Last updated: 5/8/2024

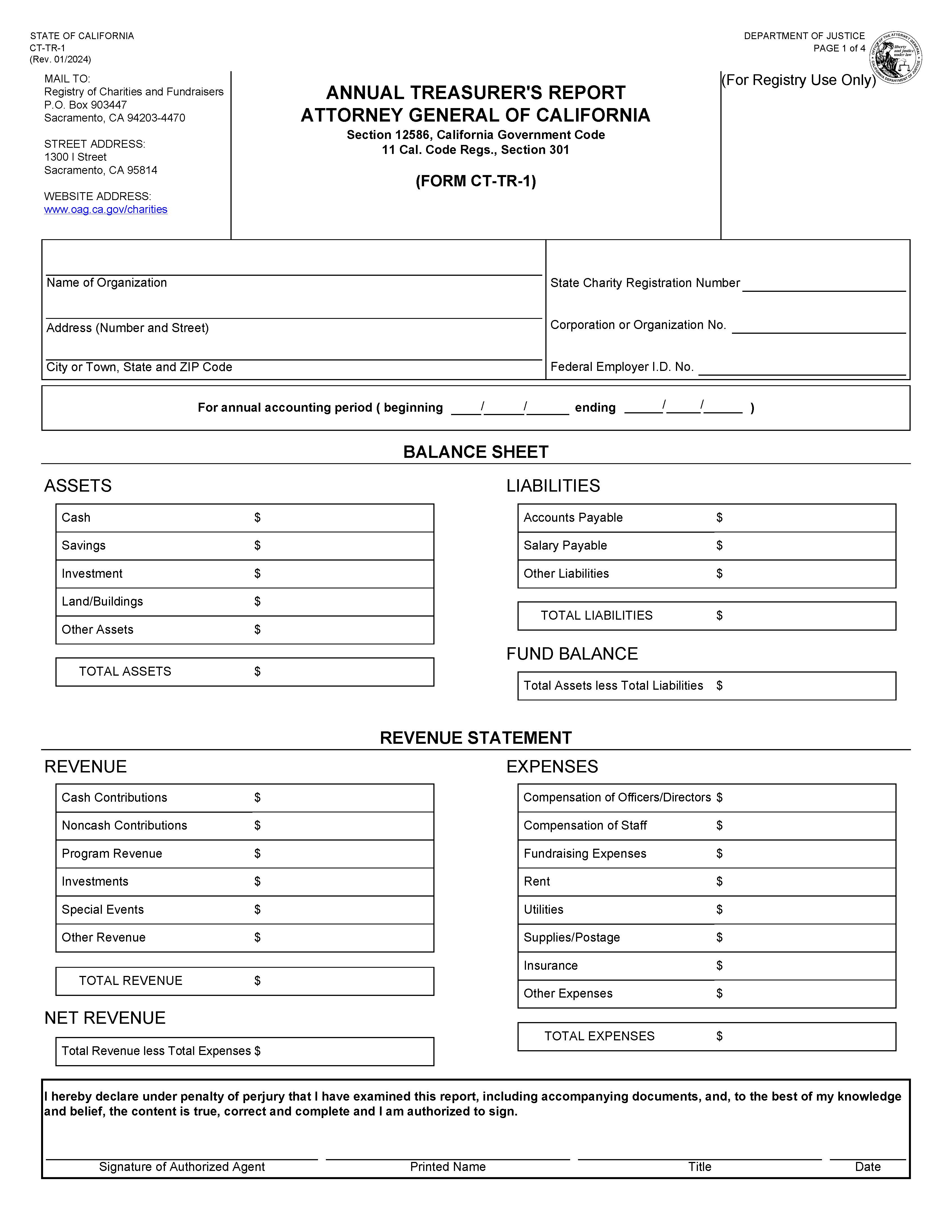

Annual Treasurers Report Attorney General Of CA {CT-TR-1}

Start Your Free Trial $ 14.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

FORM CT-TR-1 - ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF CALIFORNIA Section 12586, California Government Code 11 Cal. Code Regs., Section 301. This form requires reporting of the organization's fiscal year-end financial information and is designed to provide information to be used by the Attorney General and the public for those organizations whose total revenue falls below the threshold for filing IRS Form 990-EZ. Charitable organizations whose total revenue for the fiscal year is under $50,000 must file Form CT-TR-1 and RRF-1 with the Attorney General's Office. Private foundations are not required to file Form CT-TR-1 and instead must file IRS Form 990-PF with the RRF-1. The CT-TR-1 filing requirement does not apply to nonprofit organizations exempt from registration with the Attorney General. www.FormsWorkflow.com