination letters, organizing documents, and proof of incorporation or registration. Once completed, organizations must upload the application and attachments through the Division’s online portal using PO Box 269. There is no fee to submit Form REG-1E. www.FormsWorkflow.com