Last updated: 2/21/2025

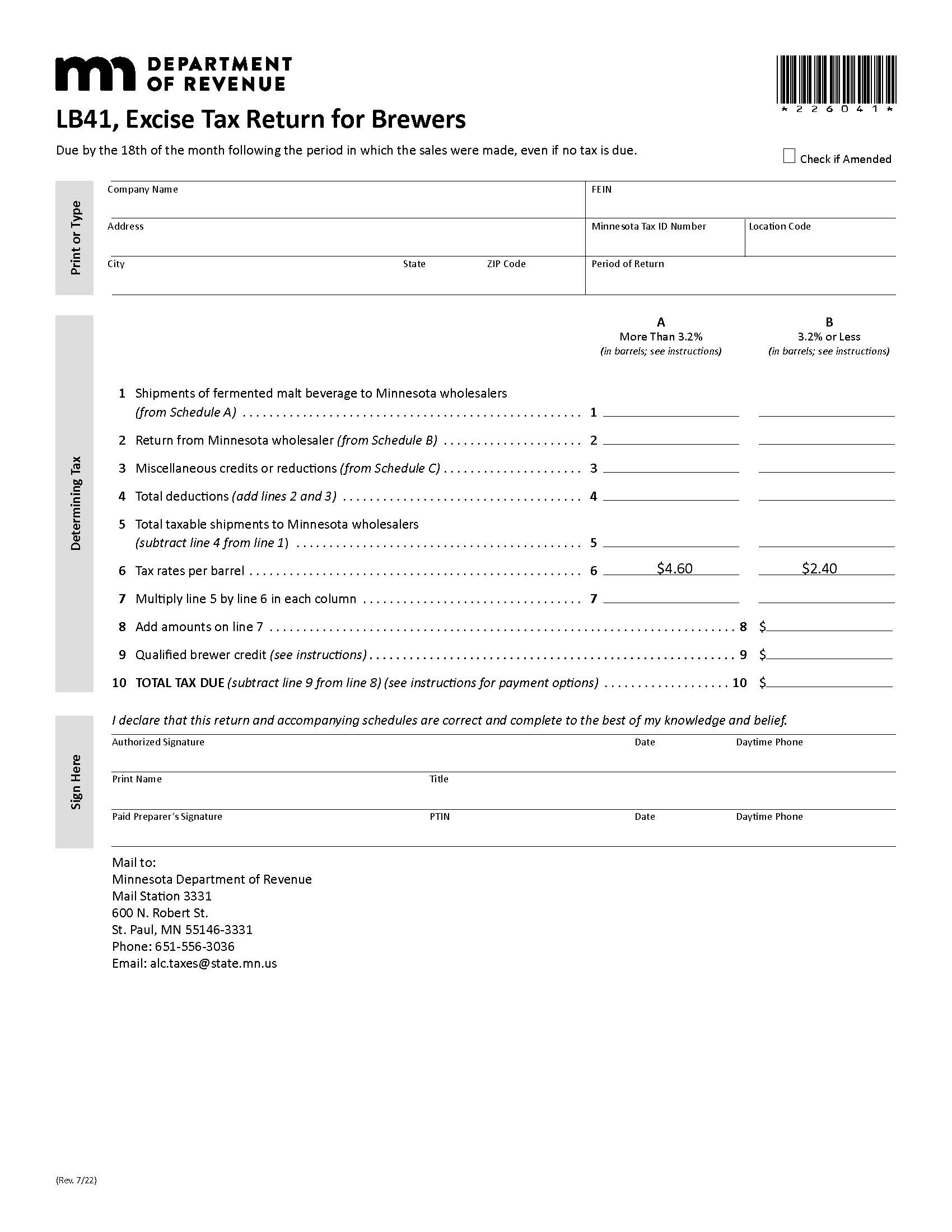

Excise Tax Return For Brewers And Importers {LB 41}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

LB41 - EXCISE TAX RETURN FOR BREWERS. Brewers who sell fermented malt beverage to Minnesota wholesalers must file and pay fermented malt beverage tax. Monthly manufacturer’s warehouse report. If you have a manufacturer’s warehouse permit under M.S. 340A.3055, you must complete Form LB41-MW, Manufacturer’s Minnesota Warehouse Report, each month and attach it when you file your Form LB41. File and pay by the 18th day of the month following the month in which the sales were made. If your monthly tax liability is minimal, contact us to see if you qualify for a different filing frequency. If the due date falls on a weekend or holiday, returns and payments received the next business day are considered timely. You must file a return even if you do not have a tax liability per Minnesota Statute 297G.09 subd. 1. Keep a copy of the return with all supporting records for at least 3½ years. A 5% late-payment penalty will be assessed on any unpaid tax for the first 30 days. The penalty increases 5% for each additional 30-day period (or any part thereof) to a maximum of 15%. Returns filed after the due date will be assessed a 5% late-filing penalty on any unpaid tax, or if no tax is due a penalty of $25 is assessed for each unfiled return. Interest will accrue on any unpaid tax and penalty. www.FormsWorkflow.com