Last updated: 9/5/2025

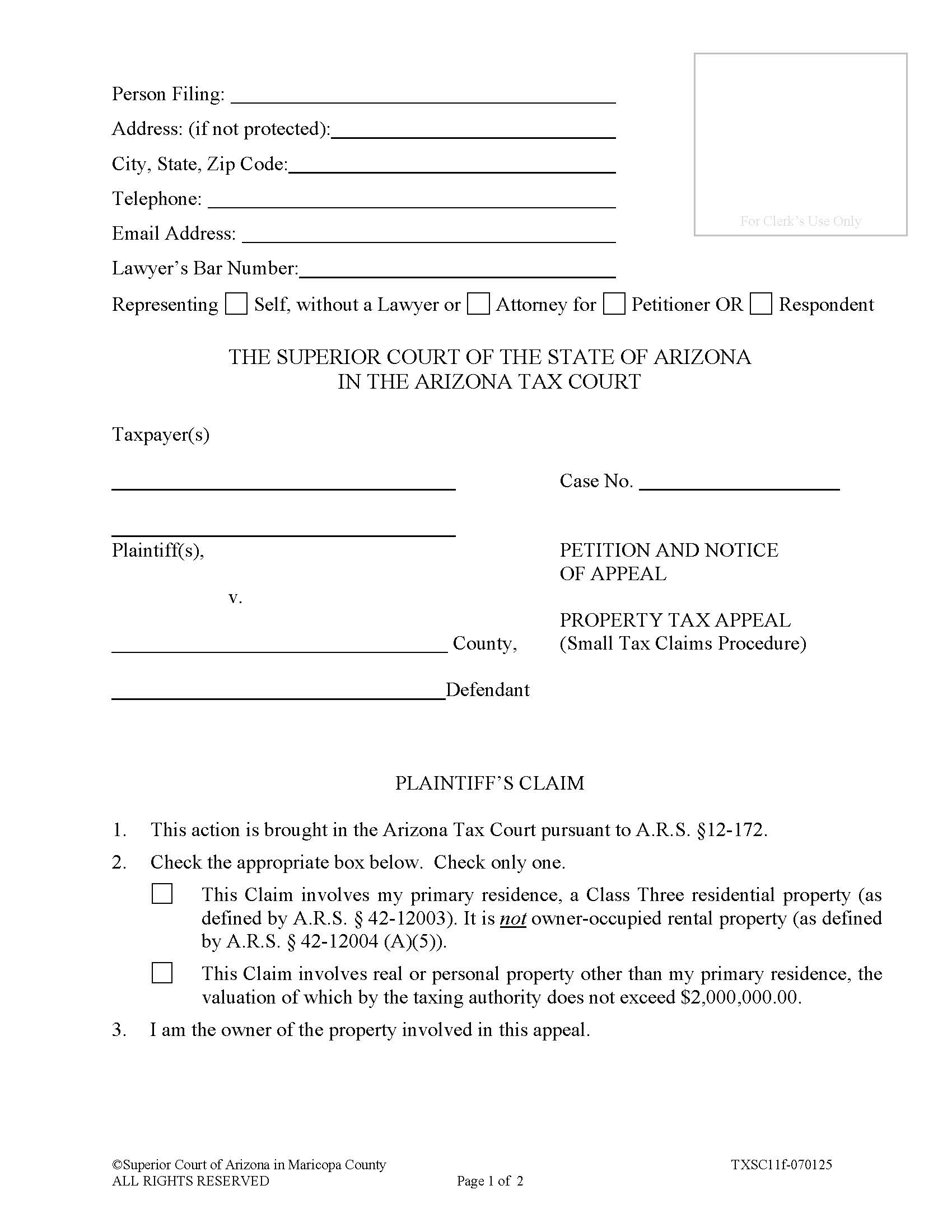

Petition And Notice Of Appeal Property Tax Appeal {TXSC11f}

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

TXSC11f - PETITION AND NOTICE OF APPEAL PROPERTY TAX APPEAL (Small Tax Claims Procedure). This form is used in the Arizona Tax Court when a taxpayer wishes to challenge the property valuation determined by the county taxing authority. This form allows the property owner to appeal the assessed value of their primary residence or other real or personal property valued at $2 million or less, in accordance with Arizona Revised Statutes § 12-172. The taxpayer provides details such as the property address, parcel number, and the valuation assigned by the county, and must state the reasons why they believe the valuation is excessive. The form also includes the taxpayer’s requested corrected value for the property. Once filed, it initiates a legal process for the court to review and potentially adjust the property’s valuation. Importantly, taxpayers are advised that all current-year property taxes must still be paid on time during the appeal process, or the court may dismiss the case. www.FormsWorkflow.com