Ohio

Statewide

Department Of Taxation

Last updated: 1/31/2025

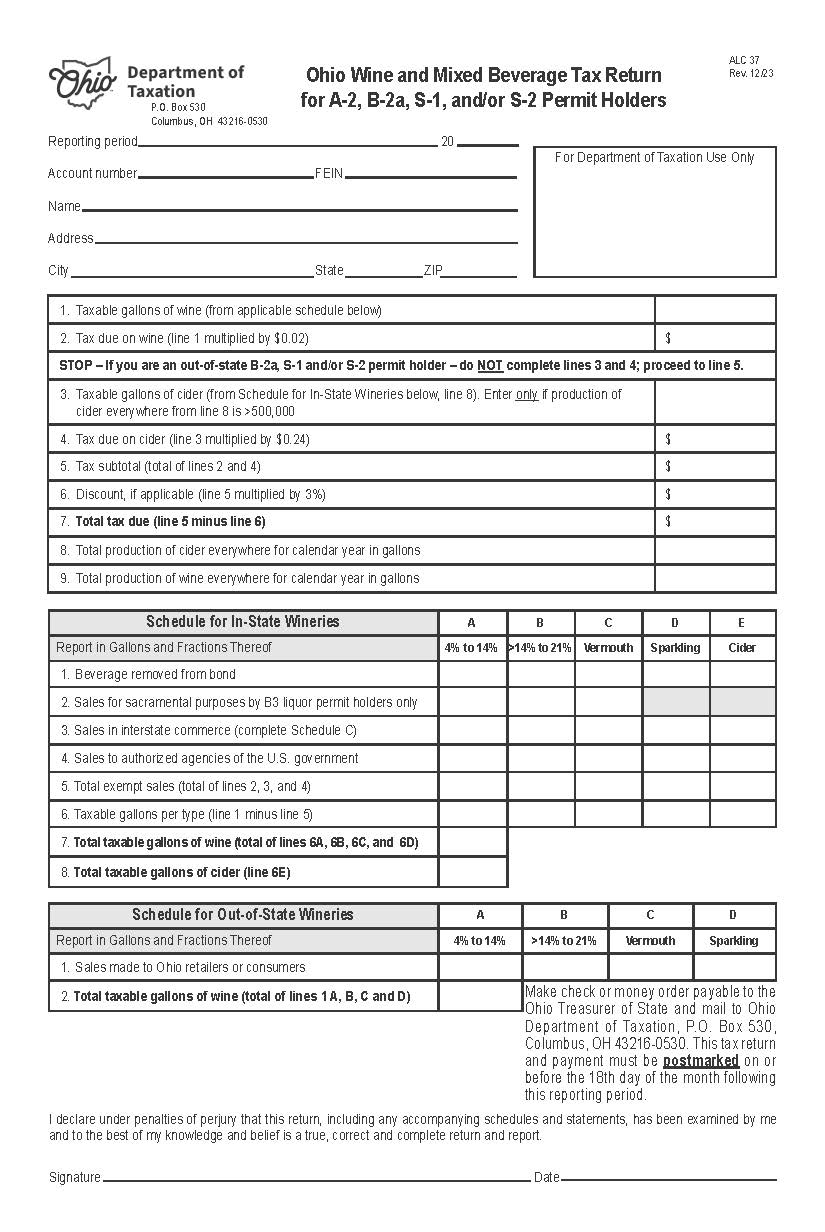

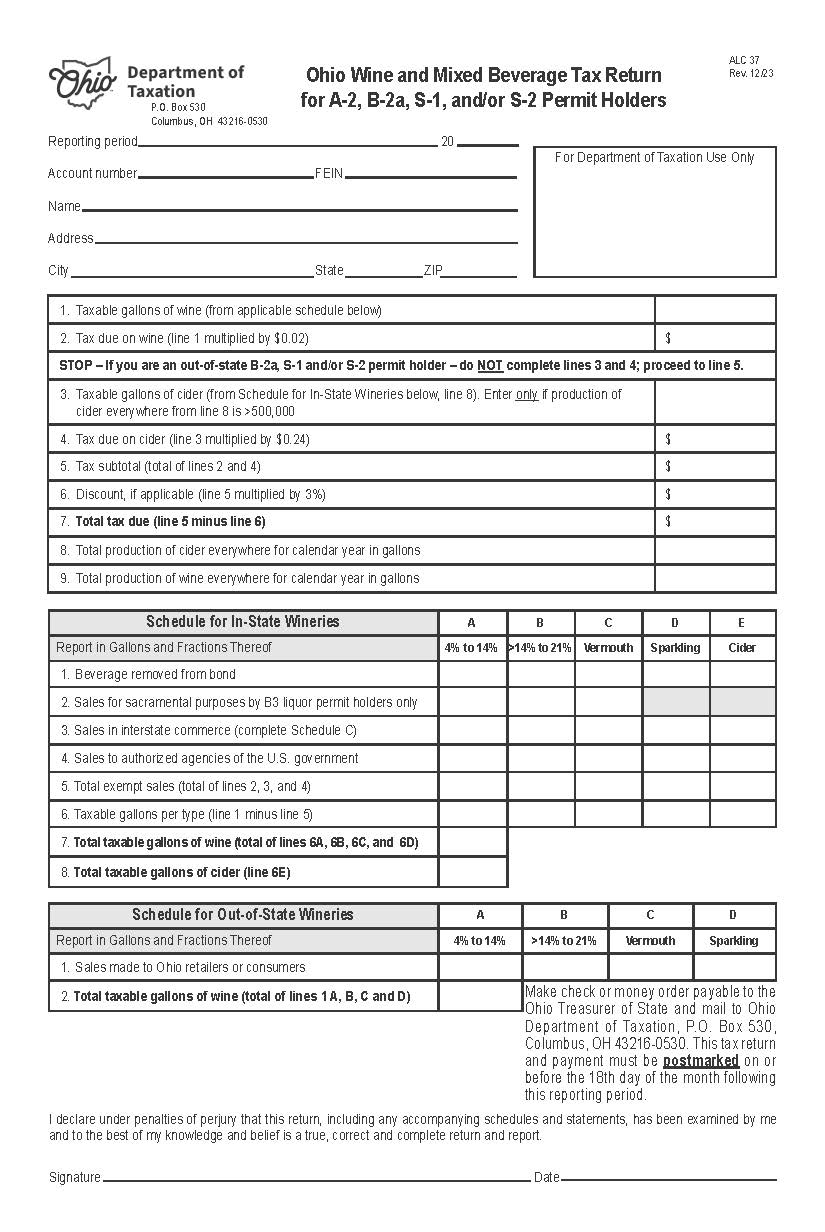

Wine And Mixed Beverage Tax Return For A2 B2a And Or S Permit Holders {ALC 37}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

ALC 37 - OHIO WINE AND MIXED BEVERAGE TAX RETURN FOR A-2, B-2a, S-1, AND/OR S-2 PERMIT HOLDERS. This form is used to report and pay taxes on wine and cider production and sales. It includes sections for tax due on wine and cider based on taxable gallons, discounts, and total tax liability. The form also requires information on production volumes and exempt sales, as well as cider and wine sales to Ohio retailers or consumers. The return must be submitted by the 18th day of the month following the reporting period. www.FormsWorkflow.com

Related forms

Our Products