Last updated: 8/27/2025

Arizona Tax Court Cover Sheet {TXSC10f}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

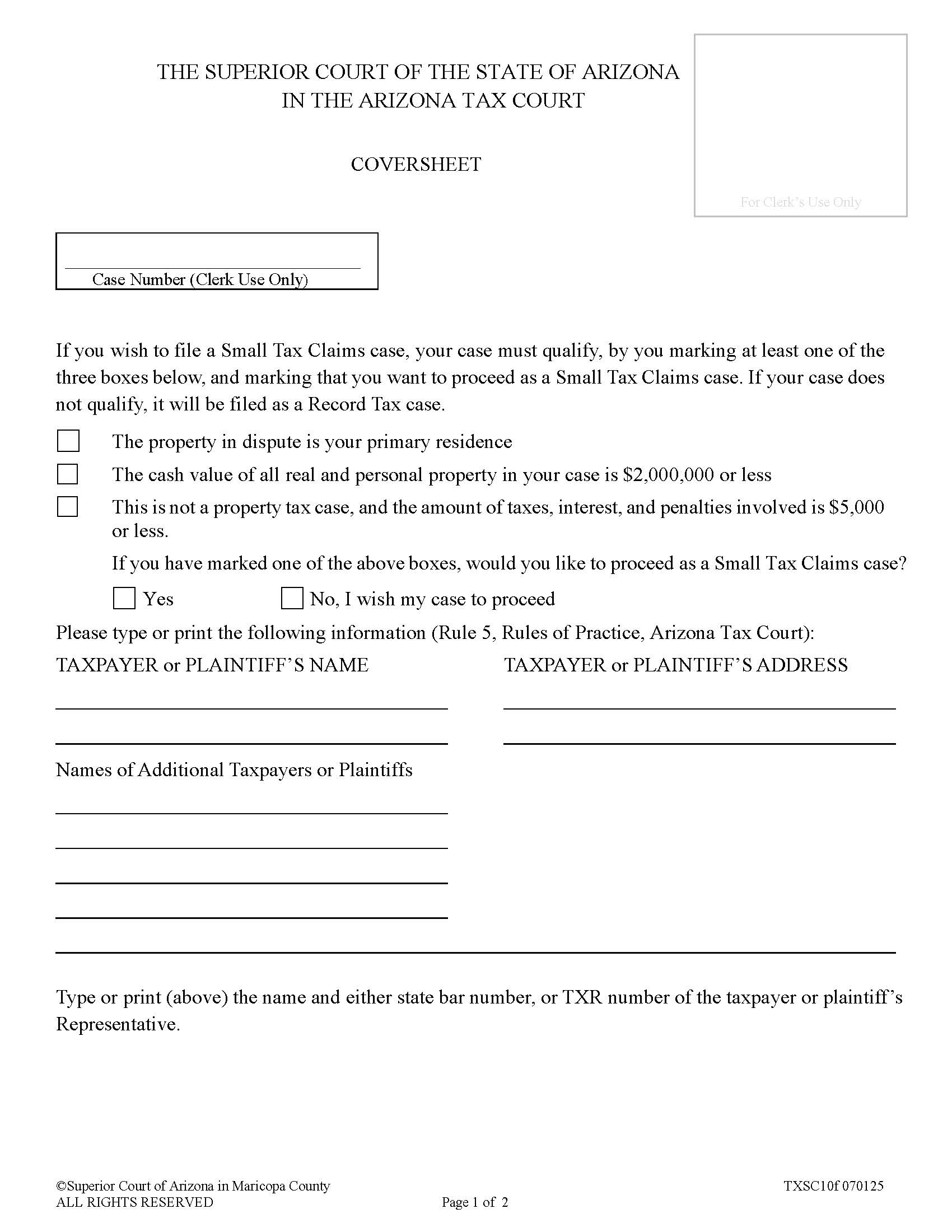

TXSC10f - COVERSHEET. This form is used in the Superior Court of Arizona when filing a new tax case, including property tax disputes or small tax claims. This form provides the court with essential information about the case, such as the names and addresses of the taxpayer(s) or plaintiff(s), the defendant’s name, and whether the case involves property tax. It also requires the filer to indicate if the case qualifies as a Small Tax Claims case, which applies when the property in dispute is the filer’s primary residence, the total value of property involved is $2,000,000 or less, or the disputed taxes, interest, and penalties total $5,000 or less. The form also asks whether the filer wishes to proceed under Small Tax Claims rules or as a regular tax case. In addition, it identifies the taxpayer or plaintiff’s representative and the legal authority for their representation. This coversheet must accompany all new tax actions filed with the Maricopa County Superior Court and ensures that the case is categorized correctly, allowing the court to process and manage tax-related disputes efficiently. www.FormsWorkflow.com