Last updated: 3/14/2024

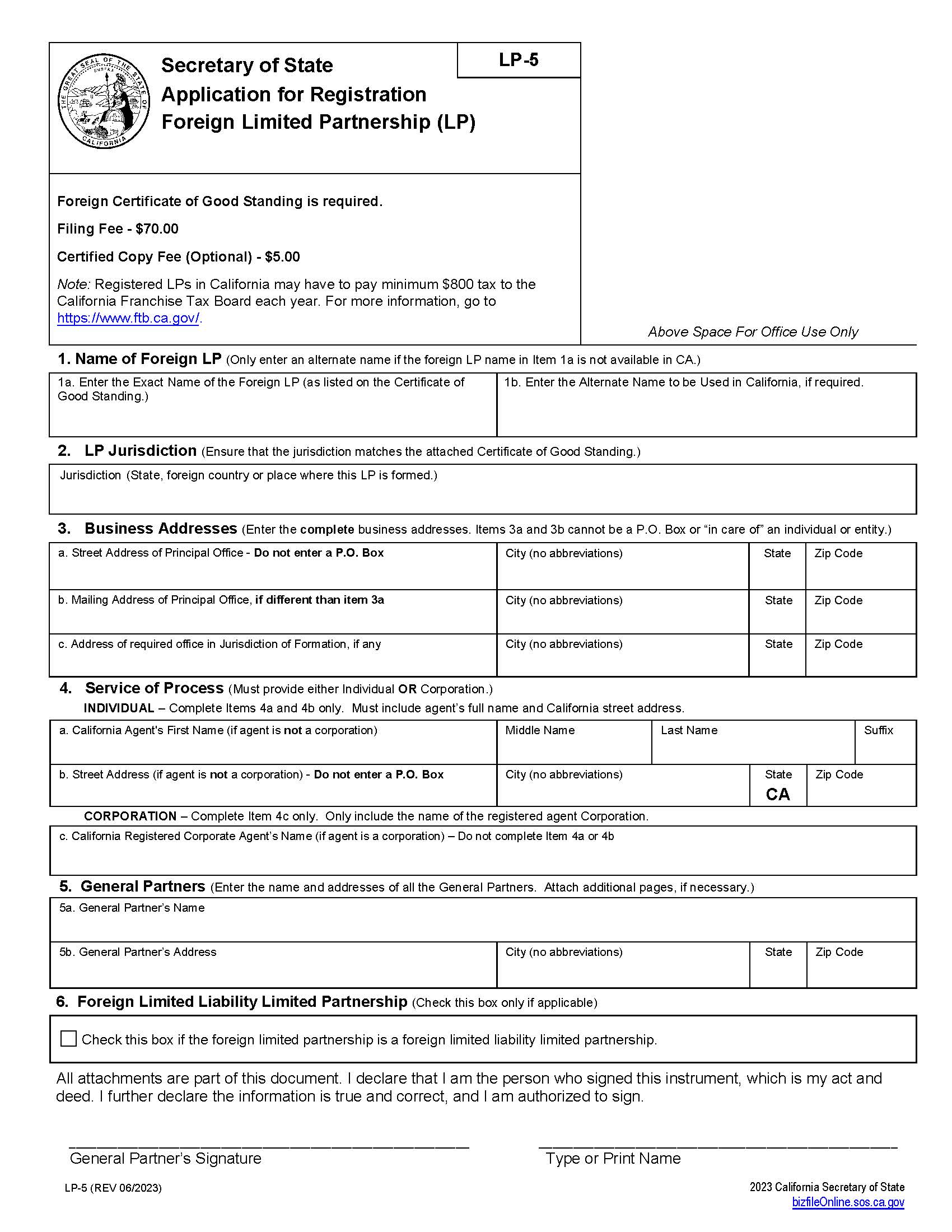

Application For Registration {LP-5}

Start Your Free Trial $ 20.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

LP-5 - APPLICATION FOR REGISTRATION FOREIGN LIMITED PARTNERSHIP (LP). To qualify a limited partnership (LP) from another state, country, or other place of origin (foreign LP) to transact intrastate business in California, you must file an Application for Registration of a Foreign Limited Partnership (Form LP-5) with the California Secretary of State. • Form LP-5 is required along with a current (within 6 months) Certificate of Good Standing (or other record of similar meaning) issued by the agency where the foreign LP is formed. The Certificate must certify that the foreign LP is in existence, in active status, or in good standing. • Before submitting the completed form, you should consult with a private attorney for advice about your specific business needs and whether additional provisions for the foreign LP are needed. Certification Fee (Optional) - $5.00. Note: Registered LPs in California may have to pay minimum $800 tax to the California Franchise Tax Board each year. www.FormsWorkflow.com