Last updated: 3/19/2025

Articles Of Incorporation For Nonprofit Corporation {4162}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

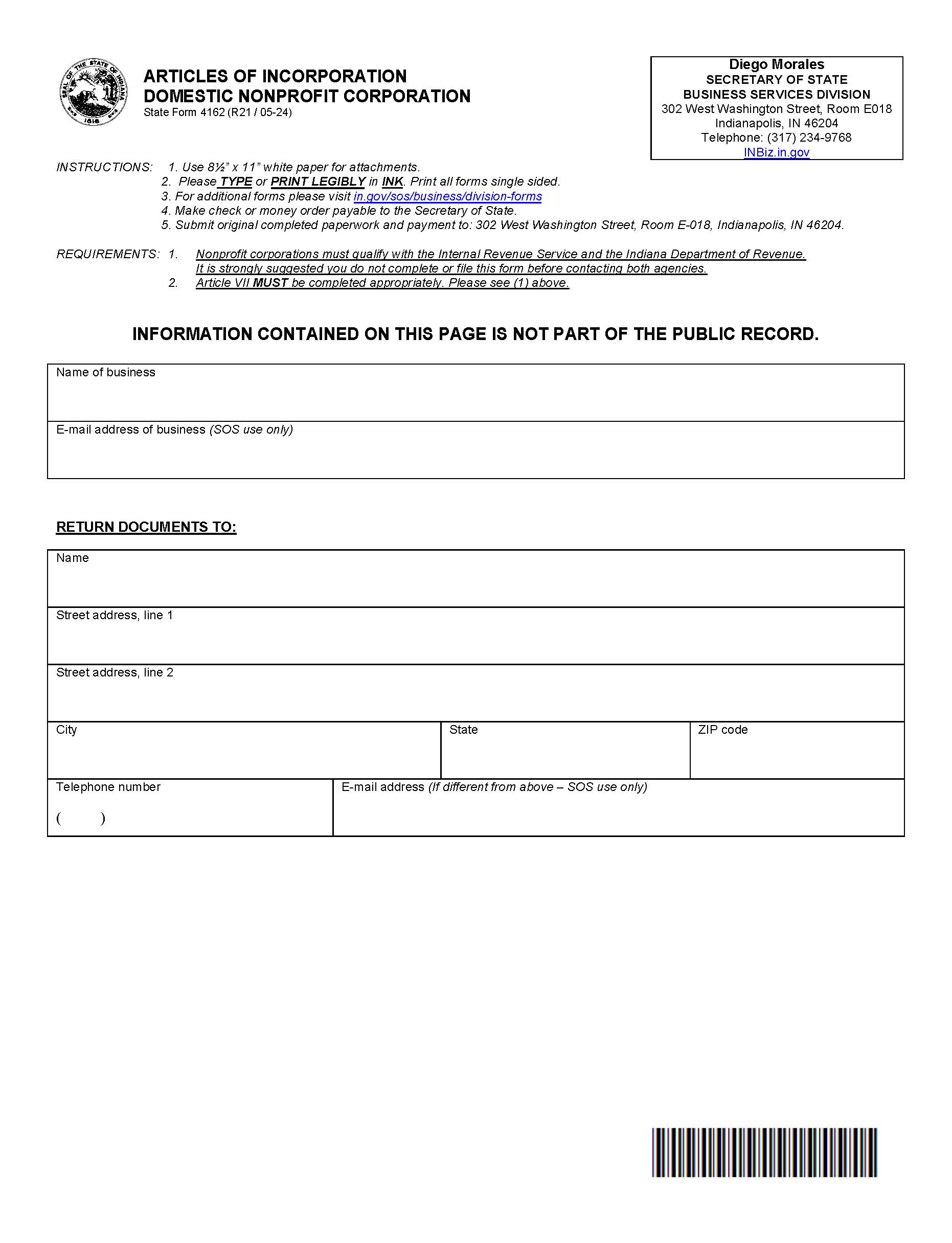

State Form 4162 - ARTICLES OF INCORPORATION DOMESTIC NONPROFIT CORPORATION. This form is used to formally establish a nonprofit corporation in the state of Indiana. This document is filed with the Indiana Secretary of State and outlines key details about the organization, including its name, principal office address, purpose, type of corporation (public benefit, religious, or mutual benefit), registered agent information, and whether it will have members. It also requires the names and addresses of the incorporators, as well as a statement on how the corporation's assets will be distributed upon dissolution. This form is essential for creating a legally recognized nonprofit entity under the Indiana Nonprofit Corporation Act of 1991 and must comply with IRS requirements if the organization intends to seek 501(c) tax-exempt status. The filing fee for this form is $50, and the incorporator(s) must sign it under penalty of perjury. Organizations are advised to consult the IRS and Indiana Department of Revenue before filing to ensure compliance with tax regulations. www.FormsWorkflow.com